KEY TAKEAWAYS

- Agency MBS are pools of securitized residential mortgage loans that are issued and guaranteed by US government agencies.

- The agency MBS investable universe is broad, providing a large opportunity set for security selection. Active rotation across coupons and MBS subsectors, security selection and duration management provide potential for additional returns relative to the benchmark.

- Historically, the risk-adjusted returns of agency MBS are some of the most attractive, with lower volatility compared to similar high-quality US fixed-income sectors.

- Agency MBS have been less correlated with equities than have corporate bonds, offering diversification benefits.

- Agency MBS have outperformed US Treasury bonds over longer investment horizons.

- Investors should consider including agency MBS as a core allocation in their fixed-income portfolios.

What Is the Agency MBS Asset Class?

Outside of US Treasuries (USTs), agency MBS represent the second largest segment of the US bond market, constituting 27% of the Bloomberg Barclays Aggregate Index.

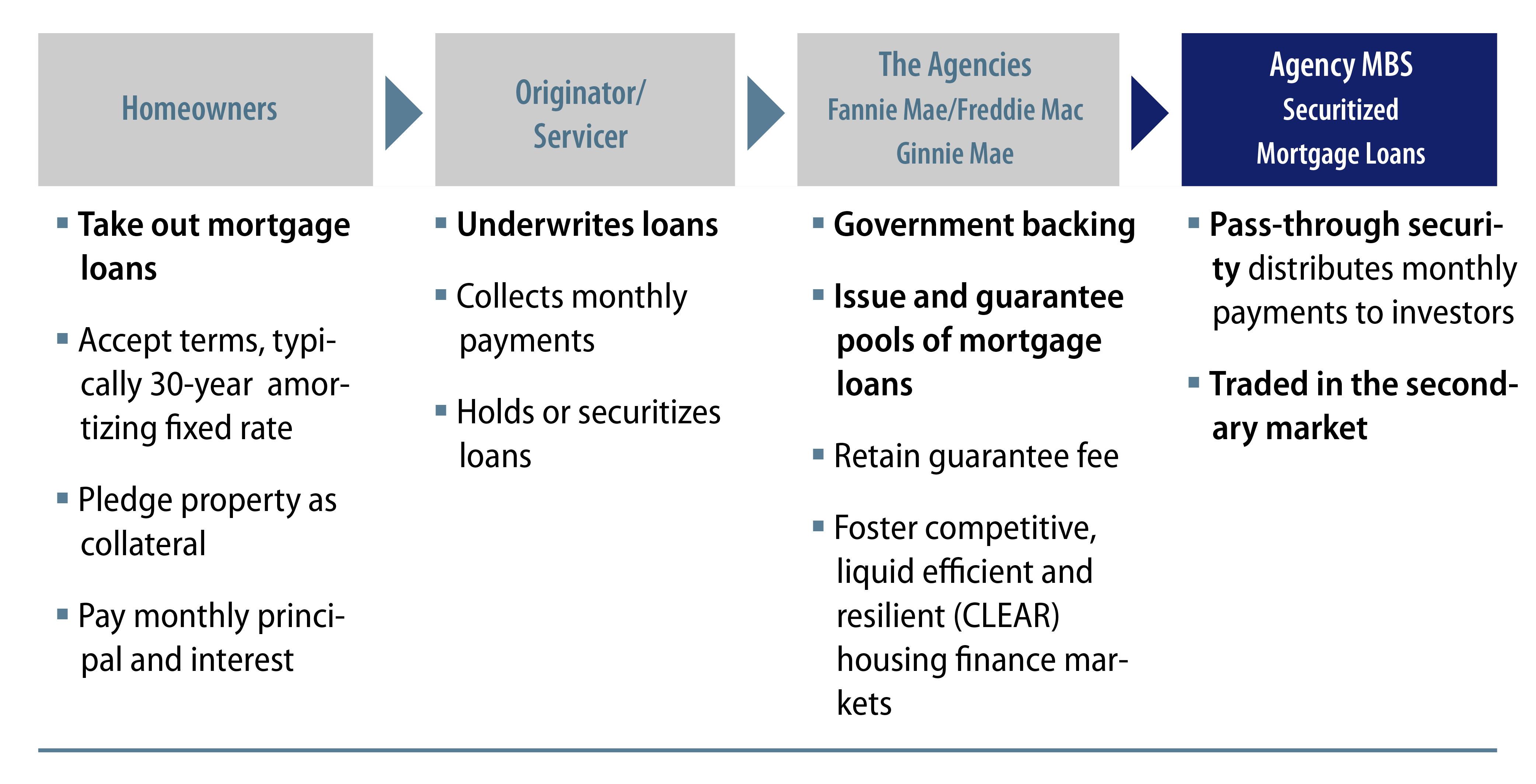

Agency MBS are created when residential mortgage loans that meet agency underwriting guidelines are securitized into a pass-through security. Investors in pass-through securities receive the underlying loans’ principal and interest net of servicing and guarantee fees. Exhibit 1 illustrates the MBS securitization process.

