Where We Are Today

With the onset of the COVID-19 crisis the Federal Reserve (Fed) has been swift to introduce a variety of measures to support different areas of the financial markets, including the money market fund (MMF) industry. The facilities the Fed has put in place now span three very important investment types for MMFs: repos, US Treasury (UST) securities and commercial paper (CP). These newer facilities supplement the extensive support the Fed already provides in programs such as the overnight and term repo open market operations.

MMFs are an important cornerstone of a well-functioning capital market providing short-term funding for a variety of financial and non-financial institutional issuers, while providing a AAA rated, diversified mutual fund solution for a wide range of institutional and retail investors. Key investment objectives for MMFs typically include capital preservation, liquidity and competitive money market yields.

Government MMFs have recently seen very significant inflows with investors de-risking and raising cash as they seek a safe harbor from market volatility. However, prime MMFs have seen material outflows as investors move their cash away from short-term, credit-based investments and into the lower-risk government MMF sector. As a result, we believe the recent steps the Fed has taken to bolster the prime MMF sector are not unwarranted. Since the start of the current crisis, short-term credit markets—specifically CP and certificates of deposit (CDs)—have seen a reduction in trading volumes as prime MMFs look to increase daily and weekly liquidity to accommodate switches out of prime funds and into government funds as a result of general risk aversion by investors. This dynamic has made short-term funding in the CP and CD markets significantly more challenging for both financial and non-financial issuers.

