KEY TAKEAWAYS

- As global equity markets tumbled and credit spreads were pushed sharply wider, our portfolio decisions were premised on our view that while near-term global growth would be severely impacted, the shortfall would prove to be largely transitory.

- GMS portfolios are currently maintaining duration positioning around 4.0 to 4.5 years, which we believe provides sufficient ballast against spread risk in portfolios.

- Heading into 4Q20, our base case view for an elongated, U-shaped global economic recovery remains intact.

- We believe that our GMS portfolios have successfully navigated the extreme market volatility experienced this year and are well positioned to benefit from opportunities available in the various liquid global bond market sectors.

Portfolio Overview

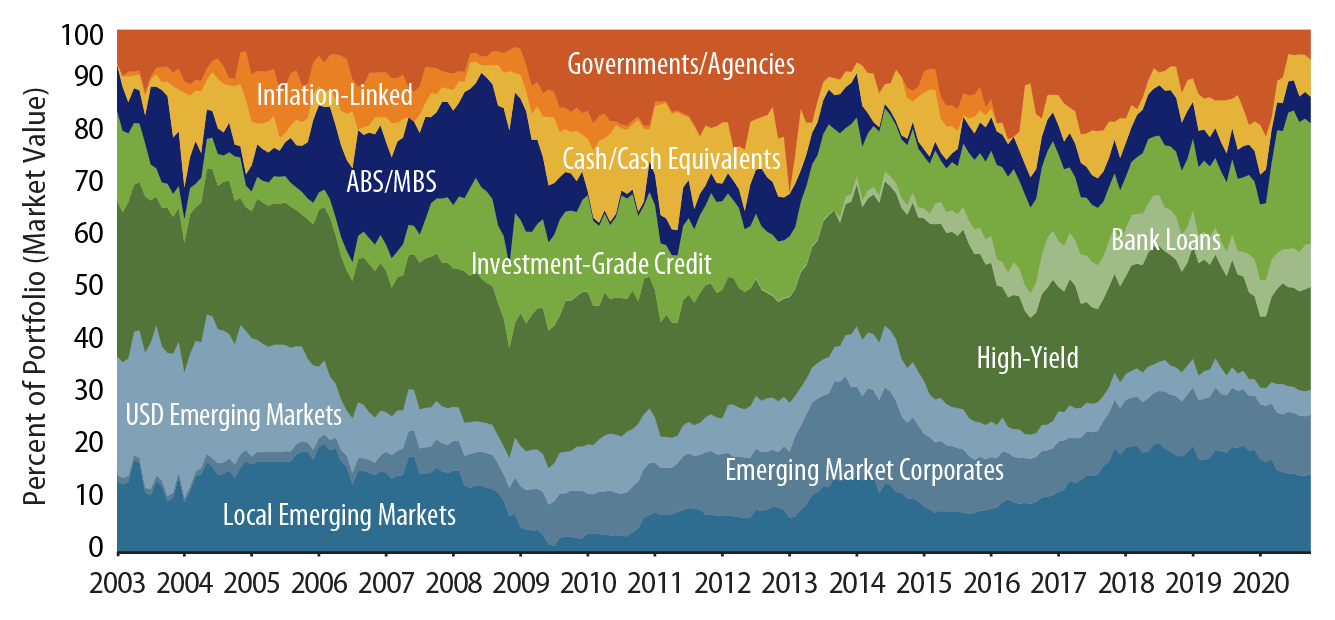

At the start of the year, Global Multi-Sector (GMS) portfolios were positioned to benefit from steady US growth, a moderate rebound in eurozone growth overall and an acceleration in emerging market (EM) growth momentum. Market sentiment was optimistic on the back of abating political tensions in Italy, the UK’s decision to officially leave the European Union (EU) and the signing of the US-China phase one trade deal. Corporate credit fundamentals were reasonably solid while the low-yield backdrop was likely to continue to provide strong technical support for EM debt, bank loans, mortgage-backed securities, and high-yield and investment-grade corporate bonds. Declining inflation in many EM countries was allowing central banks to lower rates and support economic activity. EM real yields and the differentials versus those of developed markets (DM) had scope to compress.

However, the rosy macro backdrop and positive momentum in global credit markets came to a screeching halt at the end of 1Q20 as the spread of COVID-19 intensified. This sent global equity markets tumbling and pushed credit spreads sharply wider. Safe-haven government bonds rallied, with benchmark 10-year US Treasury (UST) yields hitting record lows on the prospect of additional monetary policy accommodation.

During this extraordinary period, we recognized that policymakers still had significant firepower to work with, but it became clear with each passing day that the impact of the viral outbreak on global growth would be significant, and would likely be deflationary. The outlook became even more muddied following an unexpected oil price war that started in March 2020 between Saudi Arabia and Russia, which exacerbated the decline in crude oil prices. This, in turn, pushed credit spreads to levels not seen since the 2008 global financial crisis.

In the midst of the March selloff, GMS portfolios:

- Added selectively to investment-grade corporates and high-quality, USD-denominated EM sovereigns that were offering significant spread concessions via the primary market.

- Reduced long-dated UST exposure as yields reached levels that no longer offered value or hedging benefits to portfolio risk positioning.

These GMS portfolio decisions were premised on our view that while near-term global growth would be severely impacted, the shortfall would prove to be largely transitory as policymakers pushed to resuscitate economic activity. Indeed, significant central bank policy easing, extensive liquidity provisions and enhanced fiscal stimulus in both the US and Europe helped to support market functioning as we moved into quarter-end.

