KEY TAKEAWAYS

- After facing unfavourable market conditions in 2018, the GMS strategy has posted a strong recovery in early 2019 which was bolstered by the Fed’s dovish pivot.

- We are pleased to see the sharp recovery in EM spreads and currencies as of late as it supports our long-held view that this asset class is attractively priced when looking at underlying fundamentals.

- Given the weakness in credit during late 2018, we increased credit risk considering that the refinancing risk in short-dated high-yield issues and weakness in European financials seemed inconsistent with their fundamentals.

- Western Asset is very well placed to manage GMS as its global strategy allows for broad investment latitude which enables us to fully utilize the breadth and depth of our global investment and risk management resources.

2018 was the perfect storm on a number of fronts. How did GMS navigate throughout the year?

IE: 2018 was a challenging year as our use of duration as a ballast against spread risk did not work in the environment that materialized. On one hand, an unexpected bout of euphoria over US growth prospects prompted a sharp selloff in the US Treasury (UST) market which negatively impacted our long US duration positioning. The combined weight of higher US rates, a strong US dollar, sustained commodity price volatility and heightened fears over a possible trade war between the US and China also weighed on our exposure to spread product and local-currency-denominated emerging market (EM) debt and currencies. On the other hand, lingering concerns over Brexit and Italy as well as a spate of weaker eurozone economic data pushed core European rates lower which hurt our core European positioning.

Despite market developments challenging our views for much of the year, we stuck to our themes and never wavered from our diversified strategies approach. This conviction really paid off as GMS has posted a strong recovery starting in 2019 as markets reacted positively to the Federal Reserve (Fed) reaffirming a dovish policy stance. Credit spreads tightened given the late-2018 selloff and EM assets benefitted from receding global risks and attractive valuations.

How is the strategy generally positioned at the moment? Are there any particular opportunities that you’re looking at?

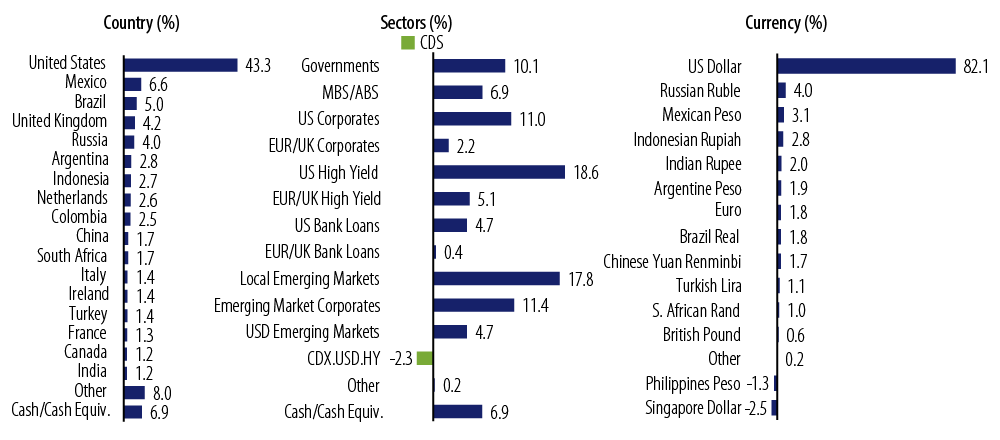

IE: Currently, the portfolio has a bias to global high-yield and EM debt, which make up approximately 55% of the portfolio. Our outlook remains positive on high-yield. For example, we have recently added short-dated/callable European high-yield bonds as we believe they will be refinanced in the next few years. In addition, we added to subordinated European financials that continue to strengthen their balance sheets; recent stress tests show much greater resilience to economic weakness. In our view, valuations don’t reflect these fundamental improvements. We’re also constructive on EM which has been a high-conviction call at Western Asset over the past year. We’re pleased to see the sharp recovery in EM spreads and currencies as of late, as it supports our long-held view that this asset class is attractively priced when looking at underlying fundamentals which, in aggregate, are either stable or on an improving trajectory. Specific stories we like are those of Brazil, India, Russia, Mexico and Indonesia. Central banks actively adjusted monetary policy during 2018 and real yields are at historically attractive levels when compared with developed market real yields. Inflation pressures are also under control, resulting, for example, in a dramatic drop in real yields in countries such as Brazil. We’ve even seen India start to reduce its interest rates to focus more on growth.

