KEY TAKEAWAYS

- The reopening of the US economy supported by effective COVID-19 vaccines has been a positive catalyst for sectors such as mortgage and consumer credit, which have lagged other credit sectors in the rebound since March of 2020.

- Sentiment toward the asset class was severely impacted by the COVID-19 pandemic and an absence of policy support for the sector relative to other credit sectors contributed to its relative underperformance.

- The combination of better than expected fundamentals with attractive relative valuations suggests potential for the asset class to generate strong performance on the back of an improved outlook, particularly given reopening of economies.

- In the residential sector, housing market data has been a leader in the recovery. Home price growth has been substantial, backed by improved affordability, strong demand and tight supply, but spreads have lagged due to continued uncertainty and less direct Fed intervention.

- While the commercial sector remains further behind in terms of recovery for certain property types hit hardest by the pandemic, such as hotels and retail, the reopening should be a positive catalyst for commercial non-agency mortgage spreads to continue recovering.

Mortgage Credit Offers Attractive Relative Value

The COVID-19 pandemic fears have primarily turned into reopening optimism. However, credit spreads remain at wider levels than they were pre-Covid for certain subsectors, despite strong consumer and US housing fundamentals. The combination of better than expected fundamentals with depressed valuations suggests significant potential for the asset class to generate strong performance. The greatest dislocated opportunities we see are in residential and commercial mortgage credit, which has lagged corporate credit in the post-Covid recovery as there has not been explicit policy support from the Federal Reserve (Fed) for much of the structured credit asset class, and there are uncertainties impacting collateral performance in certain subsectors. In corporate credit, the Fed’s purchase programs included significant support for investment-grade-rated securities (down to BBB) and even “fallen angel” credits in the high-yield segment. Within mortgage and consumer credit markets, only AAA rated conduit commercial MBS (CMBS) and new-issue AAA rated ABS have been supported by the Fed, which has resulted in full recovery of spread-widening in these subsectors. The team believes mortgage credit offers value backed by real assets that benefit from a rising inflation environment, and that it can generate attractive risk-adjusted returns. The team also believes the strong total return potential and diversification benefits will provide value to investors. The following highlights the appeal of mortgage credit versus corporate credit based on current spreads, which remain elevated for mortgage credit. The potential for spread-tightening in the asset class should benefit the strategy's total return.