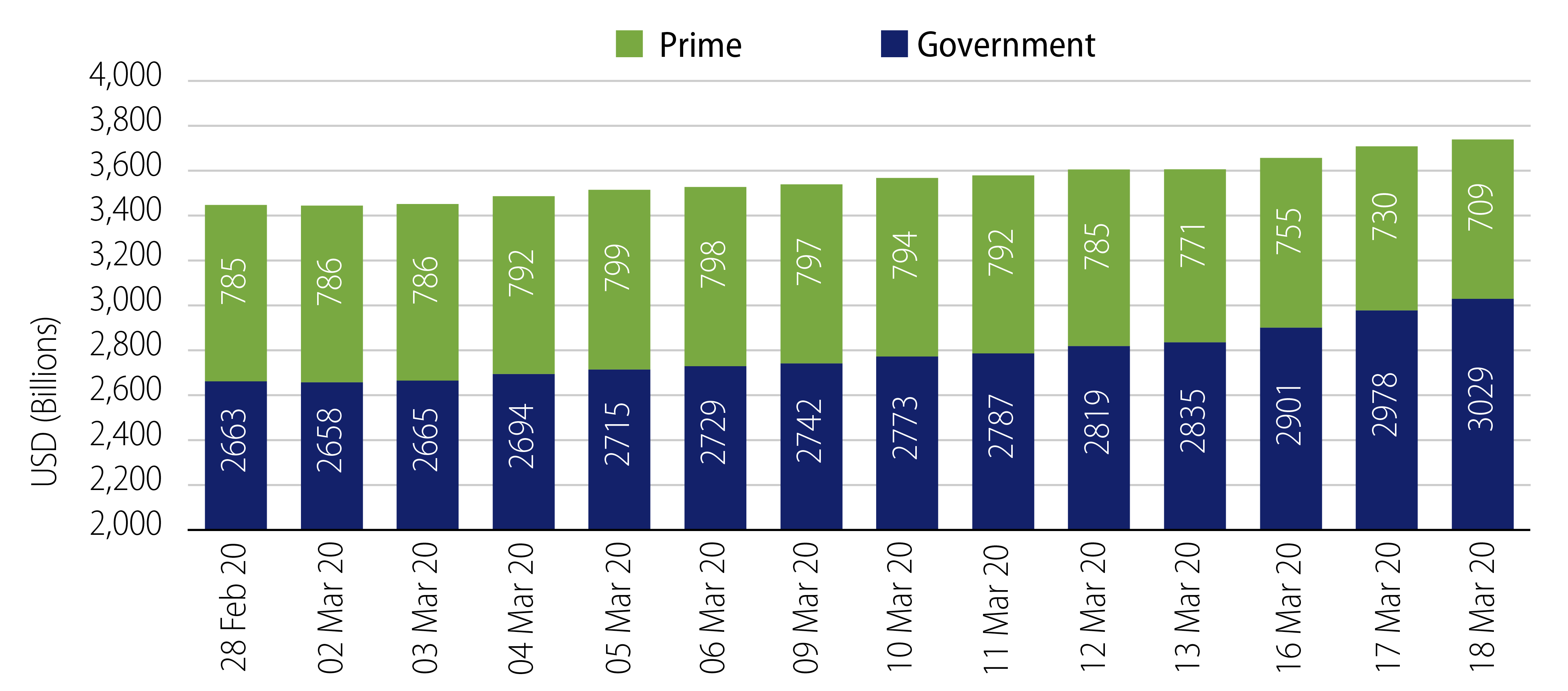

Exhibit 1 highlights the recent trend by investors moving investments from government to prime MMFs. From February 28 to March 19, 2020 total assets under management in MMFs have grown by $291 billion (8.5%); however, government MMFs increased by $367 billion (13.8%) while prime MMFs declined by $75 billion (-9.6%).