These securities are issued and guaranteed by Fannie Mae, the Federal National Mortgage Association (FNMA), Freddie Mac, the Federal Home Loan Mortgage Corporation (FHLMC) and Ginnie Mae, the Government National Mortgage Association (GNMA). Fannie Mae and Freddie Mac focus on home loans that adhere to government-sponsored enterprise (GSE) guidelines, whereas Ginnie Mae focuses on home loans originated under programs of the Federal Housing Administration (FHA) and Veterans Administration (VA).

Ginnie Mae MBS are deemed to be without credit risk and backed by the “full faith and credit” of the US government, like UST bonds. While the GSEs remain under conservatorship, it is understood that there is limited credit risk in Fannie Mae and Freddie Mac MBS.

The Agency MBS Investable Universe

The agency MBS sector offers more than one million securities, including pass-through pools amounting to a market size of $8.2 trillion with monthly trading volumes averaging $271 billion. Structured agency MBS, also known as collateralized mortgage obligations (CMOs) are comparatively smaller with a market size of $1.4 trillion and average monthly trading volumes of only $1.8 billion.1

The Bloomberg Barclays US Agency MBS Index is widely used as the benchmark for agency MBS. Unlike other benchmarks, MBS indices are not a perfectly replicable basket of tradable securities. The index consists of hundreds of “cohorts” that represent a specific mortgage issuer (FNMA/FHLMC/GNMA), terms (loan amortization schedules of 30, 20 or 15 years), year of origination (vintage) and coupon (by half percentage point). Importantly, cohorts do not contain securities with actual CUSIPs that investors can source in the marketplace, and the diverse profile of the pools contained in each cohort make passive replication non-trivial, as even the most careful selection of pools will result in some tracking error.

