KEY TAKEAWAYS

- Central banks around the world reacted with speed and force in March 2020—using a dizzying array of partly new policy tools—to combat the detrimental economic effects of the COVID-19 pandemic.

- While the response time was much faster than during the GFC in 2008/2009, the GFC did serve as a “dry run” for many of the most effective policy measures, in particular QE.

- Indeed, we believe QE can be viewed as the “winner” of this crisis, as it was used forcefully by DM central banks to influence the yield curve; even some EM central banks started to successfully use this tool to stabilize markets.

- On the other hand, major EM central banks were generally more cautious than their DM counterparts regarding rate cuts, often driven by exchange rate concerns.

- More generally, we find interesting similarities but also critical differences across central banks, and the pattern is not necessarily driven by the standard DM/EM distinction.

Introduction

Most monetary policy instruments reflect the two key roles of a modern central bank on an abstract level: setting the monetary policy stance to influence aggregate demand and being the lender of last resort (LOLR) to banks and, potentially, non-banks. In addition, many central banks have at least some regulatory and supervisory responsibilities and are increasingly concerned about financial stability. All of these roles became critical elements of the policy response during the COVID-19 crisis last year.

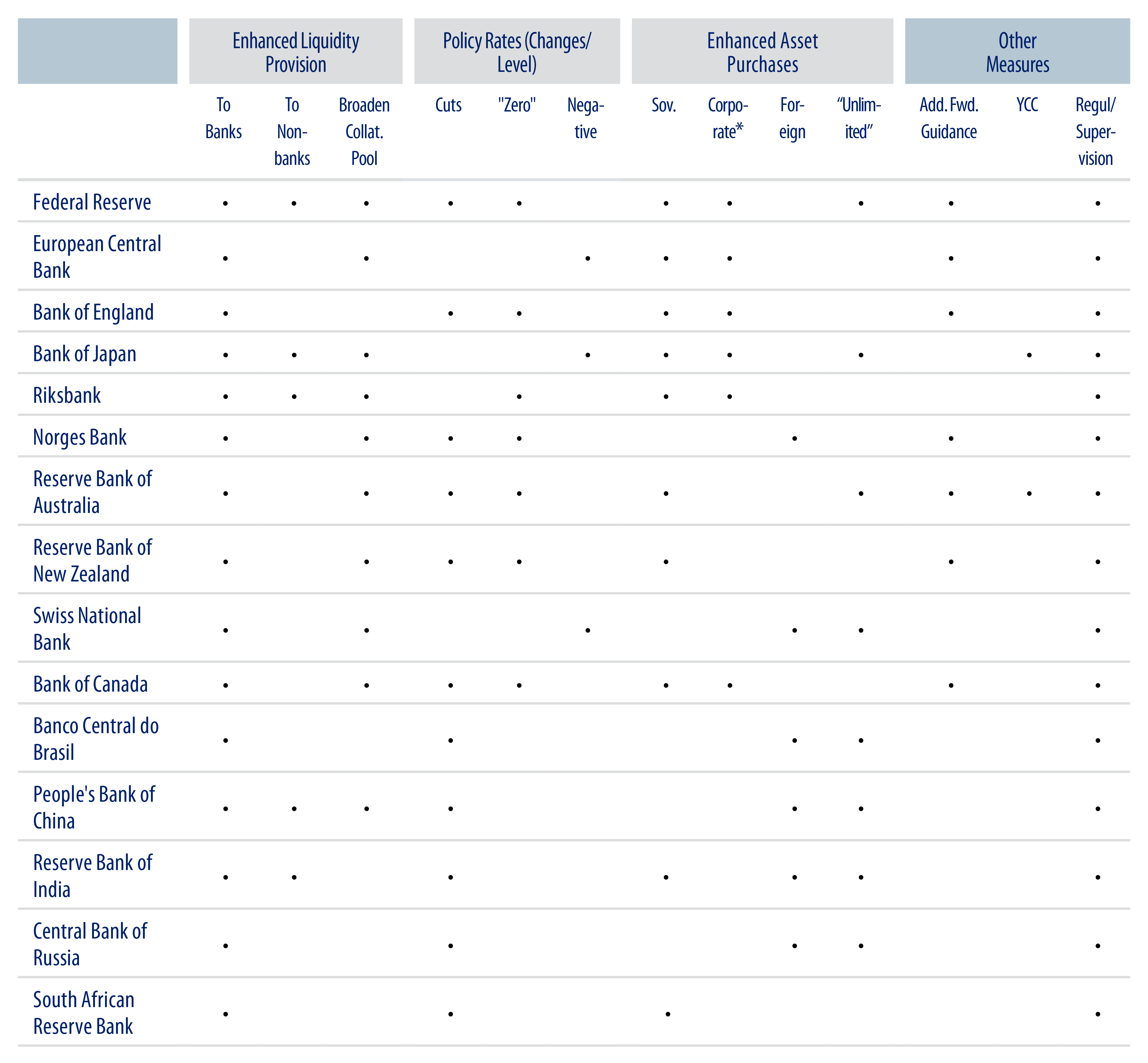

Central banks’ responses can be broadly grouped into the following buckets of instruments: enhanced domestic liquidity provision, policy rate actions, enhanced asset purchases and “other” (which includes forward guidance, yield curve control (YCC), international liquidity and regulatory/supervisory measures). We will discuss what central banks used which instruments with a particular focus on asset purchases where the most “innovation” took place. Exhibit 2 in the Appendix attempts to provide a visual summary.

Domestic Liquidity Provision3

A central bank’s LOLR responsibility requires it to provide adequate liquidity to the financial system. This is particularly important in times of evaporating market liquidity and a “dash for cash” as became evident last year when Covid first arrived. In response to the pandemic, all major central banks quickly expanded their liquidity provision programs and most developed market (DM) central banks also relaxed their requirements for the collateral pool.