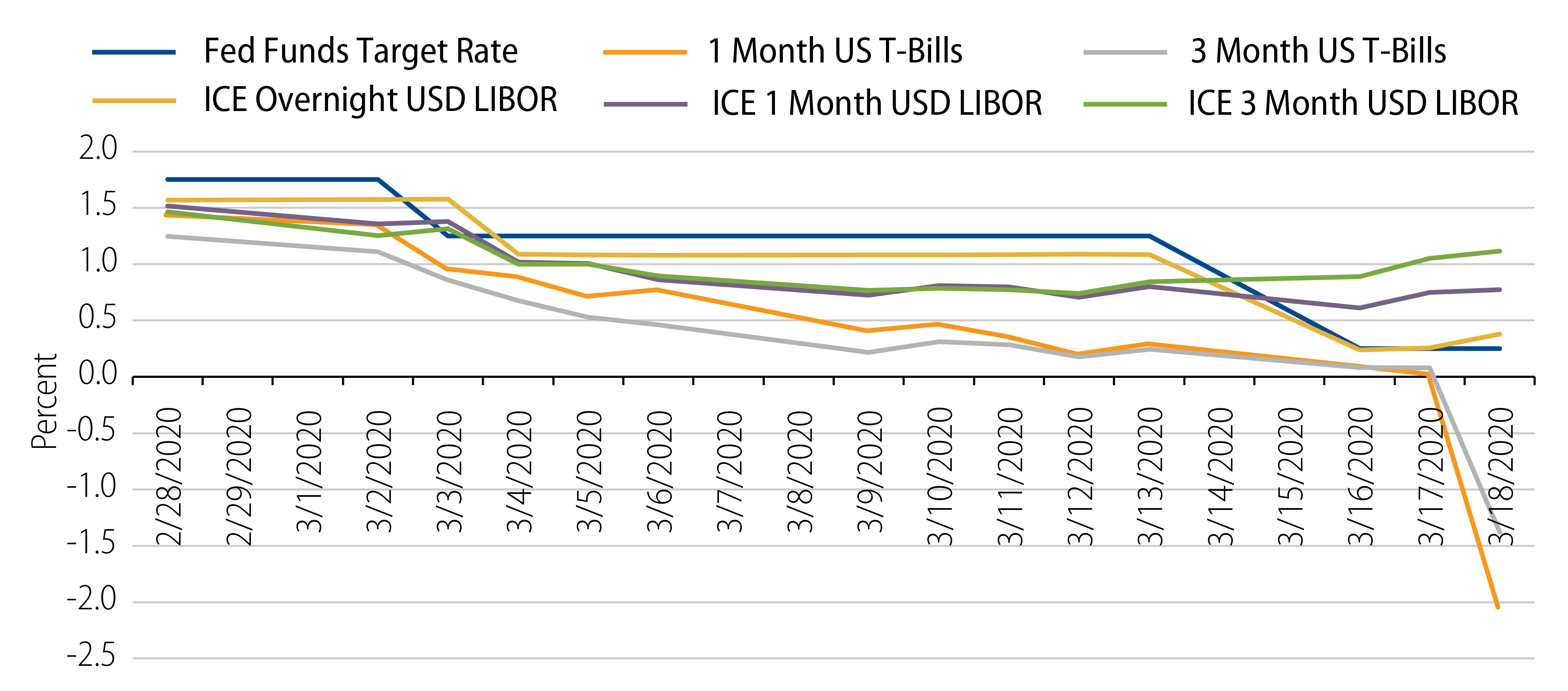

In addition to these difficulties in prime MMFs, government MMFs—which invest heavily in short-dated UST bills, agencies and repos—are experiencing their own challenging conditions due to stressed liquidity and sporadically negative UST bill yields. However, while government MMFs represent the majority of the US MMF industry and the sector remains a key area of concern for the Fed and other regulators, the main focus for actions taken to date has been on the continued functioning of the prime MMF sector. Recent moves in short-term interest rates have been dramatic: Exhibit 2 highlights movements of several key reference rates since the beginning of March 2020. The downward moves in UST bill yields are a result of significant increases in investor demand for low-risk assets combined with the dramatic announcement by the Fed on March 15 that it cut rates by 100 basis points (1%) and is embarking on bond purchases amounting to $700 billion over the coming months.

In the following, we explore a number of the facilities the Fed has introduced to support MMFs.

Overnight Reverse Repurchase Agreement Facility (ON RRP)

Established in September 2014, the ON RRP offers certain counterparties, including MMFs, the opportunity to lend money overnight to the Fed on a secured basis for a maximum interest rate set by the Federal Open Market Committee (FOMC). In the current market where the ON RRP rate is effectively zero, this facility provides MMFs with a non-negative floor for repo rates.

Commercial Paper Funding Facility (CPFF)

On March 17, 2020 the Fed announced its plan to establish the CPFF to help support the flow of credit in the US CP markets. The facility offers a liquidity backstop to issuers of US CP through a special purpose vehicle (SPV) that will purchase CP directly from the Fed if needed. Although the facility is not directly available to MMFs and does not include CDs, CP remains a significant investment option for prime MMFs and as a result is a welcome aid to help maintain investor confidence.

Primary Dealer Credit Facility (PDCF)

On March 17, 2020, the Fed established the PDCF to allow primary dealers of the NY Fed to borrow money for up to 90 days on a collateralized basis. Eligible loan collateral spans a wide range of securities, including CP (given that the PDCF is a broader alternative to the CPFF), but only for this narrower group of market participants.

Money Market Mutual Fund Liquidity Facility (MMLF)

On March 18, 2020, the Fed announced the formation of the MMLF, which has the ability to lend to banking institutions and their related entities so that they can then purchase a broad base of assets out of prime MMFs. The eligible collateral for the facility spans most of the investment universe for prime and tax-free MMFs but excludes CDs. Neither non-US nor US government MMFs are eligible for the program. Prime MMFs are the sole focus as they have been under the dual pressure of seeing liquidity in CP and CDs reduce dramatically while also facing possible investor withdrawals. Prime MMFs are managed to strict regulatory liquidity limits that require them to hold at least 10% in overnight liquidity and at least 30% in weekly liquidity, heightening the need for fund managers to potentially raise cash in short time periods.

In Summary

The depth and magnitude of the current COVID-19 crisis are unprecedented and the situation is changing rapidly. However, the number of facilities announced by the Fed in an effort to ease strains in the short-term funding market—and the speed with which they were brought to fruition—should come as some comfort to investors that broad and meaningful measures have been enacted so far. We believe more support by the Fed is to come, and although the form of this support has yet to be determined, the objective is certain: to improve liquidity, increase investor confidence and ensure the successful functioning of the markets as this crisis continues.