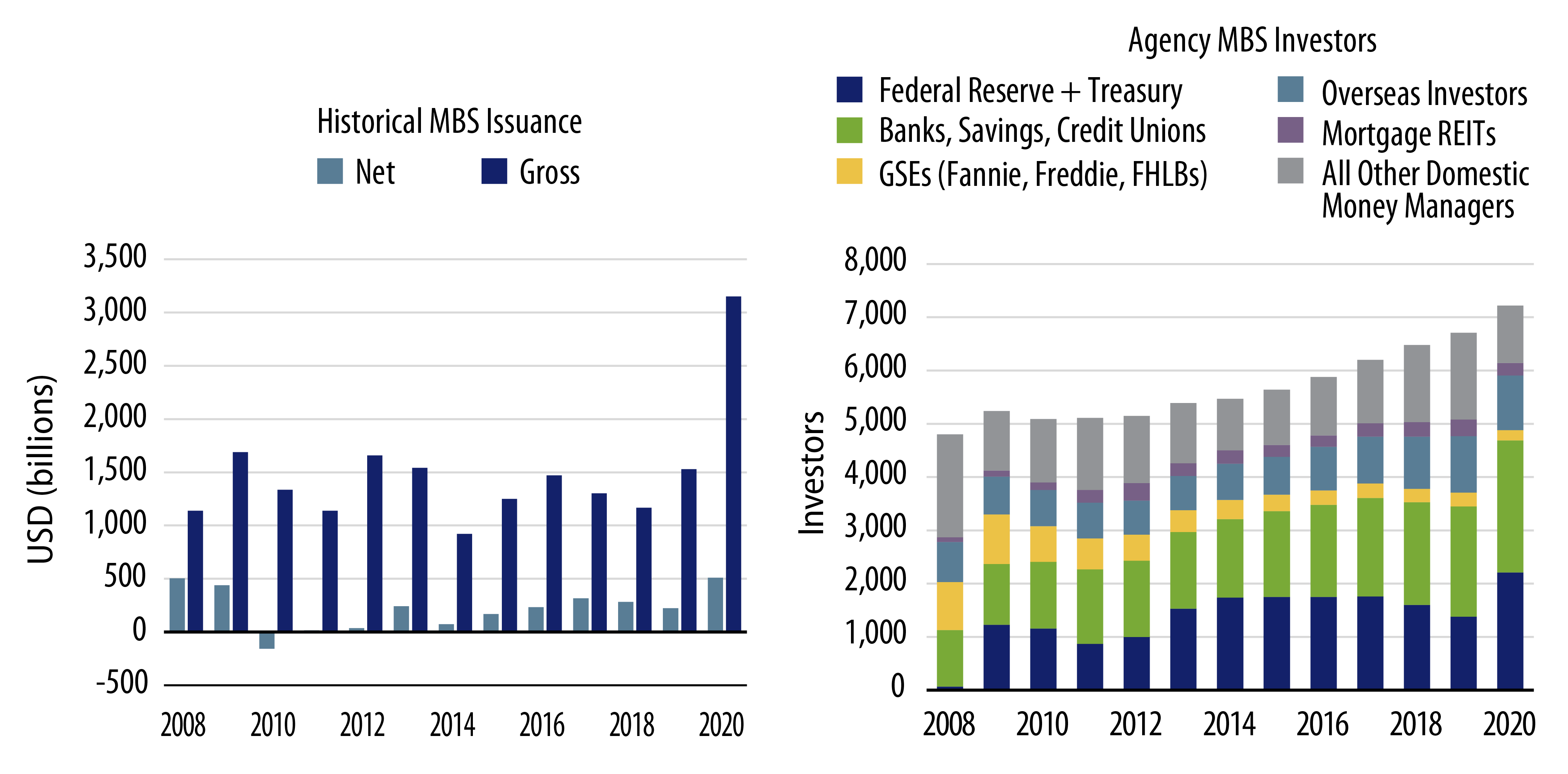

Since 2011, gross issuance averaged $1.5 trillion annually for agency MBS with 2020 a record year for supply as interest rates declined meaningfully and refinancing was elevated. On the demand side, market participants extend beyond money managers, with US banks and foreign investors representing a significant source of demand, as well as the US Federal Reserve (Fed) involvement since 2009. Exhibit 2 shows yearly MBS issuance and major investors from 2008 to 2020.

The “To-Be-Announced” (TBA) MarketThe vast majority of agency MBS trading occurs through the TBA market. A TBA is effectively a forward-looking transaction—a contract that specifies the price and quantity of MBS to be bought or sold at a specific future date. The seller of the TBA agrees on a sale price, although they do not specify which particular mortgage pools will be delivered to the buyer on settlement day; only a few basic characteristics of the pool are agreed upon, such as the issuer, maturity, coupon rate and the face value. TBA transactions are governed by specific rules set by several professional organizations including both the Securities Industry and Financial Markets Association (SIFMA) and the Treasury Market Practices Group (TMPG).