The Federal Reserve (Fed) scaled up its open market operations on March 12, 2020, offering term operations in addition to standard overnight transactions and even moved to holding several auctions per day as liquidity demand spiked. On March 15, the Federal Open Market Committee (FOMC) decided to set reserve requirements for all tranches to zero, thereby releasing additional liquidity into the system.

The European Central Bank (ECB), on the other hand, prevented a potential credit crunch triggered by banks’ short-term liquidity concerns by announcing on March 12, 2020 additional weekly bridge financing into the (previously scheduled) first Targeted Longer-Term Refinancing Operation (TLTRO) III settling in June. At the same time, the ECB eased the conditions for all TLTROs between June 2020 and 2021 on a number of fronts, including by making conditions especially attractive for banks that do not reduce lending into the economy. On April 7 of last year, the ECB followed up by adopting a package of temporary collateral-easing measures to facilitate participation in the TLTRO, including accepting Greek debt as collateral and reducing collateral valuation haircuts. In a further step on April 30, the ECB recalibrated the forthcoming TLTROs once more, bringing the interest rate to -0.5% and to -1.0% for banks that qualify for the lending threshold, and the start of the lending assessment period was also brought forward to March 1. At the same time, the ECB announced additional monthly Pandemic Emergency Longer-Term Refinancing Operations (PELTROs), to replace the bridge LTROs announced in March with maturities in 3Q21. In the policy meeting on December 10, 2020, the ECB extended the favorable TLTRO conditions by a full year, to June 2022, and increased banks’ borrowing entitlement.

Other central banks took similar measures to support and scale up domestic repo and related markets in March 2020.4 Among these, the Bank of England (BoE) introduced a new Term Funding Scheme for Small and Medium-Sized Enterprises (TFSME) to provide that specific segment of corporate borrowers with a tailored facility. The BoE also rolled out a new Covid Corporate Financing Facility geared at larger companies emitting commercial paper in cooperation with HM Treasury and the Contingent Term Repo Facility (CTRF). Japan announced measures to support the repo market. In Sweden, the Riksbank added weekly unlimited term repo facilities (with terms of 3 and 6 months) to provide banks with appropriate liquidity, and decided to lend SEK 500 billion to banks against collateral for two years in order to support the extension of corporate credit.

