KEY TAKEAWAYS

- The recent passing of Supreme Court Justice Ruth Bader Ginsburg and the process of confirming her replacement adds a new dimension to the political landscape and could reduce the chances of the White House and Senate splitting.

- While there are stark policy differences in other areas, we believe that if either party controls both the White House and Congress, substantial fiscal stimulus is likely to be a primary order of business. However, the process of confirming a Supreme Court replacement will likely dominate the focus in Washington in the near-term.

- Although President Trump has not yet proposed any changes to tax policy, future tax hikes may be inevitable given the severity of the Covid-induced economic downturn and the current record level of the US budget deficit; however, we believe taxes would generally be higher under a Biden administration.

- Under a President Biden, we could see an improvement in the US-China relationship, which may further contribute to the global economic recovery.

- Given that markets will likely remain sensitive to headline risk, particularly those that could come in the form of an “October surprise,” we remain focused on positioning our portfolios to withstand further market volatility.

The onset of the COVID-19 pandemic and its associated economic fallout have already added significant uncertainty to the outcome of the US presidential election this November. After a heart-rending plunge in March and April, economic activity has bounced back over the past few months. However, even the sectors that have bounced most strongly have not yet fully recovered, and other sectors have only begun their recoveries. Furthermore, the recent passing of Supreme Court Justice Ruth Bader Ginsburg and the process of confirming her replacement now adds a new dimension to the political landscape and could re-shape stakes in a number of key Senate races.

At the time of writing, former Vice President Joe Biden leads President Donald Trump in polling. However, Trump’s potential pick for a replacement for Justice Ginsburg could meaningfully shift the tone of his campaign over the next few weeks; historically, Trump’s court policies have been generally popular among Republican voters.

As we saw during the 2016 election, the impact of several key swing states could easily shift the overall presidential election outcome. Beyond the office of president, other elections in this cycle will result in either a further divided or a more unified government. The wider results will likely have an even greater impact on future policy, and in turn, on markets, than the outcome of any one race. Presently, Republicans hold a majority of the Senate seats up for re-election, giving Democrats several opportunities to break up the Republicans’ current 53-seat majority.

While the overall health of the US economy will be front-and-center for markets that remain sensitive to headline risk, there are also several other key issues in focus that may impact global fixed-income investors ahead of the November vote.

SUMMARY OF FIVE KEY ISSUES

1. Covid-Related Policy Support: Fiscal and Monetary

Fiscal and monetary policy will work to support the economic recovery in the US, but it is not clear how effective these tools will continue to be. The last few months witnessed an extraordinary amount of bipartisanship in fiscal policymaking. The magnitude and severity of the economic emergency driven by COVID-19 led to an unusual moment of Republicans and Democrats coming together to act efficiently. The extraordinary fiscal packages released in March and April were passed with near-universal support and have been an important lifeline for the US economy.

Such bipartisanship is certainly not guaranteed to last, however, and the breakdown of negotiations regarding the latest economic relief package may be an early warning sign of Congress members reasserting partisan considerations. Though it was widely expected that the current impasse would be resolved soon, the new emphasis on confirming a replacement for Justice Ginsburg will likely consume the entirety of the Senate’s focus ahead of the election. In light of these most recent developments, we expect that the outlook for fiscal policy will now depend on the outcome in November, with a new deal unlikely to be passed before December.

With respect to US monetary policy, we believe that Federal Reserve (Fed) policy will likely be unaffected by the election. Through its official statements following recent Federal Open Market Committee (FOMC) meetings and in comments made by Fed Chair Jerome Powell and other Fed governors, the Fed has strongly communicated its intention to maintain a dovish monetary policy for the foreseeable future. Yet while the Fed’s broader policy is unlikely to be affected by the election, the passage (or lack) of additional fiscal stimulus before December may influence the Fed to consider even more accommodative measures at its December FOMC meeting.

Market Implications: Thus far, markets have reacted the most strongly and most positively to stimulus-related news. If either party controls both the White House and Congress, substantial fiscal stimulus is likely to be their first order of business in early 2021. This will probably be the case under either a Democrat- or Republican-led government, as neither party has shown much aversion to deficits in the current environment. With that said, the overall amount of stimulus offered remains up for debate. Should we see unified control over the White House and Congress, the amount of fiscal stimulus is likely to be meaningfully greater than under a divided government.

2. US Tax Policy

While the need for additional fiscal stimulus to mitigate the economic fallout of Covid is a largely bipartisan concern, the contentious issues for fiscal policy will be the extent to which the federal government should help state governments cope with their budgetary problems that were exacerbated or instigated by the Covid crisis, and whether to roll back corporate tax cuts enacted two years ago.