The TBA market is based on the fundamental assumption that one agency MBS pool can be considered interchangeable (fungible) with another pool that has similar characteristics. The seller has control over the delivery and will seek to select the “cheapest to deliver” securities. The buyer anticipates “adverse selection” in exchange for the liquidity of the TBA transaction. These trading conventions enable an extremely heterogeneous market of multiple agency MBS pools to be distilled into standardized TBA contracts, which supports the liquidity profile of MBS pools.

Specified PoolsSpecified pools are pass-throughs with distinctive attributes that make them more valuable and they typically trade at a premium (known as “pay-up”) to TBAs. Borrowers’ loan size, seasoning (months since issuance), geography, credit score (FICO), equity position (loan-to-value), occupancy, as well as the choice of mortgage originator and servicer all lead to variations in prepayment behavior and total return performance across MBS securities. Investors can focus on call or extension protection features through security selection in specified pools.

Agency Collateralized Mortgage Obligations (CMOs)Agency CMOs are constructed from agency MBS pools by redistributing the principal and interest cash flows into various customized tranches. Multiple structure types are available, offering a wide range of average life and prepayment risk profiles for out-of-index opportunities. The inherent risks with CMOs, especially mortgage derivatives such as interest only (IO) and principal only (PO) structures, can be a much greater prepayment risk and a substantial give-up in liquidity.

Why Invest in Agency MBS?