As we moved into 2Q20, we were able to benefit from our tried and tested long-term fundamental value philosophy and 20+ years of managing GMS portfolios. We viewed investment-grade corporate bonds as offering attractive risk/reward characteristic given unprecedented action by the Federal Reserve (Fed), European Central Bank (ECB) and other central banks to ensure not only the functioning of credit markets, but also to lower the borrowing costs for corporates to help stimulate the global economy. Specifically, the implementation of the Fed’s new corporate credit facilities that stabilized credit markets, the approval of a new €750 billion support package for the EU, an increase in the size of both the ECB and Bank of England asset purchase programs, and the collective effort by EM central banks to provide emergency support in their respective countries all helped to stabilize markets.

We adjusted GMS portfolio positioning to benefit from these moves by:

- Adding meaningfully to US investment-grade corporate bonds and select USD-denominated EM sovereign issues in the primary market.

- Increasing US high-yield exposure by reducing CDS protection and purchasing select new issues.

- Extending exposure along the UST curve and capitalizing on the market strength by taking profits on various US and European credit issues in the secondary market, as DM rates started to rise and yield curves began to steepen, driven by better than expected high-frequency economic data releases.

Outlook and Positioning

As we begin 4Q20, our base case view for an elongated, U-shaped global economic recovery remains intact. We expect the battle against COVID-19 will take time; however, we are encouraged by signs of progress in the global race for a vaccine and the decline in global mortality rates. We expect central banks to remain extraordinarily accommodative, especially in light of subdued global inflation pressures, and to remain so to support the recovery. That stated, we remain wary of the US presidential transition period, post-Brexit trade negotiations, US-China trade discussions and geopolitical tensions as these all have the potential to disrupt economic and financial market activity.

GMS portfolios are positioned to withstand further market volatility, yet remain flexible enough to capture attractive value opportunities as they appear. For instance, we maintain a healthy allocation to corporate credit. Despite a strong recovery in the past two quarters, investment-grade credit market valuations remain supported by favorable demand technicals that we expect to endure. Our bias in the near term is to remain focused on higher-quality US and European industrial and financial issuers that have robust franchises, solid balance sheets and the wherewithal to survive should the path of the virus force an even longer period of repressed economic activity.

We are also constructive on high-yield corporate credit, albeit acknowledging that the outlook for fundamentals will be challenged in the near term and subject to the path of the virus. Investor flows and new issuance also remain robust. Here, our focus remains on select issuers within the financials, consumer cyclical, noncyclical, communications and capital goods sectors. We also have a modest allocation to more challenged sectors such as energy and transportation where select credits offer strong collateral protection and compelling total return upside.

Bank loans also look attractive to us given that they have lagged the high-yield rally year to date. While September saw a flurry of transactions, we expect the fourth quarter to be a light issuance period. We expect demand to outstrip supply, providing support for the bank loan market to go higher into year-end. Defensive higher-quality names are expected to benefit as ramping CLOs look to make purchases in the secondary market. Any volatility during the election season or around Covid developments will be an opportunity to add to higher-quality credits.

In EM, we maintain a well-diversified allocation. We continue to center on select EM countries with ample foreign exchange reserves, low external economic dependency, lower political uncertainty and the policy flexibility to mitigate the negative impacts of the pandemic. With this in mind, we continue to favor high-quality, hard currency sovereign bonds from both a carry and total return standpoint and EM corporates with clean maturity schedules and liquidity positions. Local rates remain attractive as the real rate differential between the US and EM countries is a dynamic that should benefit prospective EM capital and portfolio flows, especially against the backdrop of EM central banks maintaining strong policy accommodation. To control risk and in recognition of the extra nearterm challenges facing EM, we are carefully limiting EM currency exposure to currencies such as the Mexican peso, Indonesian rupiah and Russian ruble (which benefit from resilient sovereign fundamental factors and strong investor support) while holding a meaningful long positions in the Japanese yen and the euro as hedges against the credit risk embedded in GMS portfolios.

GMS portfolios are currently maintaining duration positioning around 4.0 to 4.5 years, which we believe provides sufficient ballast against spread risk in portfolios. Long US duration positioning (with an emphasis on the long end of the yield curve) reflects Western Asset’s view that the Fed will maintain a dovish monetary policy for the foreseeable future.

We are also maintaining a small short position in 10-year German bunds as we expect eurozone growth to slow after a marked pick-up over the summer months, and for news flow around COVID-19 and rolling lockdowns to weigh on market sentiment into year-end. We have also recently initiated a long UK duration position (in the 10-year part of the gilts curve) on expectations of increased volatility into year-end as UK fiscal policy is being tightened, and although the trade negotiations with the EU have been extended, they are required to conclude by year-end. The outlook for UK monetary policy has become more subjugated to events on the fiscal and trade side, which could lead to another round of monetary easing in an adverse outcome.

Conclusion

We believe that our GMS portfolios have successfully navigated the extreme market volatility experienced this year and are well positioned to benefit from opportunities available in the various liquid global bond market sectors by drawing upon Western Asset’s best ideas in a risk-controlled framework. With a track record dating back to 1996 for our GMS portfolios, our philosophy of combining higher-return assets with risk-reducing strategies and actively rotating across sectors through different market cycles should continue to stand the test of time.