Prior to President Trump’s Tax Cut and Jobs Act of 2017, the US corporate tax rate, which is now 21%, stood at 35%. If elected, Biden would support raising corporate taxes to 28%. On top of higher corporate taxes, Biden would impose a 15% minimum tax on profits—a move that would limit the ability of companies to minimize their tax bills. Regarding individual income tax rates, Biden supports restoring the top marginal rate to 39.6% for people making over $400,000 annually, up from its current 37% rate. Those making over $400,000 would see an increase in their Social Security payroll taxes. (Currently, only wages up to $137,700 are subject to the Social Security tax, of which the employee’s share is 6.2%.) Finally, those with incomes exceeding $1 million would have their capital gains and dividends taxed at the same rate as ordinary income.

While President Trump has not yet proposed any changes to tax policy, future tax hikes may be inevitable given the severity of the Covid-induced economic downturn and the current record level of the US budget deficit. With that said, we believe it is safe to assume that taxes would be higher under a Biden administration than with a second Trump term.

Market Implications: Any substantial changes to tax policy will hinge upon control of the White House and Congress. Markets tend to like a deadlocked Congress as that makes it less likely that sweeping new laws will be passed. Therefore, should Democrats control the White House and both houses of Congress and gain the ability to more easily pass tax-related legislation, we would expect spreads broadly to widen on the general concern of lower growth due to higher taxes. However, on a relative basis, we believe the impact of a potential Biden package is likely to be more positive for the tax-exempt municipals market.

3. US Infrastructure Investment

Infrastructure investment is one of the few bipartisan issues to consider this election season, as both candidates have outlined meaningful infrastructure-related proposals.

Trump’s plan details $1.5 trillion of spending, focused on traditional infrastructure. Over 10 years, the Trump package would spend $810 billion on highways and transit, and $190 billion on rural broadband, 5G cell services and other non-transportation infrastructure. The plan largely ignores clean energy and seeks to expedite the approval process for infrastructure projects.

In comparison, Biden’s proposal details a larger $2 trillion infrastructure plan over four years. Biden’s plan includes investments in clean-energy infrastructure and to provide American municipalities (of more than 100,000) with quality public transportation by 2030. Additionally, Biden’s proposal seeks to tie federal investment in infrastructure and transportation projects to minimum wages and union jobs by requiring that federally funded projects be covered by prevailing wage protections.

While infrastructure spending in itself is a bipartisan issue, there is limited certainty thus far and likely differences regarding how each plan would be funded. Biden’s rhetoric has shown him to favor increased taxes on higher wage-earners and corporations, which would likely be incorporated within his proposal. Trump’s plan provides $200 billion in federal government spending through an expansion of the existing Transportation Infrastructure Finance and Innovation Act and the Water Infrastructure Finance and Innovation Act to leverage state project spending. The Trump plan also seeks to expand private-public partnerships, and remove caps on private activity bonds (PABs). Trump does not propose any revenue increases to fund the spending, and is seeking to eliminate the 3.8% Medicare surcharge tax and make the 2017 Tax Cuts and Jobs Act tax structure permanent.

Market Implications: As both candidates favor significant infrastructure spending, we would expect industries such as basics and construction to benefit under either presidential outcome. However, given that aspects of Biden’s infrastructure plan are inherently linked to his clean-energy objectives, even a partial implementation of his infrastructure proposal may have a negative impact on the traditional energy sector. Further, should Democrats control both Houses of Congress and the White House, the defense industry might suffer due to decreased government flows.

