KEY TAKEAWAYS

- We continue to believe that US and global growth will be resilient, and that overall monetary policy will remain accommodative.

- Our economic outlook has been supported by our strongly held view that inflation would remain very subdued and that the process of inflation normalization would be not only long and drawn out, but would also require sustained monetary stimulus. Central banks have finally come around to this conclusion.

- If inflation continues to be modest, then we expect central banks will not tighten policy for a long time.

- Our view for next year is that the US economy will once again post moderate growth with subdued inflation.

- We are optimistic that economic growth prospects will continue to slowly improve, keeping the favorable backdrop for spread sectors intact.

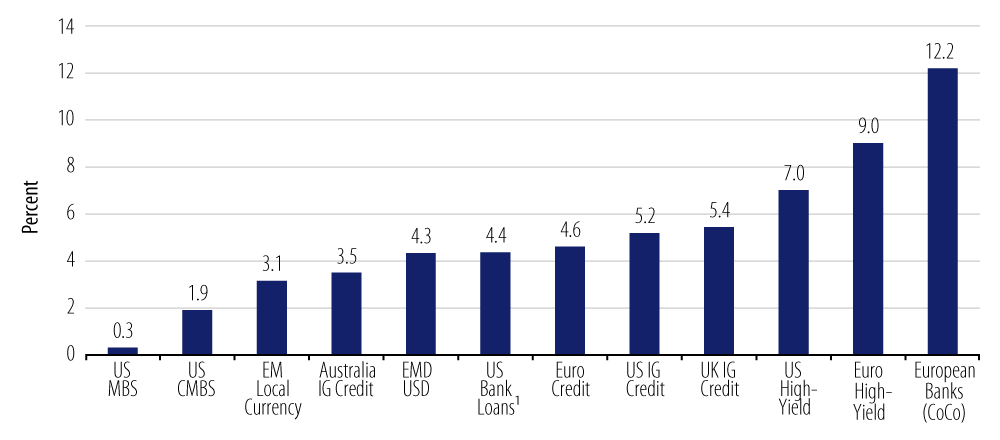

Our investment strategy this year has been underpinned by two dominant investment themes. The first is that global and US growth would prove to be resilient. Second, global and particularly US monetary policy would have to turn much more accommodative. The investment implications should these themes play out were straightforward. Spread sectors should handily outperform government bonds. Our controversial call early in the year for greater central bank accommodation has come to fruition. Our thought that global growth would be merely resilient looked like too low a bar near the start of 2019, but market focus and anxiety over this view have risen as global growth has decelerated. The combination of both of these themes broadly playing out has indeed led to a sharp outperformance of spread sectors (Exhibit 1).

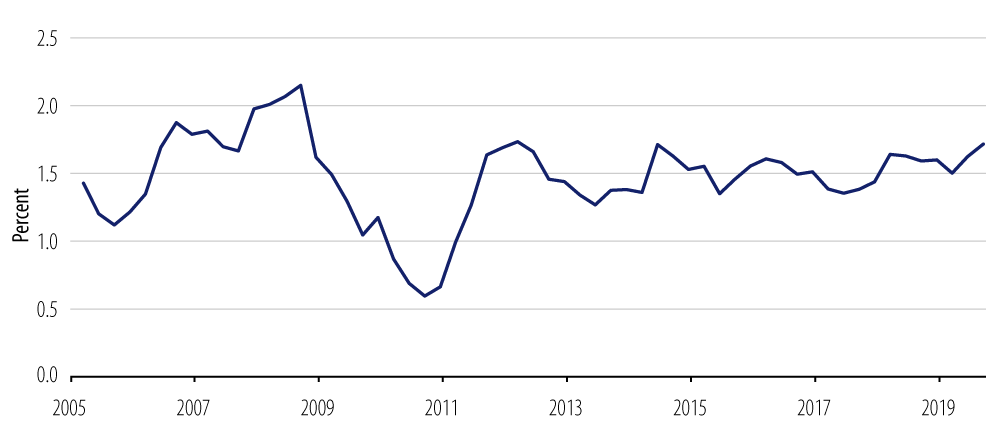

Underlying our economic outlook has been our strongly held view that inflation would remain very subdued and that the process of inflation normalization, which must precede any potential interest rate normalization, would be not only long and drawn out, but would also require sustained monetary stimulus. From our perspective, it seems like central banks have finally come around to this conclusion. Almost 10 years into the expansion, developed market (DM) core inflation rates not only remain below central bank targets (Exhibit 2), they have barely risen. The risk of a downside break should economic growth falter has galvanized central bank efforts to more directly target inflation outcomes.

This change in the central bank reaction function, while overdue, is welcome. The Bank of Japan has focused on inflation expectations and desired inflation outcomes as the focal point of its policy for the last six years. The European Central Bank moved to this approach with the resumption of quantitative easing in July and by tying its longevity directly to the achievement of attaining the target inflation rate. In the US, we believe that the Federal Reserve (Fed) has essentially adopted this approach, even if it has not openly acknowledged it. The easing of policy three times as inflation expectations continued to fall further and further below target—at the same time GDP, unemployment and financial conditions (stock market at all-time highs) would previously have precluded cutting rates—provides the ultimate proof in the category of “watch what I do, not what I say.” More importantly, Fed Chair Jerome Powell’s answer to the question of when the market should expect rate rises was clear:

“So I think we would need to see a really significant move up in inflation that's persistent before we even consider raising rates to address inflation concerns.” – Jerome Powell, October 2019

If inflation remains in the modest channel we have seen over the last decade, which is our view, then central banks will not be tightening for a long time. Indeed, their reaction function will be extremely asymmetric. They will be quick to ease on weaker economic conditions, but very slow to tighten—waiting for inflation rises to prove to be “persistent.”

Central banks’ goal of achieving higher inflation rates and inflation expectations will depend on the evolution of growth fundamentals. There is a lot riding on the sustainability of growth. It is why central banks cannot afford to take chances. It is also why an improvement in trade policy would help reduce downside global growth risks, and why the risk markets gyrate so violently on any trade rumor. While the economic expansion appears to be long in the tooth (given the number of months in the cycle) it has not come close to many previous business cycles in eliminating economic slack. We are in a low nominal GDP world. Low growth with low inflation feels unsettling. The downside risks are too apparent, even if the actual current conditions are reasonable.

Our view for next year is that the US economy will once again post moderate growth with subdued inflation. We think global growth next year should best be characterized as “less slow.” In Europe, the storm clouds from Italy and Brexit appear to be lifting. But the success for this forecast rests largely with China. There the outlook is always somewhat opaque. We have been believers that the sustained and varied stimulative programs of Chinese policymakers would ultimately lead to at first a stabilization, and then a pickup in growth. As of yet, the evidence is not compelling. Clearly, a diminution in trade tensions between the US and China would be a big help. For non-China emerging markets (EM), the very challenged growth environment of the last few years should start to relent. DM central bank interest rates are lower, and this has paved the way for extensive monetary policy easing from EM central banks all over the world. Monetary policy acts with long and variable lags. The benefits of the global monetary easing may not show up immediately, but slowly and surely, global growth will improve.

This brings us back to our investment strategy. Even though spread sectors have performed exceptionally well this year, we believe that the odds favor further outperformance over Treasury and DM government bonds. Given this year’s substantial rally, position overweights need to be more modest. But global fixed-income investors are being starved for yield. Central banks will not soon re-raise short-term rates. Monetary policy is positioned to remain accommodative. We are hopeful that economic growth prospects will slowly improve. This suggests that the backdrop for spread sectors will remain favorable.