Executive Summary

- As Fed chair, Yellen steadfastly argued that the US labor market was not tight and that more job gains were not only possible but desirable. During her tenure the unemployment rate fell from 6.7% to 4.1%.

- In her final press conference, Yellen acknowledged that the Fed has consistently fallen short of its 2% inflation mandate, and expressed concern that low inflation may be “ingrained.”

- Fed Chair Jerome Powell’s comments have strongly echoed Yellen’s themes about continued slack in the labor market. However, we also suspect that Powell may be more inertial in setting policy, consistent with his Republican background.

- The employment report for January 2018 showed a 2.9% YoY increase in average hourly earnings. While notable, it is not clear that this will do much to materially change the current low-inflation backdrop.

- The market is currently priced on top of the Fed’s expectations for coming rate hikes. We think such prices reflect a lot of optimism and for that reason should be approached cautiously.

- Risks to coming Fed hikes are likely to the downside and concerns about “ingrained” low inflation combined with an inertial approach from Chair Powell are unlikely to be the backdrop for a sharp adjustment steeper in the path of rates.

The transition from Janet Yellen to Jerome Powell as chair of the Federal Reserve (Fed) is happening at an interesting moment for financial markets and the US economy. Two topics in particular have recently come to the fore of investors’ minds: the potential for an increase in inflation and the current pricing of Fed interest rate hikes. We address both in the final section of this note. However, some context is needed first. Before addressing the topics du jour, we assess Yellen’s record and then provide an outlook for the Fed under Jerome Powell. It is only with the context properly established that we can attempt to adequately address the issues of the day.

Janet Yellen’s Record

Janet Yellen’s career at the Fed started more than 20 years ago, when she was sworn in as a member of the Board of Governors in 1994. Over the subsequent two decades she served in a number of senior policy positions and was consistently at the forefront of US economic policy. Any evaluation of Yellen that considers only the last four years necessarily understates the magnitude and breadth of her contributions. Nonetheless, focusing on the economic outcomes during Yellen’s tenure as Fed Chair provides a useful summary of what she has accomplished, and also notes what was left undone.

Yellen’s Accomplishment: More Employed US Workers

As Fed chair, Yellen steadfastly argued that the US labor market was not tight and that more job gains were not only possible but desirable. This view met resistance at a number of different junctures, and not just from policymakers known for having a hawkish bias. When Yellen began her term as Fed chair, the unemployment rate was 6.7% and most members of the Federal Open Market Committee (FOMC) forecast that it would only fall for another year or so, at which point the lack of available workers would presumably strain the US economy in some way. Yellen had a notably more optimistic assessment. In her very first press conference as Fed chair she specifically cited weak wage growth as a sign that there was ample capacity in the US economy to add more jobs:

This became the foundation of her policy for the next four years. Rather than focusing on the unemployment rate, as many others in her position might have, she took a broader perspective by incorporating indicators such as wage growth and the participation rate, among others. That broader perspective led her to advocate for a cautious monetary policy so that the labor market would have the room to improve and employment would increase.

Yellen was proven correct on this point, perhaps even beyond her own expectations. Over the course of her tenure, the unemployment rate fell by 2.6 percentage points (and, tellingly, fell a full percentage point further than the median FOMC member expected at the beginning of 2014), the participation rate stopped falling as discouraged workers reentered the labor force, and overall employment rose by 10 million workers. All of that happened without any noticeable strain on the economy, inflation or otherwise. While it would be obviously too generous to credit all of that improvement to Yellen alone, her advocacy for what was at the time an out-of-consensus view certainly contributed.

The Undone Bit: Is Low Inflation “Ingrained”?

In a fitting bookend to her initial press conference—where she referenced low wage growth and pushed back on the argument that labor markets were tight—Yellen returned to the theme of low inflation in her final press conference. Her assessment was notably self-critical, and raised some important questions about where we go from here:

A few things stand out in this statement. First, Yellen acknowledges that the Fed has consistently fallen short of its inflation mandate. In fact, year-over-year (YoY) personal consumption expenditure (PCE) inflation, the Fed’s preferred inflation measure, did not touch 2% at any time while Yellen was Fed chair, much less move symmetrically around the objective. Second, she notes that one implication of low inflation is that the unemployment rate could move down yet further, and in noting that she is returning to a favorite theme of continued slack in the labor market. Third, she suggests that the Fed’s understanding of inflation is incomplete, at best. In Yellen’s estimation, there is a very real possibility that inflation may remain low persistently, even though many standard economic models suggest it won’t (low inflation may indeed be “ingrained”). Finally, Yellen reiterates that meeting the inflation objective is an “important priority” for the Fed.