4. US-China Relations

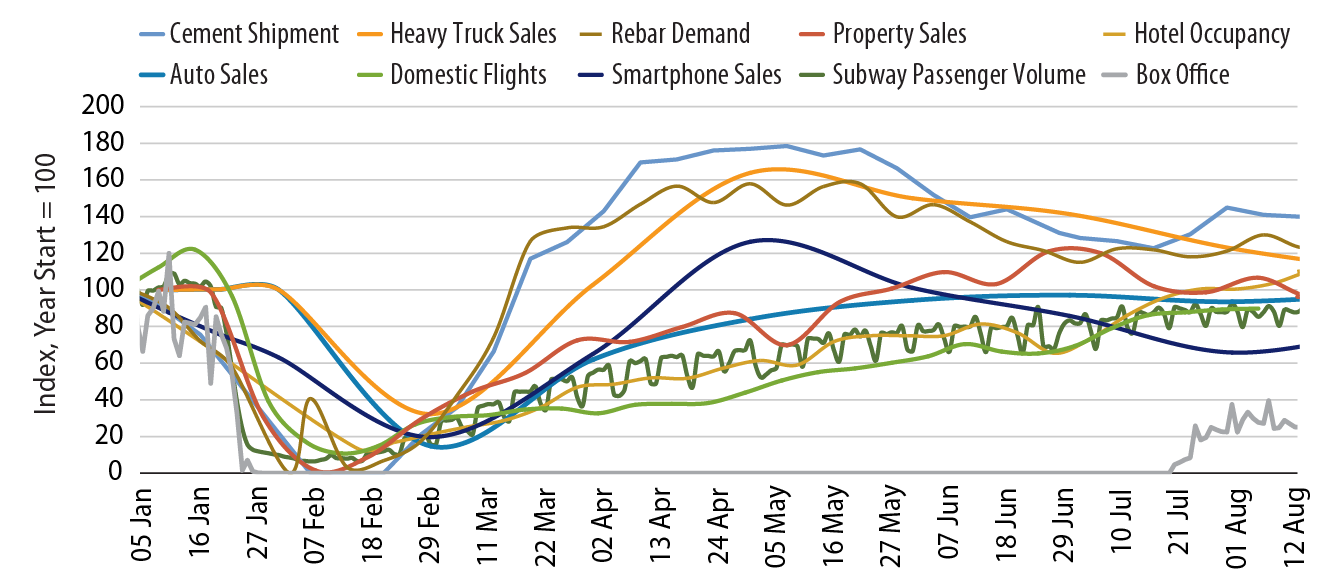

The Chinese economy has mostly recovered from the work stoppages and mobility restrictions resulting from the pandemic (Exhibit 1). However, its key weakness is related to the external sector, which is undermined by the backdrop of a rapidly deteriorating US-China relationship.

Given the track record of bipartisan Congressional support for recent anti-China legislations, we are not hopeful that either election outcome will produce a material improvement in the US-China relationship. Currently, the dynamics of the relationship are driven by the hawks in both nations, and China appears unlikely to back down on its strategic positions (e.g., related to its policies regarding Hong Kong and Taiwan). The Chinese government has a long-term perspective and will likely be positioned for a worst-case scenario of heightened US-China strategic rivalry, regardless of which camp wins in November.

That said, it is possible that a Biden-Harris administration may improve the form (not necessarily substance) of the US-China relationship. There could be some room to “agree to disagree” and for a peaceful co-existence if tensions are not amplified by hawks on both sides of the US-China relationship.

Market Implications: Markets have already been pricing in a partial and gradual disentanglement of global supply chains dependent on China. An escalation in tensions would accelerate that trend with certain industries negatively affected (e.g., retail and manufacturing industries scrambling to adjust) while others may see a positive boost (e.g., telecom and technology).

5. US-Europe Relations

Much of our future outlook on US-Europe relations will also hinge upon which party controls the chambers of Congress come November, in particular, the Senate. Though understandably, the outcome of the presidential election will be instrumental in setting the tone of future policy decisions.

During a second Trump term, we would expect to see US trade policy focus increasingly on the US trade balance deficit with the eurozone (Exhibit 2). In many ways, the US-China relationship could serve as a blueprint of what is in store for Europe. We also see a chance that divergent monetary policy—in case the Fed were to remove accommodation significantly earlier than central banks in Europe, resulting in a stronger US dollar—could bring us back to a discussion about currency wars.

Under a Biden-Harris administration, we would expect a return to more global cooperation, though not to the level of the early Obama years. We foresee a stronger international engagement than currently exists and we think some of the decisions made under Trump could be rolled back, in particular with respect to the withdrawal of the US from the Paris Climate Accord and the World Health Organization. We also believe that a Biden presidency would imply more support for functional international organizations, especially the World Trade Organization. However, we note that the Biden platform is viewed as “moderate” within the Democratic Party and such an administration will be required to balance catering to the left wing of the party. Without full control of Congress, a Biden-Harris presidency may be limited in its ability to effect a continuity of sorts with the policies promoted by the Obama administration.

Regarding US-UK relations, we believe that a mutually beneficial trade arrangement might be somewhat harder to reach under a Democratic president given the potential for conflict with the left wing of the party. That said, we don’t foresee such an agreement as a policy priority under either administration.

Market Implications: While unlikely, we believe any meaningful changes to trade policy with the UK or EU would introduce massive uncertainty with regard to global trade. Moreover, we believe that it’s possible a Biden administration would be much more willing to engage, like a replay of 2008-2009, in a constructive discussion around a one-off increase of country financing quotas at the International Monetary Fund. Such an increase could somewhat alleviate the enormous financing needs of emerging and developing countries in the face of COVID-19, and be viewed as positive for global markets.

Summary

As witnessed during the 2016 election, the ability of polls to predict election outcomes is limited. With several weeks to go before November, outcome uncertainty is high. The current political landscape was already exacerbated by the economic and healthcare climate as well as renewed calls for racial justice. The latest focus on a Supreme Court replacement adds additional uncertainty to election outcomes and could reduce the chances of the White House and Senate splitting along party lines. It is important to note that with respect to this election cycle, more than just the presidency is at stake; there are a number of highly contested Senate races, the outcome of which could lead to Democrats gaining full control over Congress.

Given that markets will likely remain sensitive to headline risk, particularly those that could come in the form of an “October surprise,” we remain focused on positioning our portfolios to withstand further market volatility. As always, we are also focused on remaining flexible enough to capture value opportunities as they appear, particularly in those sectors most likely to be influenced by election outcomes.