KEY TAKEAWAYS

- While MAC portfolios were not immune to the Covid-related market shock early in 2020, we quickly pared down our EM exposure to mitigate further drawdown risk and shore up portfolio liquidity.

- Leveraging the top-down views from our Global Investment Strategy Committee and the bottom-up views from our global sector teams, we began to deploy proceeds into the investment-grade corporate credit market.

- In terms of duration positioning, MAC currently sits at 4 years, which we believe provides sufficient ballast against the existing spread risk in portfolios.

- Looking ahead to year-end, we think the overall market direction is constructive, but not without some bouts of volatility along the way.

- Given the confidence we have in our approach and where spreads are today, we continue to believe our MAC strategy offers opportunities for strong returns going forward.

We entered the year with MAC portfolios positioned for another year similar to 2019—slow, but still positive growth. In January and February we gradually trimmed duration, reflecting our view that UST pricing during those months appeared overbought and had lost some of its value as an effective hedging instrument against risk assets. Our expectations were turned upside down with the sudden onset of the COVID-19 crisis. As we observed during March 2020, financial markets were seized by severe disruption, illiquidity and volatility on a magnitude not seen since 2008. These conditions led to a broad-based decline in spread sectors over March, and ultimately over Q1.

MAC portfolios were not immune to this market shock. Our first steps were to pare down our EM exposure (especially the currency risk associated with EM local securities) to mitigate further drawdown risk and shore up portfolio liquidity (to build up a base of dry powder). Leveraging the top-down views from our Global Investment Strategy Committee and the bottom-up views from our global sector teams, we began to deploy proceeds into the investment-grade corporate credit market, as we expected this sector would be the “first responder” to any sign of Federal Reserve (Fed) or government intervention to restore market functioning. Indeed, once markets saw the aggressive and coordinated policy response by the Fed and other central banks, the highest quality issuers came to market with deals offering significant new issue concessions. We took advantage of this opportunity, purchasing names that have all performed well in the period since issuance. We also took advantage of deep value opportunities that appeared in the high-yield secondary market, specifically names that we believed were severely mispriced and could withstand challenging conditions. With many securities “on sale,” we balanced these deeper value trades with names that we believed could endure a prolonged economic downturn and in sectors such as cable/wireless, food and beverage, health care, and waste removal.

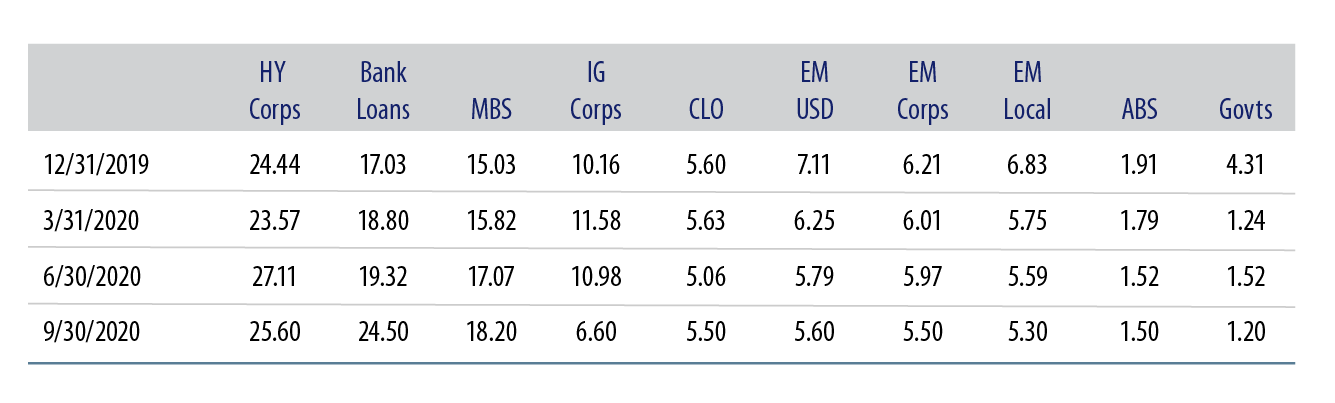

During 2Q20, we reduced our IG credit exposure (as spreads rapidly compressed to pre-Covid tights), further reduced our emerging market (EM) exposure (on concerns over EM countries’ ability to weather the economic effects of the growing pandemic), and opportunistically added to our structured credit exposure—mainly in attractively priced residential mortgage-backed securities (MBS). Following the announcement of the Fed’s new corporate credit facilities, we began to increase exposure to HY (through the new issue market) and bank loans based on our view that these sectors would be the “second responders” on the back of sustained policy support and an improved technical backdrop. We continued to add to bank loans throughout 3Q20 for several key reasons.