This last point—that raising inflation from current low levels is an “important priority”—is worth emphasizing. There are a number of standard reasons why the Fed may want inflation around its 2% objective, including to preserve its own credibility and to provide room to cut real rates toward the end of a business cycle. However, Yellen’s prioritization of inflation perhaps extends beyond that. As discussed earlier, low inflation could also be symptomatic of remaining slack in the US economy, and as such is an indication that policymakers should pursue yet more employment growth. Of course policymakers must also appreciate the uncertainty surrounding these issues, not to mention the long and variable lags of monetary policy. Nonetheless, we interpret Yellen’s prioritization of the inflation mandate as genuine and therefore her citing the inflation objective as remaining “undone” to be heartfelt and worthy of note.

Jerome Powell: A Low Interest Rate Republican

Last August we identified two characteristics we thought made it likely that President Donald Trump would choose Jerome Powell to be Fed chair: Powell favors low interest rates and Powell is a Republican. In any event, those characteristics, likely among others, appear to have been persuasive to President Trump, who ultimately selected Jerome Powell to be the new Fed chair. As we look forward to Powell’s tenure as Fed chair, we continue to think that those same two characteristics will be defining.

Low Interest Rate Person

Powell is not a trained economist, having instead attended law school before spending most of his career in private equity. But, Powell has something perhaps more valuable than a PhD: for the past five years he has worked side by side with Yellen, presumably learning and absorbing much along the way. Powell’s comments at his confirmation hearing were consistent with the notion that Yellen has had some considerable influence:

This echoes strongly Yellen’s themes on continued slack in the labor market, as well as Yellen’s insistence that monetary policymakers look beyond the unemployment rate to assess the capacity of the US economy to add more jobs. While certainly conditions can change, we infer from Powell’s comments that his bias is directionally similar to Yellen’s.

Republican

It’s difficult to generalize monetary policymakers by political party. Fed officials are protective of the central bank’s independence and therefore reluctant to associate their policies with one political party or another. The reality is, however, that Republicans generally do differ from Democrats on a few key dimensions, and it’s worthwhile to think through the differences.

First, Republicans tend to be skeptical of the benefits of regulation, and consequentially tend to favor less regulation. Much has been written on this point and we don’t have much new to add. Due to Powell’s biases, in addition to where we are in the regulatory cycle, it is highly unlikely that the amount of new regulations implemented in the coming four years will be anywhere near the amount of new regulations implemented over the past four. This is not to say that the regulations created under Yellen will be rolled back. They won’t be. Instead, the era of new regulations has likely come to an end, and, at the margin, we may see some gradual easing of regulations under Powell.

Second, and more relevant to the current discussion, Republicans tend to be somewhat more inertial in their policymaking. Some of the more strident Republican critics of the Fed over the past few years have focused on periods when the Fed has deviated from its previous plans. Republicans have generally preferred a steady and predictable Fed over a dynamic or responsive one. Deviations from preset plans, the Republican critics argue, confuse investors and businesspeople, which in turn dampens risk taking and slows economic growth. If the Fed’s deviations are indeed over-reactions, or are inappropriate because they are responses to statistical noise, then the critics’ point seems straightforward. An extreme form of this criticism argues that the Fed should be bound by a rule in order to limit unnecessary confusion caused by an uncertain Fed. (For its own part, the Fed has argued that such deviations are necessary because the outlook and markets change, and it’s appropriate for policy to change along with them.)

While we know that Powell does not believe in the strong form of this argument, and therefore won’t be constrained by any strict rules, it is likely that Powell’s policies will exhibit somewhat more inertia than Yellen’s. In the very near term, an inertial Fed path is fairly uncontroversial. Yellen laid the groundwork for gradual rate hikes, and with supportive economic data and easy financial markets, the Powell Fed is likely to continue by hiking at least in the next few quarterly meetings.

