Municipals Posted Negative Returns as Yields Moved Higher Across the Curve

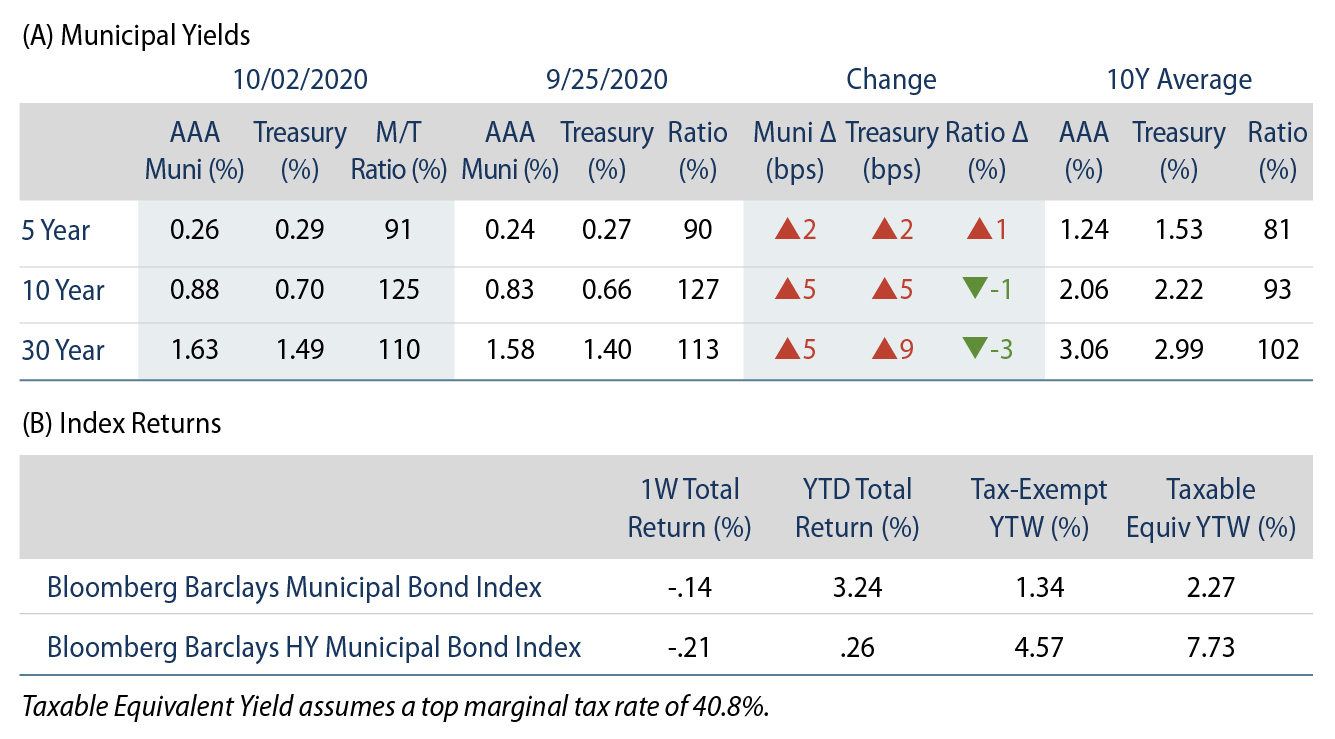

Municipals posted negative returns during the week but generally outperformed Treasuries. AAA municipal yields moved 2-5 bps higher across the curve. The Bloomberg Barclays Municipal Index returned -0.14%, while the HY Muni Index returned -0.21%. This week we provide a third quarter review and our outlook for the fourth quarter.

Municipal Mutual Funds Post Outflows for the First Time in 20 weeks

Fund Flows: During the week ending September 30, municipal mutual funds recorded $775 million of outflows following 20 consecutive weeks of inflows, according to Lipper. Long-term funds recorded $941 million of outflows, intermediate funds recorded $237 million of outflows and high-yield funds recorded $57 million of outflows. Municipal mutual fund net inflows YTD total $20.2 billion.

Supply: The muni market recorded $11.5 billion of new-issue volume last week, down 13% from the prior week. Issuance of $346.5 billion YTD is 27% above last year’s pace. Taxable municipal issuance is over three times higher year-over-year (YoY) while tax-exempt issuance is relatively unchanged. We anticipate a heavy week of issuance this week with approximately $17 billion of scheduled new-issue volume (+48% week-over-week), which would mark the largest week of issuance in 2020. Largest deals include $3.2 billion California Infrastructure and Economic Development Authority (Brightline West) and $900 million New York City General Obligation transactions.