First, loans are the most senior part of an issuer’s capital structure and are secured by assets. Senior management teams with secured loans outstanding generally do everything in their power not to lose control of their asset base. Second, companies have generally done a good job of shoring up liquidity and refinancing near-term debt to weather any turbulence that may appear through the end of the year. While Wall Street default rates for the sector range from 6%-9%, our Bank Loan Team has a very hard time seeing the rate rising too much over 6% as such an outcome would require a broad economic setback, which is not our view. Third, we expect the combination of incremental collateralized loan obligation (CLO) issuance in 4Q20 and limited new-issue loan supply to act as a technical buffer for bank loan spreads.

As for the CLO market, spreads have materially recovered from the March highs. In our view, AAA tranches still represent one of the cheapest asset classes in the fixed-income universe, especially when compared to similarly rated investment-grade credit spreads. BB and BBB tranches haven’t enjoyed the same bounce as other tranches and are still at or near their wides. But this is another segment of the CLO market we’re closely monitoring.

Turning to high-yield, returns year to date continue to reflect the tug of war between stressed sectors such as energy, gaming and airlines, which were hardest hit by the pandemic, and sectors such as cable, wireless and health care, which have benefited from the increased demand for these types of services. The high-yield market also had to absorb a record amount of new issuance. The silver lining is that these issuers have been using the proceeds to build up cash reserves. For now, we’re focused on refinancing stories (where issuers look to proactively tender debt ahead of scheduled maturities) and issuers that are poised to benefit as the reopening of the US economy gains traction.

In terms of duration positioning, MAC currently sits at 4 years, which we believe provides sufficient ballast against the existing spread risk in portfolios. Our duration positioning reflects Western Asset’s view that the Fed will maintain a dovish monetary policy for the foreseeable future. While the Fed’s broader policy is unlikely to be affected by the upcoming November election, the passage (or lack) of additional fiscal stimulus before year end may influence the Fed to consider additional measures at its December Federal Open Market Committee meeting.

One area we are monitoring closely is mortgage credit. Both residential and commercial MBS spreads have lagged corporate credit mainly as the bulk of the asset class didn’t benefit from any direct or explicit Fed stimulus and continues to be weighed down by uncertainties impacting collateral performance. If anything, we’ve only seen support toward AAA rated conduit CMBS and new-issue asset-backed securities (ABS), which explains the solid spread compression in those subsectors.

Approximately two-thirds of our mortgage exposure is in non-agency RMBS. At current valuations, this sector can withstand severe home price declines (10%-15%+), but this is not our base case. Coming into the COVID-19 crisis, aggregate US consumer fundamentals were in a strong position, with debt as a percentage of income at the lowest level in over a decade. And while some may be expecting to see a wave of homes coming onto the market, the policy response has reduced the risk of homeowners being forced to sell. We’re seeing evidence that many homeowners who were planning to sell their homes have now taken their homes off the market. The spike in forbearance applications that materialized as the crisis unfolded has also declined, and temporary suspension of foreclosures and evictions along with generous forbearance plans has reduced distressed housing sales pressures. Our focus in MAC portfolios is on more seasoned borrowers with low loan-to-value (LTV) ratios, which provides more downside protection should housing prices decline.

CMBS valuations, however, are still pricing in extraordinary price declines and permanent impairment, which isn’t our view. CMBS delinquencies increased significantly following the shutdown, with single-asset-single-borrower collateral performing better than conduit MBS. As the economy has been slowly reopening over the past few months, we’ve begun to see some improvement in property cash flows and collateral performance. But the hardest-hit sectors have undoubtedly been retail and hotels. Retail malls were already under pressure for a number of years; the shutdown just forced certain retailers to file for bankruptcy or close stores. Within hospitality, there have been some green shoots in occupancy and revenue that have bounced off their historical lows as the economy reopens. For now, we expect commercial real estate debt to continue lagging other parts of the market as investors assess the path and implications of the virus.

Looking ahead to year-end, we think the overall market direction is constructive, but not without some bouts of volatility before and after the November US presidential election. Market sentiment will also be heavily influenced by the latest COVID-19 headlines. On this note, we remain encouraged by the fact that the brightest minds in the world are coordinated in developing therapeutic medicines, improved treatment techniques and a vaccine to prevent COVID-19 infection. We think it’s not a matter of if, but when, a successful vaccine or advanced treatment becomes available.

We’re also encouraged by the transparent roadmap that policymakers across the major economies have laid out; their rhetoric continues to reinforce a commitment to providing monetary stimulus to support economic activity and market functioning as needed. And while the Fed’s pace of corporate bond purchases has slowed recently, this by no means suggests it’s running out of buying power. If we were to see another dislocation or wider spreads from here, the Fed would easily ramp up the pace and size of its purchases. For all of these reasons, and given where spreads are today, we believe our MAC strategy offers strong return potential going forward.