Where this observation becomes more interesting is over the medium term. A more inertial Fed chair will be somewhat slower to adjust policy in response to changes in either financial or economic conditions. Accordingly, we do not expect the Fed under Chair Powell to make any sharp or sudden changes to its economic outlook or forecast for rate hikes. This works in both directions. The substantial gains in the price of risk assets in the month of January were suggestive of a widespread reassessment of the upside risks to global growth. Certainly the Fed is aware of the reasons for optimism—US tax cuts, a weaker US dollar, synchronized global growth, etc.—but unlike an investor that needs to buy or sell the market every day, the Fed is under no obligation to respond immediately.

Conversely, while the correction in risk prices in early February raised concerns about tighter financial conditions, the Fed again is under no obligation to respond immediately. Instead, we suspect the Fed will continue to monitor the developments and upgrade its outlook only if the hard economic data become convincing one way or another. The fact that inflation has been running under its 2% objective gives the Fed an extra margin of safety to be cautious and gradual in changing its outlook.

In addition, we suspect Chair Powell will be skeptical of proposals to make any changes to the Fed’s inflation objective. There has recently been a renewed interest among monetary policymakers in reassessing the Fed’s inflation objective. Some have argued that a higher inflation objective would give the Fed more room to cut real rates in a crisis, some have argued that the Fed should adopt a nominal GDP target, and some have advocated changing the objective to a range (say, 1.5% to 2.5%) instead of a single number. While each idea may have its own merits, all of them would require a proactive change and would be inconsistent with the inertia that we expect from Chair Powell.

To be clear, if the outlook were to change substantially we would expect Chair Powell to eventually respond with a changed plan for Fed actions. However, relative to Yellen, we also expect that Powell will be somewhat more Republican in the sense that he may exhibit some more inertia in policy setting. And in that sense, the Powell Fed may appear differently than what some are used to from the last four years.

Two Topics Du Jour

With the context of Yellen’s record and the outlook for Chair Powell now in place, we turn to two topics currently important for investors: the outlook for wage inflation and inflation more broadly, and the expectation for Fed hikes in the coming years.

Wage Inflation and the Implications for Broader Inflation

The employment report for January showed a 2.9% YoY increase in average hourly earnings, the fastest such increase since 2009. This report has reignited hopes that the period of low wage growth has ended, and at the same time engendered some fear that an inflationary period may be approaching. We would not be surprised if wages did increase somewhat, given how exceptionally low they have been. However, we are skeptical they will increase so much as to materially change the low-inflation backdrop. It’s entirely possible for wages to increase without sparking higher overall inflation.

First, some perspective is helpful in assessing whether 2.9% is in fact a “high” print for wage inflation. In the same 2014 press conference referenced earlier, Yellen said:

So, at 2.9%, wage growth has not even crossed the bottom of Yellen’s range for “normal.”