However, very few central banks have widened the circle of counterparties beyond traditional banks, for example, the Fed, the Bank of Japan (BoJ) and the Riksbank, which included non-bank financial institutions (cooperatives) in late March 2020. Similar to the Fed, the Reserve Bank of India (RBI) also introduced a support mechanism for mutual funds. In China, liquidity provision to non-banks occurred mainly via the policy banks.

Policy Rates

Turning to the second major monetary policy tool, many central banks around the world—both DM and emerging market (EM)—have cut rates in response to the demand shock. One interesting feature of this global rate cutting cycle is that all DM central banks that did cut reached the practical zero lower bound, but they did not cut below zero. In fact, since the global financial crisis (GFC), the hurdle to cut into negative territory seems to have increased. On the other hand, all three G-10 central banks already sporting negative policy rates prior to the pandemic—the ECB, the BoJ and the Swiss National Bank (SNB)—have not cut rates since March last year.

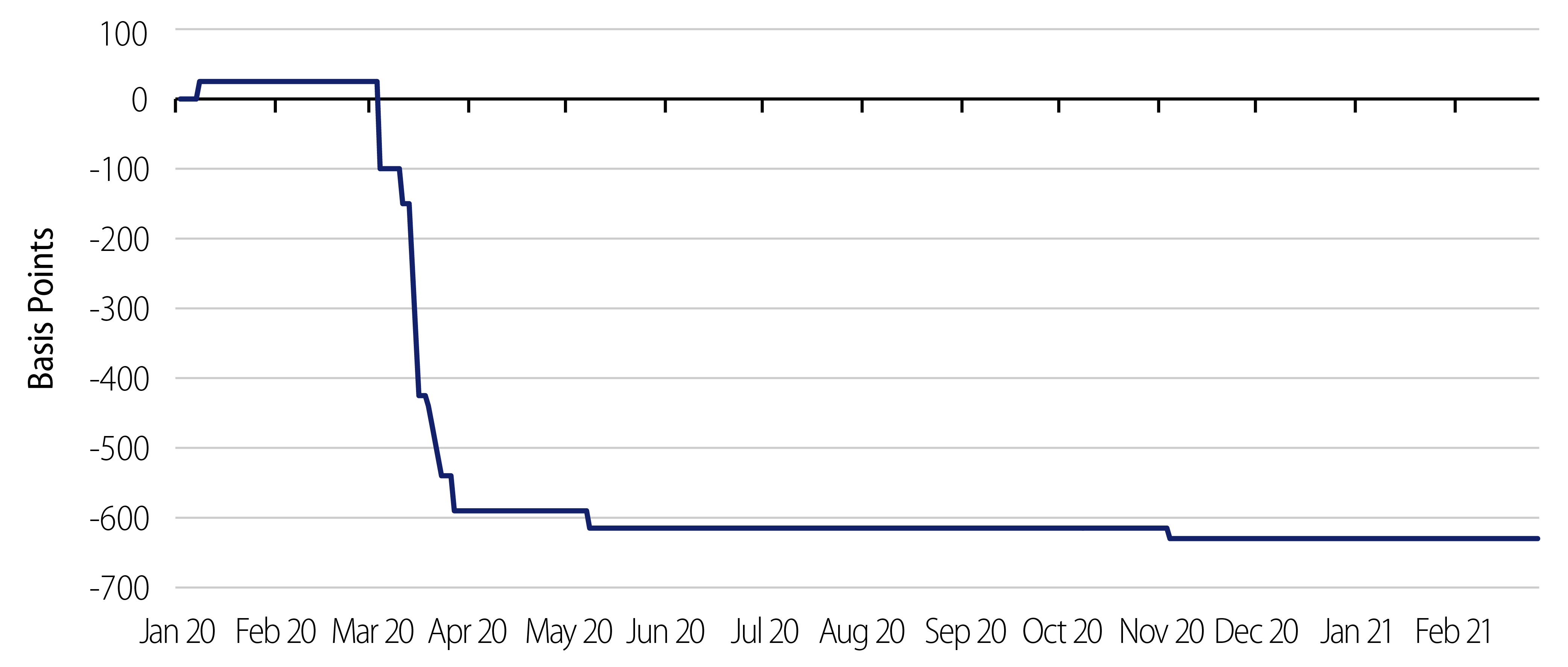

Half of the policy rate cuts made by G-10 central banks (315 bps out of a total of 655 bps5) came during the third week of March after the Fed had anticipated its regular meeting by a few days (Exhibit 1). On Sunday evening, March 15, the Fed cut the fed funds target rate by 100 bps, bringing it to zero—a clear signal to the world of just how concerned the FOMC had become at that stage. On the same day, Canada, Norway and New Zealand also cut their interest rates. In fact, this was already the second cut by the Fed after a 50-bp reduction earlier that month (on March 3), which coincided with cuts made in Canada and Australia and “close monitoring” in the eurozone and the UK.

Four G-10 central banks did not participate in the cutting cycle: the BoJ, the SNB, the Riksbank and, of course, the ECB. The Riksbank appeared particularly unwilling to return to negative rates territory after just having successfully exited. The other central banks judged repeatedly that rate cuts, while in principle possible, were not the most effective tool at that juncture, including because the rate levels were, arguably, close to the de facto lower bound. These central banks engaged in alternative easing policies, most prominently asset purchase programs of various sorts.

