The Census Bureau reported today that housing starts rose 22.6% in July, while the June figure was revised upward by 2.9% to show a 17.5% increase on top of an 11.1% increase in May. For single-family starts, the July increase was a less spectacular 8.2% increase, with June’s figure revised upward by 4.6% to show a 19.4% increase, following a 7.2% gain in May.

To be sure, all these gains were necessary to recoup the declines seen during the shutdown. Total starts in July were still 4.5% below the pre-COVID February level, after having been down 40.4% through April. Single-family starts in July were still 9.1% below February levels, after having been down 34.3% through April.

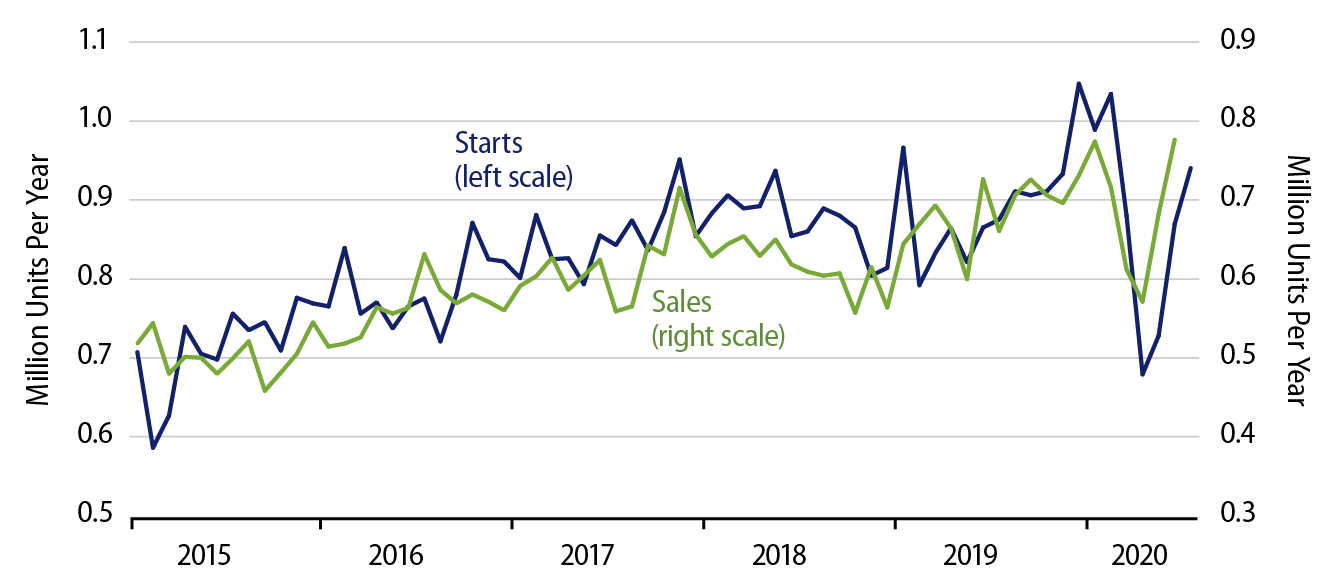

As you can see in the accompanying chart, single-family starts in July moved back to and through the levels prevailing in most of 2019 but remained lower than early-2020 levels. So, homebuilding has a ways to go yet before it is fully recovered from the shutdown. However, with new-home sales in June already back to pre-shutdown levels, there is reason to think that starts will indeed regain early-2020 levels in the months to come. The net declines evinced by housing starts through July are a very creditable performance relative to what we are seeing in other sectors.

As discussed last week, retail sales of merchandise have recovered fully from the shutdown effects, but factory production is rebounding more slowly, with inventories being drained in the process. The recovery in various hard-hit service sectors is fledgling at best. So, the facts that housing starts are within spitting distance of pre-COVID levels and that housing demand looks to be fully recovered are indeed impressive.

Because of the lags in the homebuilding process, actual residential construction spending continued to decline in June, and it is not a sure thing that it will rise in July. However, given the sharp—dare we say, V-shaped—bounce of housing starts over the last three months, it is inevitable that residential construction spending will start to rebound soon, and its total in 3Q should easily exceed that of 2Q.

This is the third straight major economic release where announced reality has outshined popular fears/perceptions (following jobs and retail sales). For all these metrics, recovery continues, and if the pace of recent declines was less than that of May or June, that was only to be expected.

In the words of Walt Kelly and Pogo, “We have met the enemy, and he is us.” The biggest threat to the present economic recovery is renewed shutdowns of economic facilities, not fear or insufficient demand on the part of consumers or businesses. Whether or not Congress passes another stimulus package doesn’t worry me. Whether governors move to further restrict economic activity does.