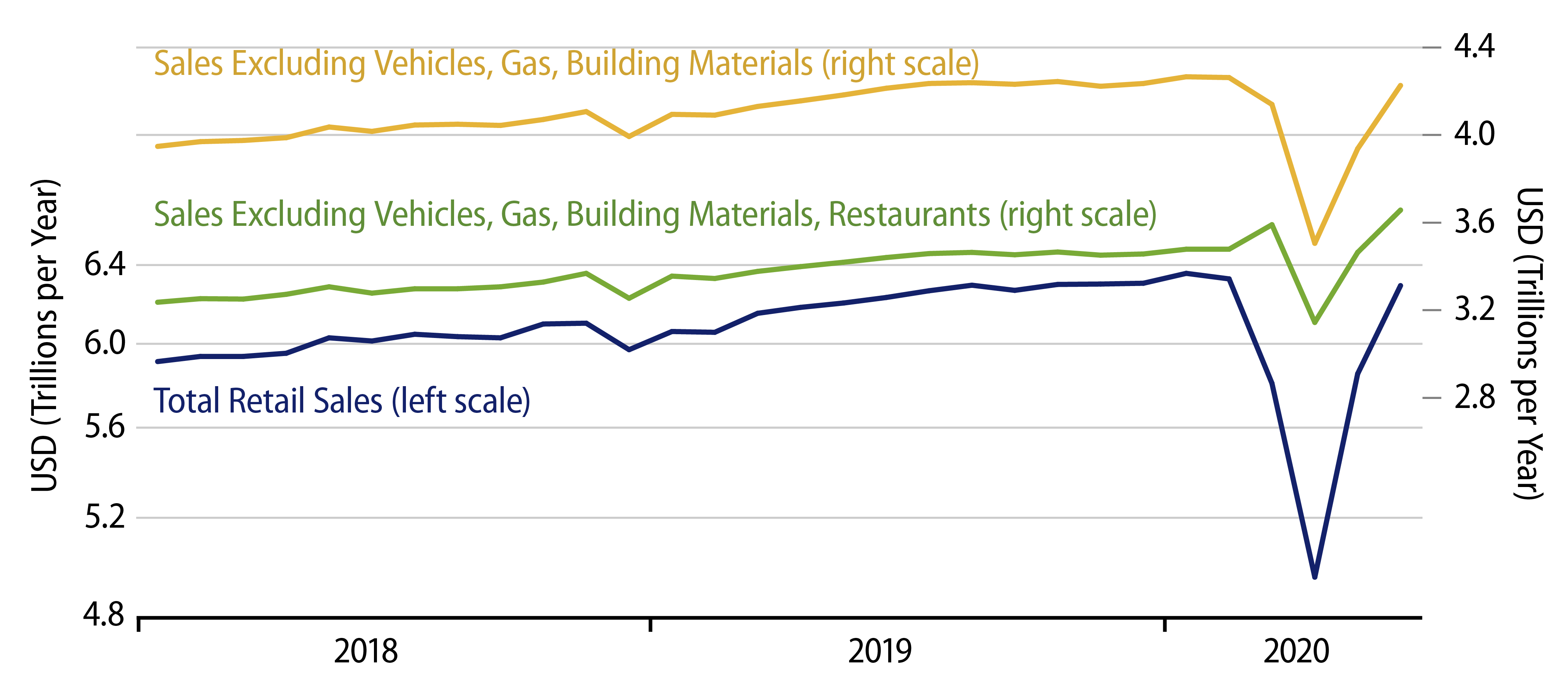

Retail sales continued to increase strongly in June, furthering their recovery from the COVID-induced shutdown that debilitated activity through April. Total sales increased 7.5% in June, following an upwardly revised 18.2% gain in May, leaving them just 0.6% below their pre-COVID February peak.

For our preferred “control” sales measure, sales excluding vehicles, gasoline, and building materials, June saw an increase of 7.2% following a 12.3% May gain, leaving them 0.8% below February’s peak level. Our control measure differs from that followed by Wall Street analysts in that it includes restaurant sales, our thought being that restaurants are normally as indicative of consumer spending trends as the other retail sectors. (In case you are wondering, vehicles, gasoline and building materials are typically excluded from control sales because they reflect business spending as much as consumer spending, and the intent of the control sales measure is to focus on consumer trends.)

However, with COVID-19 fears still heavily restricting activity at restaurants and bars, these are not normal times. So, the commonly presented measure of control sales is more reflective of underlying consumer demand than ours, at least for now. The former measure showed a 5.6% June gain on top of a 10.1% May increase, leaving it 5.2% above the February level.

To repeat, outside of the sectors still heavily restricted by COVID-related realities, consumer spending has actually more than fully recovered from the shutdown imposed on the economy in mid-March. Some prominent analysts have talked of a “cratering of demand” occurring during the economy’s slide in March and April. We would disagree sharply with that assertion, countering that demand was instead artificially suppressed, by consumers forcibly prevented from going to the store. The bounce-back we have seen in sales over the last two months, where allowed, testifies to that description.

Now, certainly, a surge in online sales has facilitated the consumer rebound, so it is not quite business as usual at malls. Still, spending is occurring as best it can. Interestingly enough, sales at nonstore vendors (which include online retailing) actually declined about 2% in June, even while other components of control sales rose sharply. So, again, it is not just online shopping that is powering consumers’ redux.

Restaurant sales remain depressed. After a 54.1% cumulative decline there in March and April, their 57.9% cumulative increase in May and June leaves them 27.4% below February sales levels. (Blame the “magic” of compounding for this fact.) Similarly, we are seeing even sharper net sales declines in other, non-retail service sectors hard hit by the shutdown, such as hotels, recreation and passenger travel.

As long as social distancing restricts activity in these sectors—as well as in medical care—recovery in the economy will be less than complete. However, as seen with the retail sales data today, “less than complete” can still be substantial. If business spending and construction can rebound anything like what we are seeing from consumers, 3Q20 GDP growth could easily be in the high-20% range, with 4Q20 likely to show a strong, single-digit increase.

That would leave the overall economy at year-end still well below pre-COVID activity levels, but it would still constitute a V-shaped recovery and more of a bounce than most countenanced two months ago. Such a scenario obviously assumes no widespread renewal of shutdown edicts, but otherwise is right in line with recent economic indicators.