For the ECB in particular, the question about the “reversal rate” came to the fore. The deposit rate acted as the de facto policy rate given full allotment. Would a meaningful cut below the level of -50 bps—in place since September 2019—produce a significant easing in monetary conditions or would it trigger a counterproductive reaction from banks to safeguard interest income? While the ECB repeatedly stated that it had not reached the reversal rate, it also viewed further front-end cuts into more deeply negative territory as less effective compared to asset purchases.

Among major EM central banks, the interest rate response was a lot more cautious and driven by country-specific concerns, such as exchange rate depreciation. The Chinese central bank did not change its key rate, the loan prime rate (LPR), but did adjust a number of auxiliary interest rates as early as mid-February in response to the crisis. For Brazil, the economic crisis extended a long-lasting cutting cycle that would have otherwise probably petered out. The Banco Central do Brasil (BCB) was hesitant at first given the ongoing depreciation of the real and cut the Selic rate by only 50 bps on March 18. The more significant cuts (75 bps each) came in May and June before a final 25-bp cut in August. Therefore, this appears to be rather a response to the incoming economic data once the currency situation had stabilized somewhat instead of aggressive front-loaded rate cuts along the lines of most developed market (DM) central banks. Russia presents a similar picture: the Central Bank of Russia (CBR) kept rates stable at 6% until late April when it cut by 50 bps, followed by two more cuts, in late June (100 bps) and a final July cut (25 bps) before indicating most recently that the cutting cycle had come to an end. India and South Africa were arguably the most aggressive major EM central banks. The Reserve Bank of India (RBI) anticipated its regular meeting in early April into the previous fiscal year (March 27) and cut the policy rate by 75 bps. Similarly, the June meeting was shifted to May 22 and the repo rate was cut by another 40 bps. The August meeting took place as planned and the policy rate has remained unchanged since. Finally, the South African Reserve Bank (SARB), which is similar to the RBI in that it is on a bimonthly meeting cycle, cut its policy rate by 100 bps at its regular meeting in late March, then inserted another extraordinary meeting in mid-April to make another 100-bp cut. At the regular meeting in late May, the SARB cut another 50 bps, and a further 25 bps in late July, but the central bank has refrained from further cuts since.