In general, how has GMS fared during difficult market cycles?

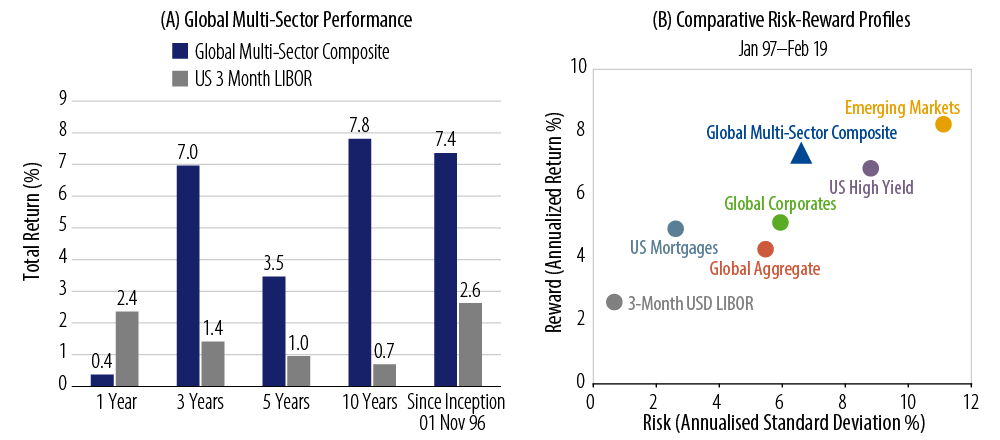

RA: As context, GMS is a highly diversified strategy that seeks to deliver positive, risk-adjusted returns over time. The investment parameters ensure the strategy maintains an average credit rating profile that is at all times Baa3/BBB- or better. We also aim to achieve a return over a market cycle of LIBOR + 2% to 3% with a volatility target or risk budget in the range of 5% to 7%. In our view, this return target is achievable because we’re employing active management and issue selection approach that includes up to 70% invested in a combination of high-yield and EM debt. That means the GMS strategy always has at least 30% in liquid, higher-quality assets that can help dampen volatility during periods of market stress.

That stated, there are periods such as those in 2008, 2015 or 2018 when risk assets sold off sharply and became a lot more correlated. There are times when our diversification strategies—for example, using US duration—aren’t enough to offset the volatility of risk assets in the portfolio. But this is when we have to remind ourselves of our long-term fundamental value approach to investing. During extreme market conditions, we roll up our sleeves and reassess the basic fundamentals driving our investment themes and try to tie all of that information back to current market pricing. If there’s a big deviation in the price of an asset or sector from our assessment of fair value (in other words, what we believe makes both quantitative and qualitative sense), then that’s a signal for us to either buy or sell. For example, adding to long-dated investment-grade credit in late 2015 and early 2016 may have appeared to be risky given the panic-stricken environment. But, in our opinion, that was a good risk/reward opportunity given our constructive view on fundamentals and the pessimistic default rates that were being priced in to corporate bonds at the time. We felt the downside risks were much more limited. Over time, as market conditions normalized, we realized that value in our portfolios.

More recently, given the weakness in credit during late 2018, we took the opportunity to increase credit risk as valuations became more compelling; refinancing risk in short-dated high-yield issues and weakness in European financials seemed inconsistent with their fundamentals. Another strategy that we often utilize to take advantage of market stresses is to reduce some of the hedges in the portfolio. In particular, recently we’ve seen a repricing in the US interest rate market such that future expected increases by the Fed are no longer anticipated. As a result, we’ve been reducing front-end duration risk as it no longer provides an effective hedge against our credit positions in portfolios.