This Week in Munis: Quarter in Review—Positive Momentum Wanes With Federal Aid Prospects

The municipal market picked up the positive momentum from its strong second quarter as economic activity rebounded and expectations for additional federal stimulus increased in July and August. The momentum decelerated in September, when returns were largely unchanged as robust stimulus hopes faded across the market and supply-and-demand technicals weakened.

All told, the Bloomberg Barclays Municipal Bond Index returned 1.23% in the 3Q20, bringing YTD municipal bond returns to 3.33% through September 30. The High Yield Municipal Bond Index returned 3.09% during the quarter, turning YTD returns positive to 0.37%. Revenue-backed securities, particularly industrial revenue and lease-backed sectors outperformed while General Obligations underperformed.

While the market continues to hold out hope for a bipartisan deal ahead of the elections, we have seen more evidence of the pandemic taking a toll on state and local economies.

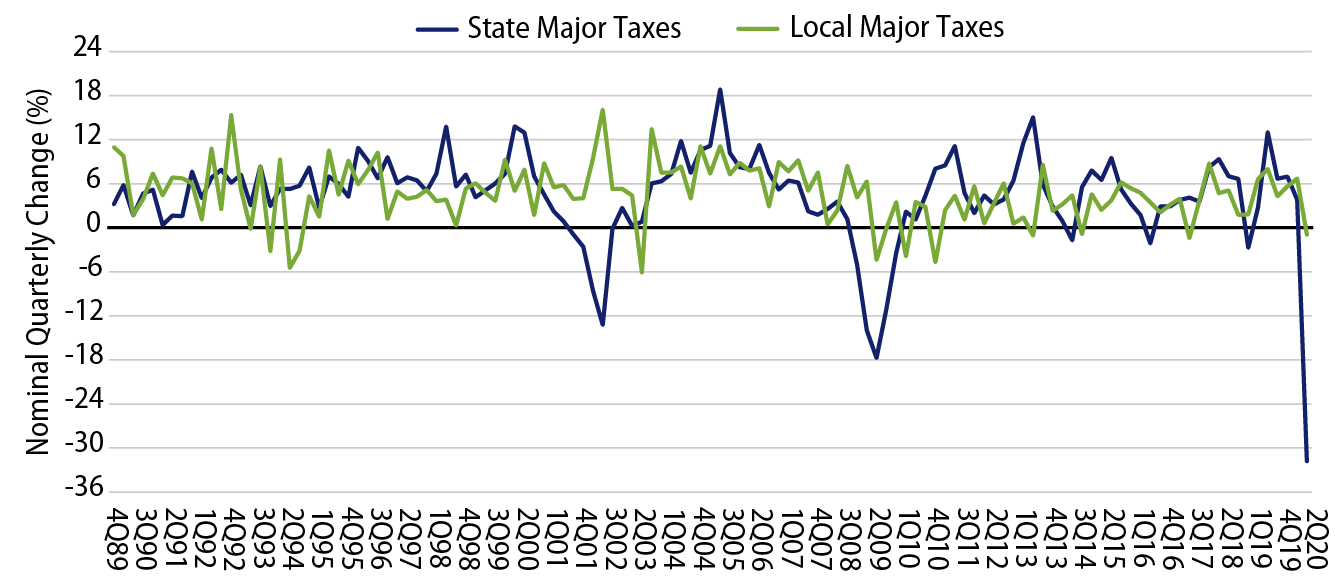

- According to the Census Bureau, YTD through June 2020, state and local tax revenues declined 8.5% YoY to $713 billion. State and local income tax collections were down 22% YoY to $236 billion, while sales tax revenues were down 5.4% to $208 billion. First half of year numbers are somewhat skewed due to the extended July tax deadline, and we expect marginal improvement in 2020 income tax collections when third quarter data is released.

- Municipal defaults have reached post-great financial crisis highs as 60 issuers (+62% YoY) of $5.2bn of debt (+84% YoY) missed debt service payments for the first time YTD through September 30, according to Municipal Market Analytics. While the increase is significant, default rates remain relatively low and are concentrated in certain high yield subsectors of the municipal market.

