KEY TAKEAWAYS

- Market sentiment has declined markedly over the last quarter based primarily on deteriorating global growth prospects and ever-lower inflation expectations.

- The negative backdrop has pushed global central banks back to the dovish side, intensifying their attention on "inflation-based outcomes."

- Struggling to find consensus, the Fed is likely to move cautiously toward additional easing.

- If growth remains resilient, we think the Fed will have time to implement a more appropriate policy position.

- Until inflation reaches or exceeds the long-standing 2% target, we don’t see policy rates going any higher.

Three months ago the fixed-income world seemed pretty placid. The Federal Reserve (Fed) had been on hold since the beginning of the year. The US economy was growing in line with expectations. The Fed held interest rates steady at its May meeting, citing the strength of the economy, low unemployment rate and positive financial conditions. Fed officials shrugged off the undershoot in inflation, attributing it to factors that were merely "transitory." At the European Central Bank (ECB) General Council meeting on June 6, ECB President Mario Draghi gave an upbeat assessment of European growth, noting that there was very little chance of a recession in Europe. And while he noted that the ECB’s policy toolkit was adequate if downside risks arose, there was no immediate issue on the horizon. A fixed-income investor pondering his portfolio structure could have been reasonably forgiven for not gleaning any sense of urgency from those remarks.

Fast forward to today. Yields across the global investment-grade universe have plummeted. $16.7 trillion of debt trades at negative yields. The US market is the only place where positive yields are available in abundance as the US has 95% of the positive yield in the investment-grade space (Exhibit 1). The ECB has strongly intimated that it will be cutting interest rates to further negative levels and is considering reinstituting quantitative easing (QE) as well. In the US, the Fed has cut interest rates and is suggesting more cuts are coming. Both central banks note a downshift in global growth, focusing particularly on manufacturing and the weakness in global trade. They draw specific attention to the increase in uncertainty and downside risks (this is essentially code for the global slowdown and the protracted nature of the trade war). A fixed-income investor today is in a truly excruciating position. Yields are at or near historic lows in the developed world, spreads are tighter than they have been in the recent past and, most importantly, there is very little prospect that central banks will provide any higher interest rates in the reasonably foreseeable future.

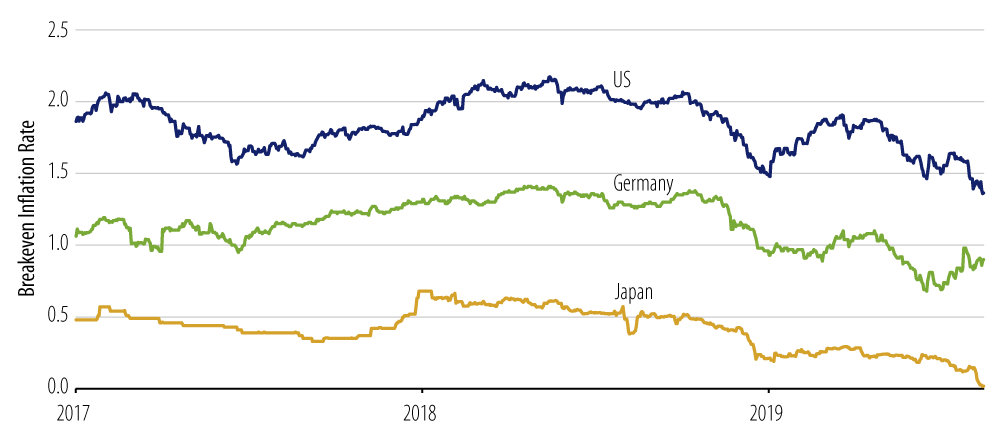

In the last several weeks, two things changed. The global outlook has darkened, particularly with the manufacturing sectors around the world, as uncertainty over the trade war continues to weigh heavily on capital expenditures. Just as importantly, the global inflation picture has shifted downward. Inflation expectations have moved decisively lower. Markets appear to be questioning whether policymakers can actually achieve their 2% inflation goal in Japan, Europe or now even in the US (Exhibit 2). These developments have forced central banks to move monetary policy more dovishly, and to accelerate their emphasis on what we might term "inflation-based outcomes" in addition to their more traditional GDP forecasting.

Bank of Japan Governor Haruhiko Kuroda talks about the challenge of raising inflation expectations in a society that has not seen inflation in over a generation. His solution is to promise to run an extraordinarily accommodative monetary policy until inflation exceeds the target for "a sustained period of time." While 2% seems far off in Japan, the focus on the inflation outcome is instructive—and don’t expect any tightening of policy unless and until inflation is over target for a sustained period.

In Europe, Draghi also has much to worry about. Growth has downshifted. The global trade uncertainty weighs very heavily upon Germany, where the risk that it may enter at least a technical recession is very real. The politics of Italy and Brexit meaningfully complicate the growth outlook. Additionally, the chronic undershoot of inflation has been the bedrock of the ECB’s extremely dovish monetary policy. Indeed, the further downward shift in inflation expectations has spurred Draghi’s call for further rate cuts and potential implementation of further QE. And even though that day may also seem far off, he too speaks of the need to achieve above-target inflation for a substantial period of time.

Now consider the Fed. We would argue that it is moving, even if haltingly, to more inclusiveness of inflation outcomes as an integral part of its policy-making approach.

Consider the Fed’s pivot to a dovish policy in June. With unemployment at multi-decade lows, the stock market at record highs and GDP data coming in as forecast, a Fed ease would have seemed virtually inconceivable based on the Fed’s approach over the last 30 years. At best, one might devise a risk management case for "an insurance cut."

Importantly, an inflation-centered approach yields a meaningfully different policy implication. The Fed has forecast the return of above-target inflation in each of the last eight years, yet missed it every time. Inflation remains below target, and inflation expectations are falling. Fed Chair Jerome Powell has written and spoken at length about the persistent nature of long-term structural inflation challenges. He has stressed the need for "inflation credibility" (i.e., convincing people that the target will someday be achieved). In this context, the policy impulse would be to unambiguously ease.

In explaining how the Fed is balancing these two overlapping but distinctly different approaches Powell is inconsistent. Usually, he muddles through, talking about growth uncertainties, but referencing low inflation. Clearly the entirety of the Fed Board does not have consensus. Since Powell is either unable or unwilling to stay on the inflation point, we continue to expect the Fed to move slowly toward greater easing. The risks to growth both here and abroad as trade uncertainty continues to put manufacturing under pressure augurs for "insurance" at a minimum, even as the undertow of inflation and expectations suggest greater alacrity is needed.

Given this backdrop, we would like to make two investment points. In the short term, we think the heightened pessimism around global and US growth is overdone. If growth is resilient, the Fed will have time to get to a more appropriate policy position. But clearly we need growth to hold. Anxiety over both growth and Fed policy will provide heightened volatility for risk assets.

Longer term, we think the prospect of any renewed tightening campaign by central banks will be a very long time in coming. The inability to get inflation to—let alone above—targets is sobering. We think the operative policy for tightening going forward will be a wait-and-see approach. No more tightening will be allowed based on central bank forecasting. Instead, inflation will actually have to show up. Only when it rises above target, and stays there for the hoped-for "sustained period of time" (which seems to mean at least a year), will we see any higher policy rates. In our view, that is a long way off.