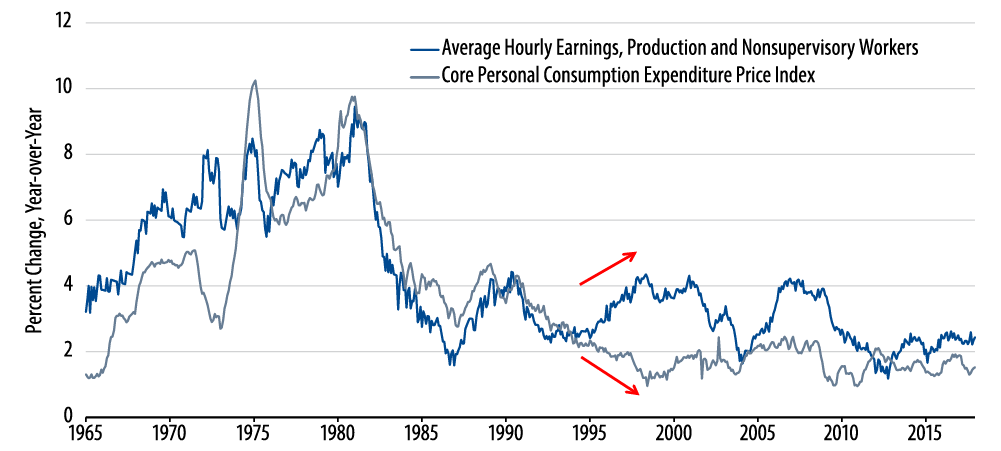

Of course, the “normal” level depends in part on productivity, which is the second salient point to make on the inflation outlook. If wage inflation is coincident with an increase in productivity, the upward pressure for broader inflation is muted, at best. Something similar happened in the mid-1990s. From January 1995 to July 1998 wage inflation accelerated from 2.5% to over 4%; yet during the same period core PCE inflation actually fell and was temporarily below 1% in 1998. (Incidentally, Fed Chair Alan Greenspan resisted hiking during this period, arguing that the increase in productivity would in fact be deflationary, which turned out to be a prescient view indeed.) A final point is that the high level of corporate profits provides another dimension of adjustment, insofar as higher wages may mean lower profits and not necessarily higher prices. Should wages continue to trend higher, that should be considered a welcome development, especially if it does not cause a move higher in broader inflation.

Wage and Core PCE Inflation

Fed Pricing

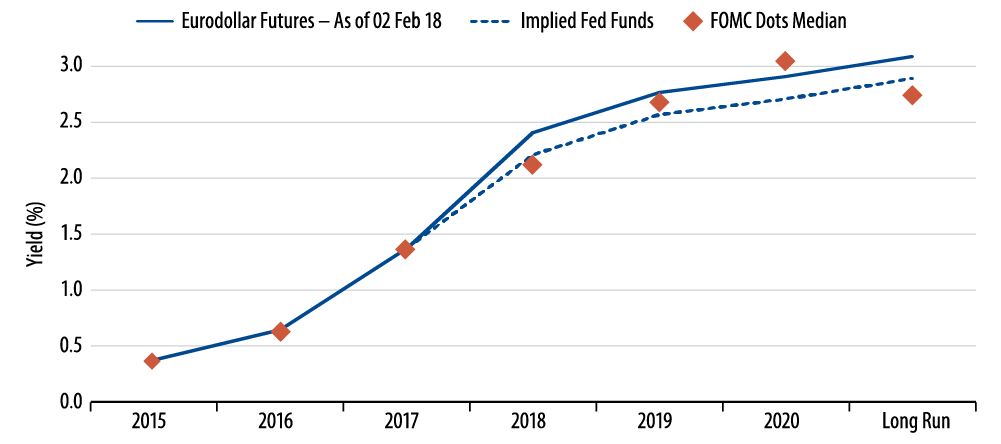

The past few weeks have seen a sharp repricing of market expectations for coming Fed hikes, culminating after the January employment report last Friday. The move was evident in the very front part of the yield curve, where the market pricing shifted from two hikes priced for this year to more than three hikes fully priced. The repricing was even more striking further out the curve. After the January employment report the market was pricing a fed funds rate above 2.5% by the end of 2019; and in a coincidence almost unheard-of in the last few years, the market was on top of the Fed’s own estimate for terminal rates by 2020.

FOMC and Market Expectations for Rate Hikes

Note: Implied fed funds are computed as the yield on Eurodollar futures minus 0.2% to account for the basis between LIBOR and fed funds.

In our view, the market’s pricing of Fed hikes reflects a substantial amount of optimism. It reflects optimism that the nascent wage inflation will not only be sustained but will also lead to overall inflation. It reflects optimism that the positive momentum behind US and global growth will continue uninterrupted for the coming three years. And, by pricing a terminal funds rate on top of the Fed’s own estimate, it reflects optimism that long-term growth and inflation trends are just as likely to exceed the Fed’s expectations as they are to come in under it. We are optimists too, insofar as we have long held that the global economic recovery can continue. But, the current optimism priced into rate expectations warrants caution.

Finally, the lessons from this discussion suggest that the risks to coming Fed hikes are to the downside. The concerns about “ingrained” low inflation that former-Chair Yellen expressed in her final press conference, combined with an inertial approach from Chair Powell, are unlikely to be the backdrop for a sharp adjustment steeper in the path of rates.