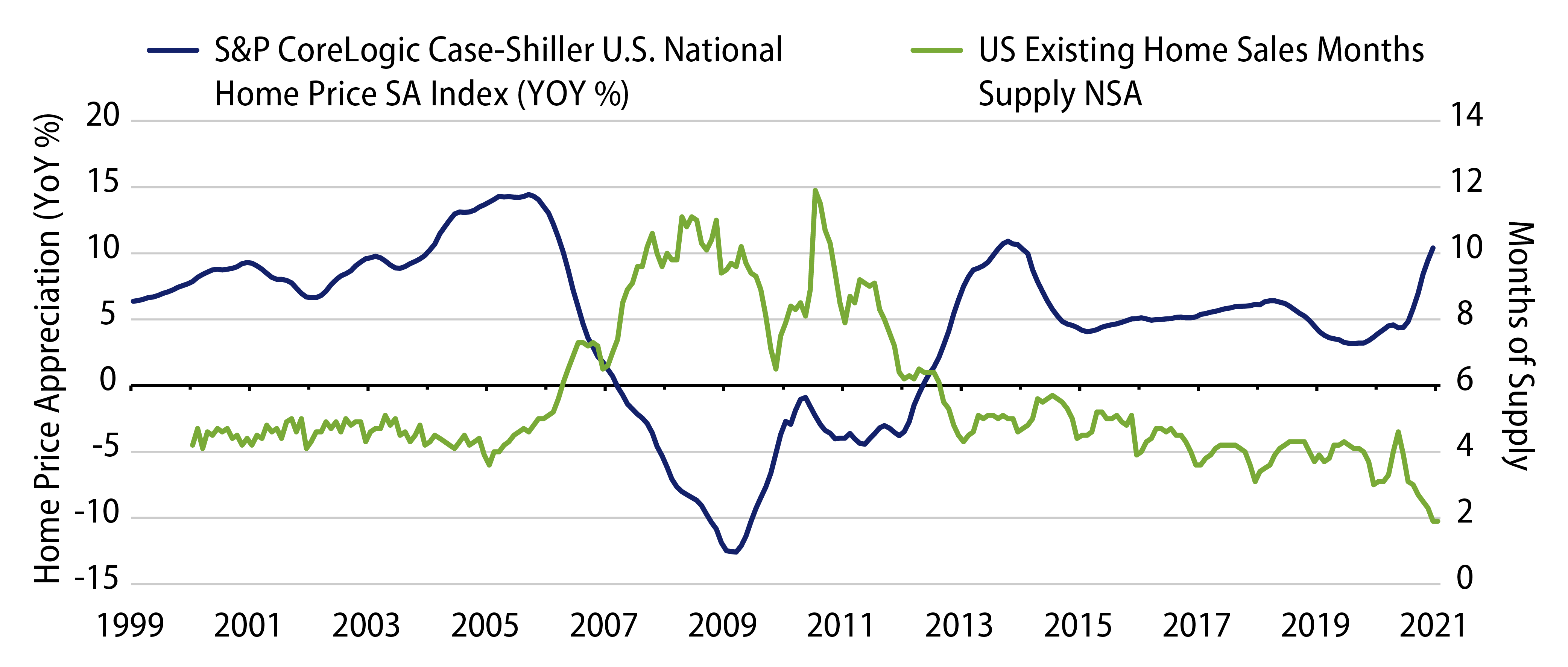

By many metrics, the US housing market has already experienced a V-shaped recovery, but improvements in spread levels have failed to fully reflect this. Home price appreciation (HPA) posted a year-over-year (YoY) gain of 11.9% as of January 2021. Historically low mortgage rates, a dismal lack of supply on the market, tight lending conditions and a rebirth of household formations are fueling the housing boom of the post-Covid world. Consumer fundamentals have improved post-Covid with increased savings rates; revolving consumer credit outstanding YoY and lower interest rates have decreased debt burden levels to the lowest in 20 years. The spike in forbearance applications that materialized as the Covid crisis unfolded has since come down. Temporary suspension of foreclosures and evictions and generous forbearance plans have reduced distressed housing sales pressures. All of this is leading us to believe that US home prices are on strong footing and will continue to increase, albeit at a more moderate pace.

While a healthy balance of supply and demand provides an explanation for growing home prices, investors may still question the stability of mortgage credit given today’s elevated home prices. While low mortgage rates entice many households to seek cheap financing, lenders currently are requiring much more from borrowers than they had pre-GFC. Due to lending standards such as qualified mortgages (QM) and ability to repay (ATR), the mortgage products seen during the go-go days of subprime lending are virtually extinct. Within residential MBS (RMBS), the team has a focus on more seasoned borrowers with low loan-to-value (LTV) ratios, a subset of the investable universe that is better positioned to withstand significant home price decline (not our base case) while also participating in spread compression driven by reopening economic activity.

Commercial Real Estate Seeing Momentum Building Too

While the commercial sector remains further behind in terms of recovery for certain property types hit hardest by the pandemic such as hotels and retail, the reopening of economies supported by the release of multiple effective Covid vaccines should be a positive catalyst for commercial non-agency mortgages spreads to continue recovering. We believe large loan credit/single-asset single-borrower (SASB) non-agency mortgages secured by high quality commercial properties with strong equity sponsors will benefit as COVID-19 restrictions lift and the economy moves toward a full reopening offering.

Focus on Large Loan Credit Backed by High Quality Real Estate

From a credit perspective, the team believes it is strongly positioned with a focus on large loan credit rather than conduit securities. The structured product representative portfolio has approximately 30% of the risk in commercial MBS with the vast majority of that in large loan credit. Large loan credit is represented by SASB securities (that result from one large loan to a single borrower—it could be one property or a few properties held by the same owner) rather than conduit securities (which hold a diverse set of underlying loans, diverse by region and property type). The benefit of SASB is that the quality of real estate backing these securities is higher than we see with conduit deals (they are typically class A properties) and the operational expertise of the borrower that manages the underlying properties tends to be higher.

The Western Asset Mortgage and Consumer Credit Team spends a lot of time underwriting these deals and pushing for stronger covenants and protections to protect investors from this kind of environment. It continues to see value within the SASB sector that is being severely impacted by the path of the virus. This continued uncertainty is reflected in valuations that are pricing in extraordinary price declines (15%-30%) and permanent impairment in some instances, which is not our base case, especially on the back of reopening economies and properties' improving cash flows.

Concerns Remain Over Subsectors Such as Retail and Hospitality

The COVID-19 crisis has severely impacted the commercial real estate (CRE) market as properties have been forced to shut down, rents are down as some tenants are not paying and owners are facing liquidity challenges in servicing debt. CMBS delinquencies increased significantly following the shutdown, with SASB collateral performing better than conduit MBS. As the economy has been reopening, we have seen improvement in property cash flows and collateral performance. The amount of SASB payments less than 60+ days delinquent has steadily decreased over the past eight months, while for conduit they still remain elevated.

The hardest-hit sectors have been retail and hotels. Retail malls have been under pressure for a number of years and the shutdown has forced certain retailers to file for bankruptcy or close stores. Within hospitality, there have been green shoots in occupancy and revenue that have bounced off their historical lows as the economy reopens. The team is expecting that commercial sectors such as hospitality will take two to three years for cash flows to recover to pre-Covid levels and during the period borrowers may need to work with lenders on modifications or forbearance requests. The investment team has been working with borrowers and servicers, and the general tone of those discussions has been constructive. The vast majority of borrowers has remained current on their loans within the portfolio. The team is not seeing a widespread inability for operators to fund their commercial operations. Almost all deals held in the portfolio have extension options so the team doesn’t see a significant potential for maturity default in the very near term.

Improved Economic Outlook Should Provide Continued Support to the Asset Class

The reopening of the US economy supported by effective COVID-19 vaccines has been a positive catalyst for sectors such as mortgage and consumer credit, which have lagged other credit sectors in the rebound since March of 2020. The combination of improving fundamentals with attractive relative valuations suggests upside potential for the asset class to generate strong performance. The greatest dislocated opportunities we see are in residential and commercial mortgage credit, which are sectors that have not received the benefit of a Fed backstop. The team believes the sector offers value backed by real assets that benefit from a rising inflation environment and can generate attractive risk-adjusted returns. The holdings in the structured product representative portfolio are secured by assets with low LTV ratios and high-quality borrowers with potential significant recovery value and low default risk. The team believes the strong total return potential and diversification benefits should provide value to investors.