Balance Sheet Measures, Quantitative Easing and Asset Purchases

Quantitative easing (QE) is defined as expanding a central bank’s balance sheet to (semi-) permanently acquire assets held by the private sector without sterilization, resulting in an easing of monetary conditions beyond the natural limits of nominal interest rates; it has been used in Japan since the early 2000s to create excess reserves and flush the system with liquidity. Several other central banks have gained experience with large-scale asset purchase programs over the last decade or so, including the US and the UK during the GFC, and the ECB and Riksbank starting in 2015.6

As the Covid crisis unfolded, central banks around the world, both with and without previous QE experience, started to engage in or scaled up their outright large-scale asset purchase programs (LSAPs), either to ease the monetary stance (or prevent it from tightening) or to tackle dysfunctionality in specific markets, morphing essentially from a lender to a dealer of last resort. Most central banks—but not all—focus on domestic assets, which customarily includes sovereign debt but also, often, corporate debt.

The Federal Reserve

The Fed announced on March 15, 2020 that, in tandem with the 100-bp rate cut, it was also going to purchase at least US$500 billion in Treasuries and US$200 billion in agency mortgage-backed securities (MBS) to “support the flow of credit to households and businesses.” This was only the starting point for the Fed’s asset purchases as the numerical targets were removed barely a week later (March 23) and commercial MBS added to the purchase program. By August, the Fed’s purchases of Treasury securities had stabilized at around US$80 billion per month.

In an eerie repetition of events during the GFC, the Fed also responded around the same time, on March 18, to the broad flight to safety by investors and associated massive redemptions from money market mutual funds (MMMFs) by introducing the Money Market Mutual Fund Liquidity Facility (MMLF). By making advance funding available to eligible counterparties to purchase certain assets from the MMMF, the Fed wanted to avoid having to “break the buck” as market conditions did not allow market participants to liquidate their assets in a timely fashion.

While this summarizes only very roughly some of the key policy decisions of the Fed to counteract market stress and support the economy, the upshot is quite simple and representative of the Fed’s strategy throughout this crisis: when a problem became apparent, the Fed reacted without hesitation—a lesson from the GFC. Additional policies reflecting this simple mantra were implemented in two major steps, on March 23 and April 9. In doing so, the Fed also went clearly beyond its standard LOLR role in that it engaged directly with non-financial corporates:

- On March 17, the revival of the Primary Dealer Credit Facility (PDCF), providing the ability for members of this circle to access term funding (up to 90 days) against collateral (investment-grade debt and equity securities). This facility had been introduced during the GFC, but at the time it only provided overnight liquidity.

- On March 23, the creation of the Primary and Secondary Market Corporate Credit Facilities (PMCCF/SMCCF) to provide a direct funding backstop for large corporates (Primary) as well as to support market liquidity for corporate debt by purchasing individual bonds and ETFs. These facilities are largely geared at investment-grade corporates and fallen angels. Purchases were initiated in May (under the SMCCF) and became fully operational by end-June.7

- On the same date, the establishment of the Term Asset-Backed Securities Loan Facility (TALF), under which the Fed can lend to holders of AAA rated ABS backed by new consumer loans including student loans, credit card loans, auto loans as well as small business loans.

- On April 9, 2020, the introduction of the Municipal Liquidity Facility (MLF) to counter market stress experienced by state and municipal borrowers.

- On the same date, the creation of the Main Street Lending Program (MSLP) to purchase qualifying loans of lenders to small and mid-sized businesses and nonprofit organizations.

- Also on April 9, the creation of a liquidity facility based on the Small Business Administration’s Paycheck Protection Program (PPPLF), geared at enabling small companies to furlough employees rather than fire them.

European Central Bank

The ECB experience presents an interesting contrast. With rate cuts deemed ineffective, its policy response focused on liquidity provision (discussed earlier) and balance sheet measures, foremost an aggressive version of QE. On March 12, the ECB announced, among other things, a temporary envelope of additional net asset purchases of €120 billion for the rest of the year (i.e., about €13 billion per month on top of the €20 billion under the standard Asset Purchase Program (APP) in place since November 2019). It is worth noting that a simple augmentation of the existing APP substituted, in a way, for several new and separate Fed tools as the ECB’s APP already purchased assets in a variety of markets, namely sovereign and corporate bonds, as well as ABS and covered bonds, a European specialty. This top-up was meant to safeguard favorable financing conditions in the eurozone although the ECB had not yet witnessed any severe market strains.

