KEY TAKEAWAYS

- Our assumption that all ground lost due to the pandemic can be made up, and the pre-pandemic trend can be re-established in just a few years’ time, is inherently optimistic and by no means a certainty.

- Further advances in the battle against Covid, continued global economic growth and broad-based DM central bank monetary accommodation would and should all augur well for our investment outlook.

- We reduced overweights in investment-grade and “plain vanilla” high-yield in favor of reopening high-yield sectors, residential and commercial structured products, bank loans and EM corporate bonds.

- As EM remains far away from its pre-Covid spread levels, the best and perhaps last reopening opportunity may be in EM local currency bonds.

Perhaps, in looking back at recent market-related news, it will turn out that the surprisingly high inflation prints and the unexpectedly low unemployment and retail sales releases will be superseded by the CDC’s guidance on dropping masks. This, combined with the Biden administration’s announcements on shipping vaccines abroad, may highlight that the war on COVID-19 is entering its final phase. Ballparks are coming back to full capacity. Airports are bustling. Soon, mask and social distancing mandates may be dropped. Vaccine production continues to ramp up, even as developed market (DM) vaccination rates rise steadily. In the US, supply exceeds demand. Europe may have a similar situation by the end of summer. A year from now, the same might be true worldwide. The expected vaccine production by the end of this year amounts to a staggering 12 billion doses, according to a Duke University study. Reasonably soon the world may be swimming in vaccines.

Our thesis has been one of optimism about overcoming this disease. This perhaps once-in-a-century pandemic has caused unremitting misery. The concomitant economic devastation will take years to repair. The enormity of the monetary and fiscal policy utilized to keep global economies afloat has never before been seen. As we consider what the post-pandemic future may hold, humility with respect to the broad array of outcomes is warranted. Our base case has been one of reopening optimism, which was upgraded meaningfully as vaccines became available. Overweights in investment-grade and “plain vanilla” high-yield were reduced only to introduce them to reopening high-yield sectors, residential and commercial structured products, bank loans and emerging market (EM) corporate bonds. Needless to say, the tailwinds of improving growth and monetary accommodation are crucial for the success of this configuration.

Two alternative outcomes would be much faster growth and inflation, and while it is not part of the current narrative, the more dangerous possibility is that of weakening economic growth. For the former, portfolios are positioned in sectors that traditionally do very well during inflationary times. Real estate, energy, finance, bank loans and EM all have high historical correlation with rising inflation rates. Indeed, for those of us old enough to recall investing in the “stagflationary ’70s,” corporate bond yields sat nearly on top of government bond yields. In the event growth fails to perform up to the current high market expectations, though, spread sectors and risk assets could be vulnerable. In such a scenario, the prospects for Treasury bonds to provide substantial outperformance are very good, and a meaningful complement would be needed for portfolios with high spread sector exposures.

There is a very broad scope of potential outcomes around the reopening where such a portfolio performs well, without either of the alternative risk cases coming fully into view. Our general position is in line with the Federal Reserve’s (Fed) game plan—not a position we often find ourselves. But this pandemic has been brutal. Our assumption that all the lost ground can be made up, and the pre-pandemic trend can be re-established in just a few years’ time is inherently optimistic—but by no means a foregone conclusion. Market expectations have jubilantly leapt ahead to a full recovery and a new permanently higher structural growth and inflation rate that would require precipitous Fed tightening. But that is a stretch given the current enormous economic slack and the still pervasive headwinds of debt and demographics. More importantly, there is no possible way the Fed should or would take such a chance.

After the reopening bounce and as we look into next year, the uncertainty of what lies ahead will necessitate policy caution. Slowly rising long-term core inflation rates, with a broadening economic recovery, is the objective. We believe that such a path is attainable. As the global economy reopens supply chains will come back. The balance of supply and demand will no longer be one-sided. The question of a permanently higher structural growth rate will also demand much greater scrutiny. Fiscal policy globally will throttle back. In such a better but not booming environment, spread products should do very well. If the Fed someday gets to its aspiration of a 2.5% terminal interest rate—which will necessitate economic growth holding up for multiple years as monetary policy is perpetually tightened—today’s forward Treasury yield curve (where five-year, five-year forward rates are at 2.59%) would be realized.