What do you view as key risks in the near term?

RA: There are certainly a number of moving parts. At present, China remains a big unknown given the slowdown we’re seeing in economic activity and the current trade talks with the US. We take some comfort from the fact that Chinese officials are responding to the negative impact of tariffs on manufacturing and employment by announcing new fiscal spending measures and loosening credit conditions. But, it appears that more may need to be done to reverse the downside momentum, especially in the Chinese private sector where default pressures appear to be rising among small, inefficient companies with excess capacity. The good news is that the current rhetoric between China and the US remains constructive. Any flare-ups in political brinksmanship or an escalation of tariffs would certainly weigh heavily on global markets.

We’re also closely monitoring eurozone economic activity. Despite weak economic data prints coming out of the region, we’re not expecting a major deceleration in growth. At present, there are some positive data surprises coming out of France and Spain, offset by more negative data out of Italy and Germany. The global investment team is looking for more clarity in forward-looking data, as some of the more recent headline numbers are reflecting short-term disruptions. These include news reports about auto weakness, transport problems and weather-related factors mainly out of Germany. One encouraging sign is a mild pickup in core inflation data on the back of rising wage pressure. For now, we’re maintaining our short position in German bunds as we feel that, especially with medium-term German government bonds yielding close to zero, they’re pricing in a long-term structural weakness in European growth.

How do you view interest-rate and currency risk in GMS?

RA: The developed market government bonds held in GMS are mainly used for risk management purposes, primarily as a hedge against the credit risk in the portfolio. However, there are times when interest-rate risk itself can be undervalued, as was the case with intermediate-term USTs last year. Similarly, the long end of the US yield curve flattened significantly during 2014 after UST yields rose during 2013 as the Fed began reducing quantitative easing. In general, we have a flexible approach to duration management and have a wide range built into GMS to permit that, but overall, duration management is not a key long-term driver of returns.

With respect to currency risk, we use active currency overlay strategies in an effort to hedge volatility stemming from commodity-related credit exposures and broader market risks. We often hedge against our commodity-related bonds by selling the Australian dollar. These hedges tend to be more tactical in nature. GMS has the flexibility to diversify away from the US dollar, but can also, from time to time, diversify away from other currencies. For example, we currently fund some of our local EM exposures with a basket of low-yielding Asian currencies such as the Korean won and Singapore dollar. These are cheap to fund and should act as a hedge against an economic slowdown in the Asian region. There’s no question that exchange-rate volatility can be significantly higher than that of bonds, so we’re always thoughtful with the sizing of any currency exposures to ensure they don’t overwhelm investment results.

What type of clients are invested in GMS and what opportunities do you believe it can offer in the years ahead?

IE: GMS has a globally diversified investor base from the US, UK, Europe, Asia and Canada. Over the last several years, the client base has evolved to include pension funds, insurance companies and other institutional investors. Our investors use GMS for a variety of purposes. For example, pension funds that have hedged out their long-term liabilities via an interest-rate swap often invest in GMS to help meet the cost of the swap. Other clients who use GMS are those who wish to invest in EM and high-yield, but don’t have the resources to manage sector allocation. Also, some clients who have exposure to more traditional core fixed-income mandates invest a portion of their portfolios in GMS to seek more of a “core plus” style of investment.

Thankfully, Western Asset is very well placed to manage GMS. Running a global strategy that has broad investment latitude means we fully utilize the breadth and depth of the Firm’s investment and risk management resources. In addition to the rates, credit and mortgage teams in the US, our global footprint enables us to draw on the knowledge and expertise in our local offices in Europe, Asia and Latin America as well as in the US to help inform our investment decisions. This ensures that we’re well positioned to search for global opportunities across all fixed-income asset classes for the benefit of our clients.

View the Performance and Risk Disclosures for Global Multi-Sector.