These market strains appeared very quickly, however: Barely a week later the ECB changed tack and launched, on March 18, a temporary Pandemic Emergency Purchase Program (PEPP) worth €750 billion for the remainder of 2020, or about €80 billion a month in addition to the roughly €30-€35 billion of purchases already performed under previously adopted programs.8 The discerning element of this facility rested in its flexibility: contrary to previous eurozone-wide purchase programs that were fulfilled in observance of the ECB’s capital key, the PEPP was (at least temporarily) able to “go where it hurt” in terms of distribution over time, across jurisdictions and asset classes.9 At the same time, the ECB also added commercial paper to the Corporate Sector Purchase Program (CSPP) and broadened the pool of assets eligible for collateral. The central bank also committed to review self-imposed limits, which was an important element of the announcement as the PEPP could have potentially hit certain purchase limits quite quickly. On June 4, the PEPP was augmented by another €600 billion to €1.35 trillion and extended to last at least until June 2021.10 Notably, this extension did not change the theoretical pace of average monthly purchase amounts (around €100-€110 billion) across programs, but did have a dovish impact stemming purely from the extension itself. The ECB also committed to reinvesting principal payments under the PEPP until at least end-2022 as a signal that a reversal of the policy stance was not imminent. On December 10, the ECB added another €500 billion to the PEPP envelope, in conjunction with extending the favorable TLTRO conditions as discussed earlier. In policy communications since, the ECB has repeatedly underlined that the current PEPP envelope of €1.85 trillion could be further increased or not used in full, depending on the recovery progress.

The ECB broke new ground with the PEPP as this program is more flexible than the APP, both intellectually, and in a de facto sense (the PEPP was not required to respect the capital key at every step and could even purchase Greek bonds not eligible under the APP). It distinguishes several intervention layers, meant in one part to implement the expansionary monetary stance valid across all eurozone countries when close to the lower bound for nominal interest rates and in another, more chiseled part, meant to combat problems with monetary policy transmission in certain jurisdictions and even specific markets as necessary. The PEPP has now become the ECB’s main tool to guarantee appropriate “financing conditions” across the eurozone.

Other Central Banks

Among other DM central banks, the BoJ stepped up purchases of a variety of assets on March 16. On the same day, the Riksbank decided to augment its existing bond holdings by up to SEK 300 billion in nominal and real federal and local government bonds as well as covered bonds before the end of the year. In two further steps, (in July and November 2020), the envelope was augmented to (ultimately) SEK 700 billion and the purchase window was extended to end-December 2021. The BoE increased its asset purchases by £200 billion in the unscheduled meeting on March 19 and then again in June and November by an additional (combined) £250 billion as the economy went through economic setbacks related to the ongoing pandemic. The Reserve Bank of Australia (RBA) introduced on March 18 an APP with two very specific characteristics: it focused on government bonds with a 3-year maturity due to the pivotal importance of that point of the yield curve in the domestic interest structure, and set a target yield equal to the cash rate—in other words, a flat front end of the yield curve. In addition, the RBA also initiated a bond buying program that includes subnational issuers for a total of AUD 200 billion and that is expected to last until September 2021. Meanwhile the Reserve Bank of New Zealand (RBNZ) decided on its large-scale asset purchases (LSAP) at the meeting on March 22. In several subsequent steps in April, May and August, the program size was raised from AUD 30 billion to AUD 100 billion, additional bond classes were added, and the program was extended from March 2021 to June 2022. The last G-10 central bank to launch an APP was the Bank of Canada on March 27, focusing on the government debt and commercial paper markets.