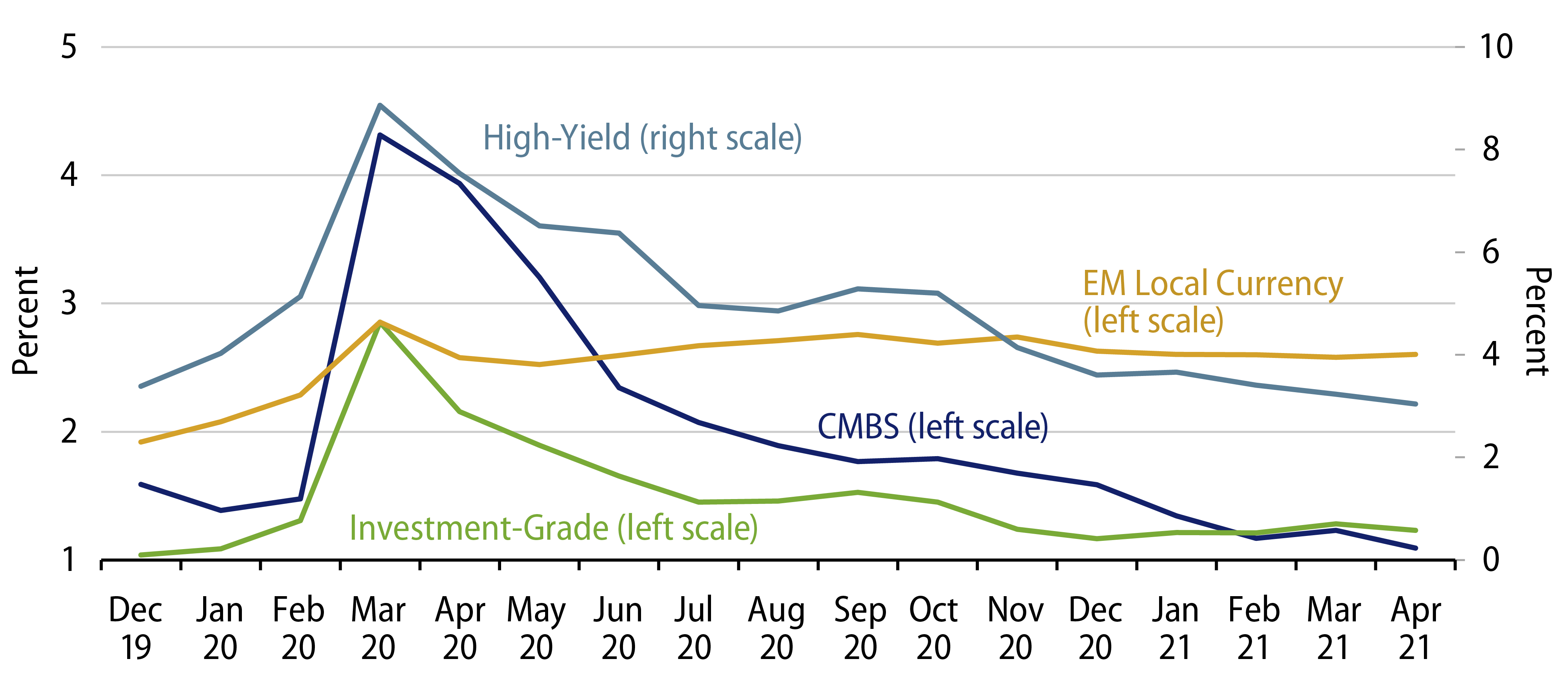

The best and perhaps last reopening opportunity may be in EM local currency bonds. Investment-grade and high-yield spreads have retraced all of their post-Covid widening. Structured products, particularly commercial real estate, still have some distance to travel to recoup the spread widening. But EM remains far away from its pre-Covid spread levels (see Exhibit 1). And this underperformance is very understandable. By and large, EM countries lacked the medical infrastructure and fiscal resources DM countries had to battle the pandemic. And this underperformance comes after almost a decade of previous disappointment. The weak global growth and depressed commodity prices of the previous decade combined with trade nationalism left local currency EM in a challenging position even before the Covid crisis commenced.

Current pessimism about the difficulty in broadly distributing the vaccine and the new danger of the “Indian variant” are more than understandable. The fiscal overhang of the enormous debt burdens now faced in the aftermath of the pandemic will restrain future growth. The fear of rising inflation in the wake of the weakening of EM currencies has already necessitated some countries to raise policy rates. And last, the fear that DM countries may sharply accelerate policy tightening as global inflation fears surface weighs heavily on this sector. So the reasons for market pessimism are clear.