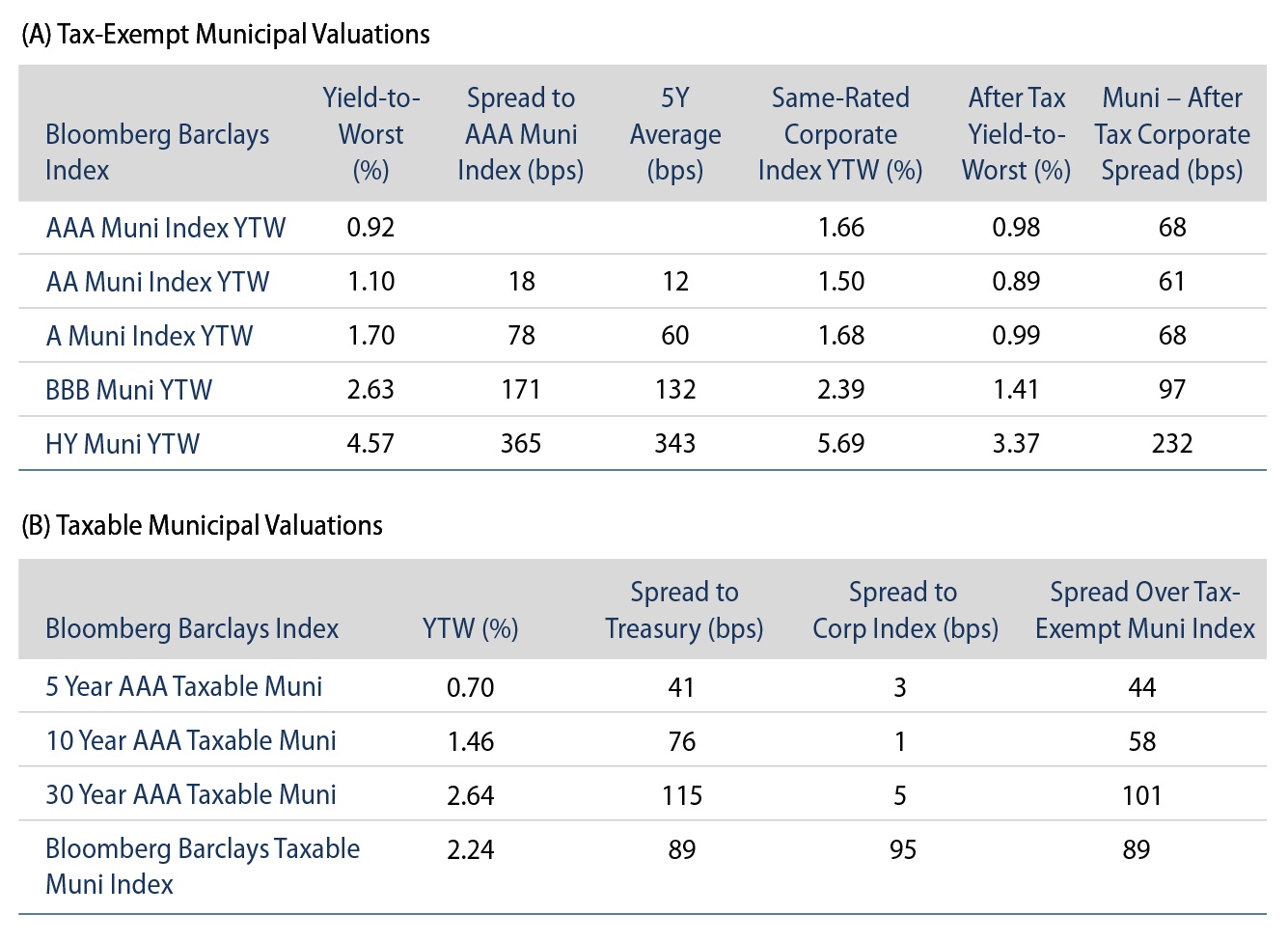

Despite near-term challenges, we remain favorable on medium- to long-term prospects of the municipal market due to the sector’s relatively higher quality and general budgetary resiliency, as well as favorable demographic trends and potential tax rate increases that we believe will continue to attract demand. However, we anticipate that a fraught election season, pandemic-related headlines and increasing muni supply could drive market volatility in the fourth quarter. We believe a patient approach entering the fourth quarter, paired with diligent credit analysis, could provide long-term investors favorable risk-adjusted income opportunities.