Switzerland and Norway are the two DM central banks that have, instead, focused on intervening in external markets, albeit for opposite reasons. While foreign currency (FX) interventions are customarily viewed as an exchange rate policy, the line between that and QE is blurred. Switzerland has historically engaged in a special form of QE: purchasing FX largely without corresponding sterilization of the liquidity injection—implying a “longer” balance sheet to prevent the exchange rate from appreciating. The SNB’s foreign currency reserves have increased by around CHF 130 billion between March 2020 and the end of the year, corresponding to almost 20% of GDP. Norway’s intention in March was the opposite—intervene to support the domestic currency after a significant depreciation triggered by the selloff in crude oil prices and correlated assets. Norges Bank did not launch a domestic LSAP because it deemed that the government bond market had little impact on other interest rates in the economy and real activity, in addition to being a lot smaller and less liquid than elsewhere.

Adopting QE-type policies in EMs offers a slightly different angle on monetary policy. Contrary to DMs, policy rates in EMs may be at historical lows but are—with a few exceptions—not at zero, let alone in negative territory. That implies that a purchase program has little to do with easing the policy stance when nominal policy rates are unable to do so. Instead, introducing QE in EMs intends to support markets that have become illiquid, although the definition of illiquidity lies very much in the eye of the beholder. Historically, a lack of credibility would often imply that purchases of government debt by an EM central bank resulted in FX selloffs and inflation rather than in a market stabilization, but the experience of many EMs during this most recent crisis has been the opposite. Among the major EM central banks covered here, South Africa’s SARB and the RBI have purchased government securities, the latter partly in a variation of the Fed’s “operation twist.”11 The BCB received a mandate to do so, but hasn’t yet. While there are many other EM central banks that have bought at least some government bonds, none of the major EM central banks has ventured beyond the sovereign in terms of domestic assets, but several have intervened in FX markets (e.g., Brazil and Poland).

A separate but related topic is the amount of intervention, with the major distinction being “unlimited” or not. Some DM asset purchase programs are ex ante limited, for example the ECB’s PEPP and, initially, the Fed’s program. That said, the Fed, but also the BoJ and the RBA due to their YCC commitments, have ultimately opted for, in principle, unlimited interventions. The SNB, as it is a purchaser of FX, can also engage without limits, at least in theory. Norges Bank, on the other hand, was limited in its support for the domestic currency by the foreign assets it deems “for sale.” Similarly, many of the major EM central banks are more or less active in FX markets, but, to the extent that they are supporting their respective currencies, their interventions have a natural limit. This intervention is not necessarily related to the pandemic, but the degree of sterilization can be obviously varied over time, with additional domestic liquidity providing a stimulative effect if needed.

Other Measures

In this section, we summarize several other instruments that all deserve more space in principle but where the implementation has been quite homogenous. For example, most DM central banks have adopted or changed their forward guidance as a result of the Covid pandemic. One striking exception in this context is the SNB. Only two central banks have engaged in YCC: For the BoJ, YCC has been part of its policy stance since 2016. The RBA, as mentioned in the previous section, has committed to keep yields for the 3-year maturity point in government bonds equal to the policy rate. As the target of the RBA operation is a specific shape of the yield curve rather than a specific purchase quantity, the measure is already closer in spirit to YCC than “classic” QE.

All central banks across DMs and EMs (or the respective bank regulators) have adopted regulatory and supervisory measures geared at easing the burden on banks. Partly, this was done in the international environment (delaying the introduction of certain Basel III requirements), partly in the domestic realm. The latter includes enabling banks to use (countercyclical) capital and liquidity buffers but also weighing on them to limit or even cancel dividend payments to prop up their balance sheets. Official guidance regarding dividends and share buybacks has been softened only very recently. Some countries also conducted fiscal policy operations geared at bank lending (e.g., guarantees) in close coordination with monetary policymakers, but this topic is beyond the scope of this paper.

Summary

The response of leading global central banks to the challenges brought about by the COVID-19 pandemic was extraordinary in many ways. It was speedy, targeted, and for the most part, well-coordinated with fiscal policymaking without putting central bank independence in acute danger. This reaction was straightforward as the initial demand shock lowered the inflation outlook around the world and there was no trade-off between fiscal stimulus and low inflation. The reaction strategy was also straightforward in a different sense: banks could be “used” to fight the economic devastation of the pandemic as they have, following a decade of building up capital and liquidity buffers, not been a concern for policymakers in this crisis—the opposite of the GFC experience.