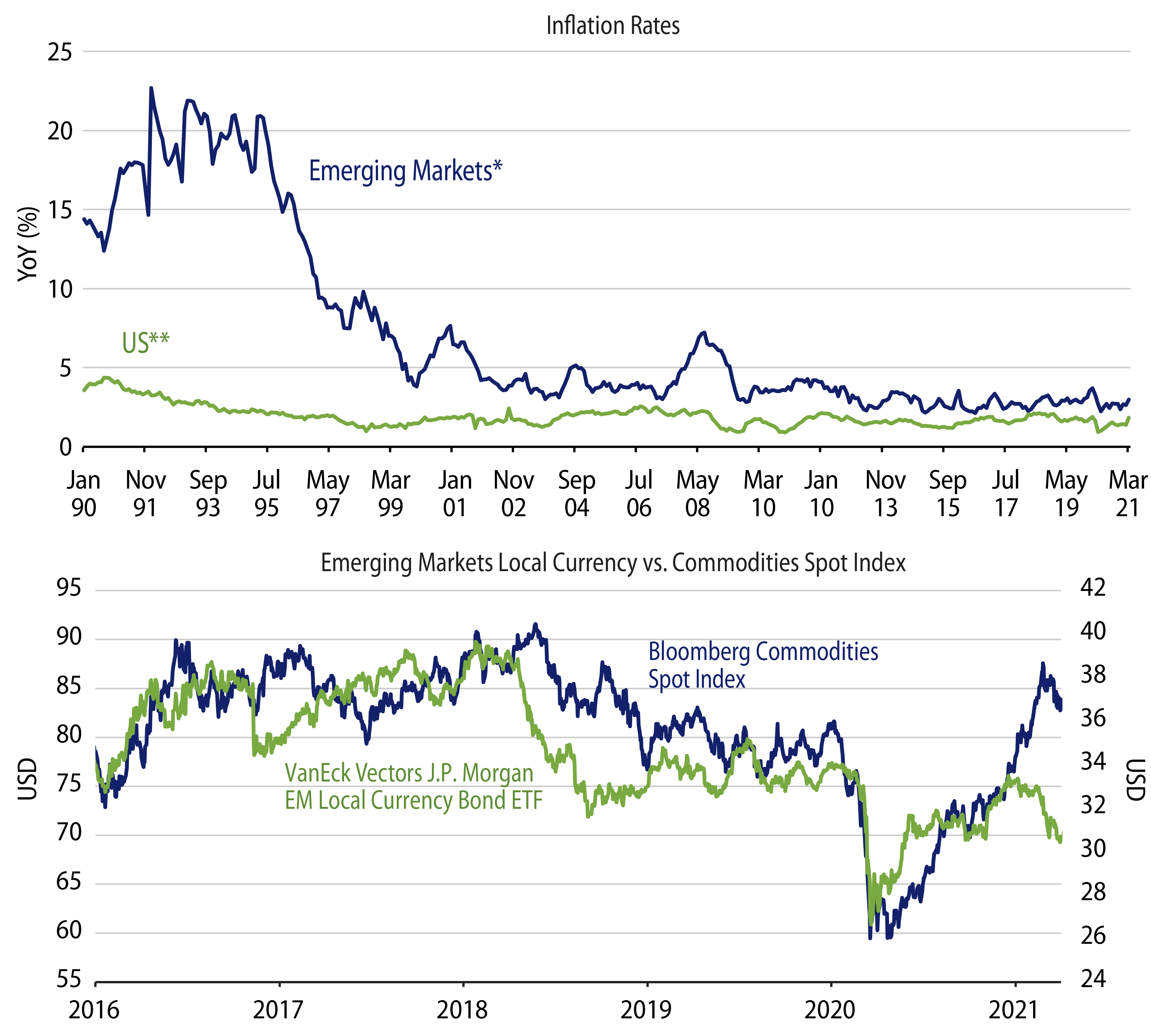

The question for EM currencies may boil down to, “can anything go right?” Our thought is that a yes answer is in the offing. The Covid victory is coming to EM, even if it is not yet visible. The twin fears of rising internal and DM inflation are already meaningfully priced in, and more importantly, may prove to be overblown. Exhibit 2 highlights these issues. In the top graph, the performance of EM local currency inflation shows it is actually still quite modest. The bottom graph shows the correlation of EM local currency with commodity prices. Here, based on the very high correlation displayed, the rise in commodity prices should already have given EM quite a boost. Instead, it was the rate-hiking fears supercharged by the US fiscal increase that caused EM to dip. As rates more recently have moved sideways, EM has found a bit of footing.

The challenge of any reopening trade is that the value proposition lies in investing before the evidence becomes widely visible. An acceleration in the progress against Covid, continued global economic growth and broad-based DM central bank monetary accommodation would and should all augur well for this theme.