The “winner” of this crisis is QE: First, it morphed from a tool to influence inflation expectations to an integral part of expressing the monetary stance. Second, the amounts deployed have often dwarfed similar efforts during the GFC and the subsequent period of low inflation. Finally, a significant part of the EM world has also started to successfully use this tool to stabilize markets. This should be seen as a major accomplishment because EM central banks purchasing government bonds—even if on the secondary market—would have been a major red flag for EM investors not too long ago. Up to now, these historic concerns have been largely unfounded during this most recent crisis.

The two major central banks (the Fed and ECB) were in the middle of a strategy review when the crisis hit. The Fed, further ahead in the process, decided to finalize its new framework and essentially became more ambitious on the employment leg of its dual mandate—a good commitment tool in the middle of a crisis. The ECB, on the other hand, suspended work on its review process last year, but has restarted it since. The ECB’s conclusions will certainly be less geared at employment than the Fed’s, but the ECB should nevertheless be ambitious in tackling other issues that have been building up over the last two decades, for reasons that mirror those of the Fed. In the end, the response to the Covid pandemic has raised many questions about central banking and the conduct (and limits) of monetary policy—and it is not clear a priori what role an employment target should play in monetary policy going forward. In fact, the biggest question of them all remains unanswered for now but is already moving to the center of the markets’ attention: what happens when the global monetary policy stance needs to go into reverse?

- Ferrel, Will and McKay, Adam. “Anchorman: The Legend of Ron Burgundy,” Apatow Productions, 2004.

- With comments to an earlier draft from Western Asset Portfolio Manager John Bellows, Portfolio Manager Richard Booth, Co-Head of Global Portfolios Gordon Brown, Portfolio Manager Dean French, Portfolio Analyst Matt Hodges and Portfolio Manager Kevin Ritter.

- With respect to international or FX liquidity, the Fed, and to a lesser extent the ECB, provided liquidity to other central banks globally via standing and renewed swap facilities for key central banks since mid-March. To prevent selling of assets in illiquid markets, the Fed also established a new repo facility wherein other central banks that did not have access to the swap window could borrow US dollars against US Treasuries and other qualified collateral.

- In fact, most central banks around the world have taken steps to support the banking system directly via a more robust repo market, often to include term lending against collateral. Many central banks also have introduced separate lending programs to benefit the corporate sector. This section only highlights selected examples among G-10 central banks.

- Cumulative unweighted, including the two laggard cuts by Norges Bank in May 2020 and the RBA in November 2020, and abstracting from the Riksbank hike in early January 2020.

- The ECB had expanded its balance sheet marginally in 2009 to kickstart the frozen covered bond market.

- Eligible issuers for both facilities also included “fallen angels”—corporates that were rated investment-grade at the time of the introduction of the program but downgraded subsequently, though not below BB-/Ba3.

- See An ECB PEPP Talk.

- The capital key reflects the capital contributions of eurozone and other European central banks to the ECB (although the ECB’s LSAPs obviously focused on eurozone countries). Data provided by the ECB suggest that purchases under the PEPP were never very far from the capital key. In the first two months, however, it did buy substantially more Italian government bonds and, to a lesser extent, Spanish and German bonds than what would have been indicated by the capital key but it fell short on French and supranational bonds. Moreover, the weighted average maturity of bonds purchased was substantially lower than the eligible universe of bonds for Germany. Over the summer, the ECB reduced the shortfall in French bonds significantly and the overshoot in Italian bond purchases and, more broadly, has come more in line with what one could expect under the capital key. The ECB is still somewhat behind as far as expected supranational bond purchases are concerned, but that is not a major surprise given forthcoming issuance under various EU programs.

- See Sticking to the Brief—ECB Back to Focusing on Inflation Outlook.

- Similarly, Banxico’s switch auctions serve to relieve stress in a particular section of the yield curve, leading to a net reduction of DV01 in the market.