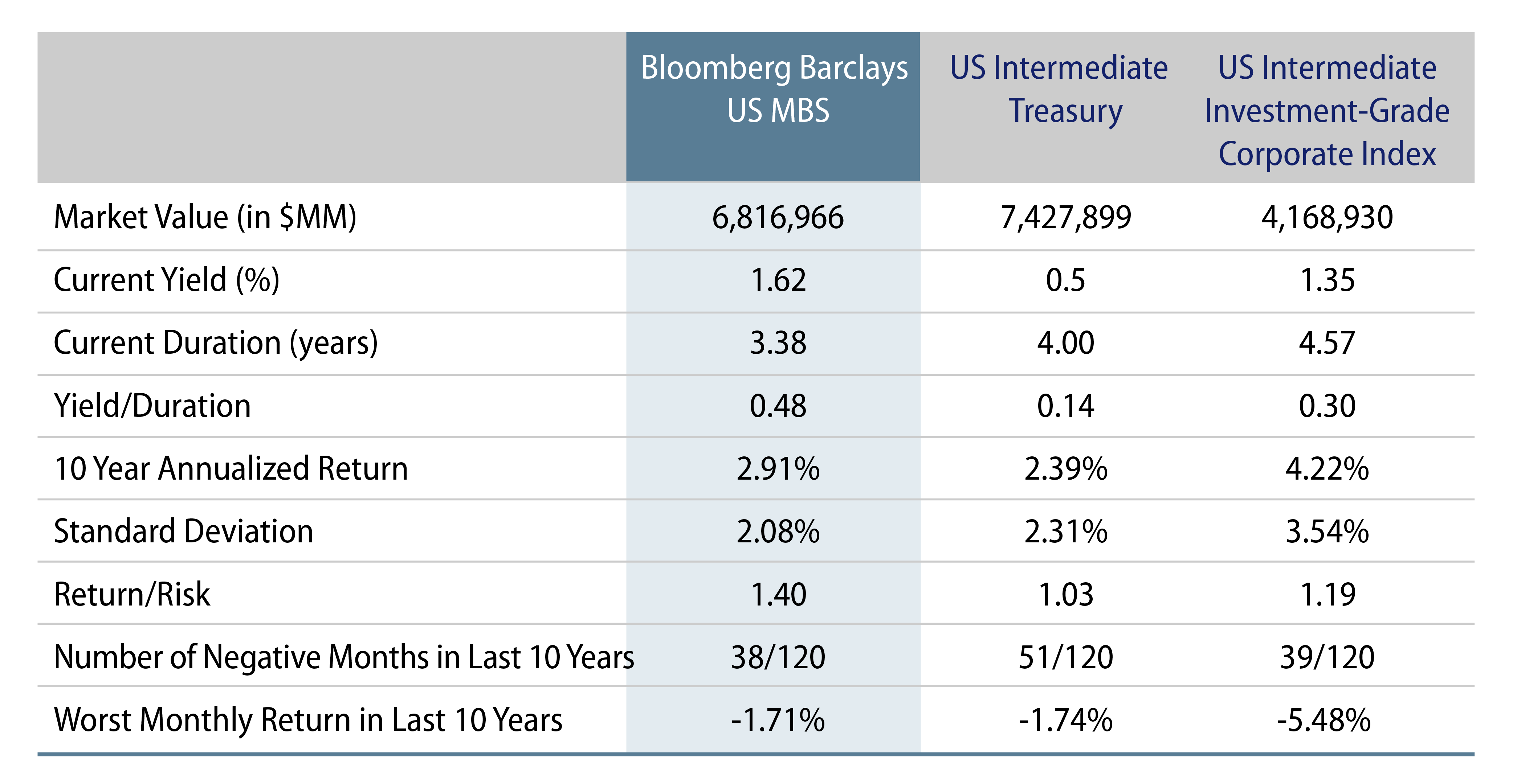

Agency MBS have historically offered the highest risk-adjusted return profile compared with similar high-quality fixed-income sectors, as highlighted in Exhibit 3. Key features from the historical comparison include lower volatility, better downside outcomes and a low correlation to equities.

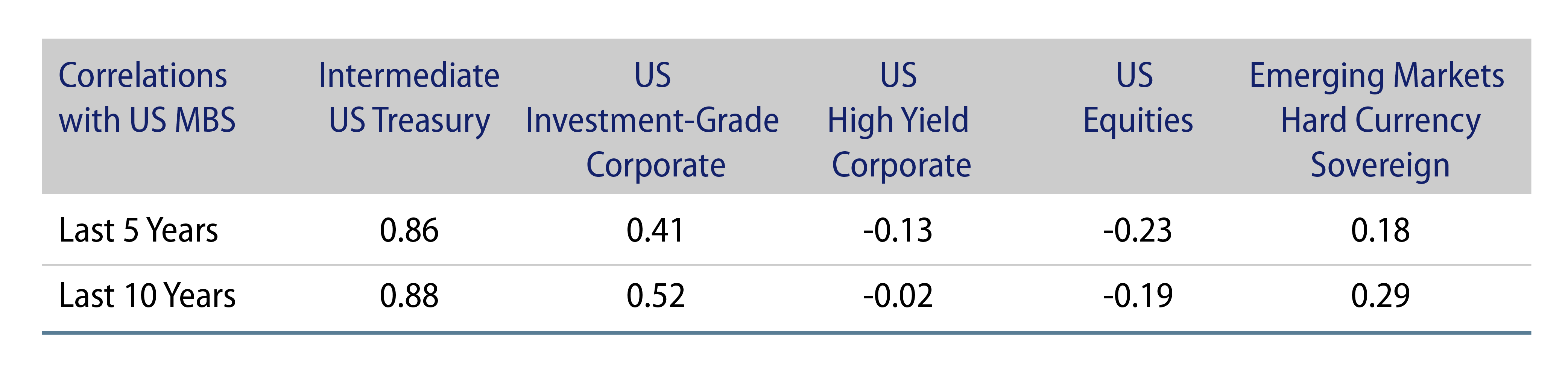

Agency MBS have been less correlated with stocks than have corporate bonds, offering diversification benefits as shown in Exhibit 4.

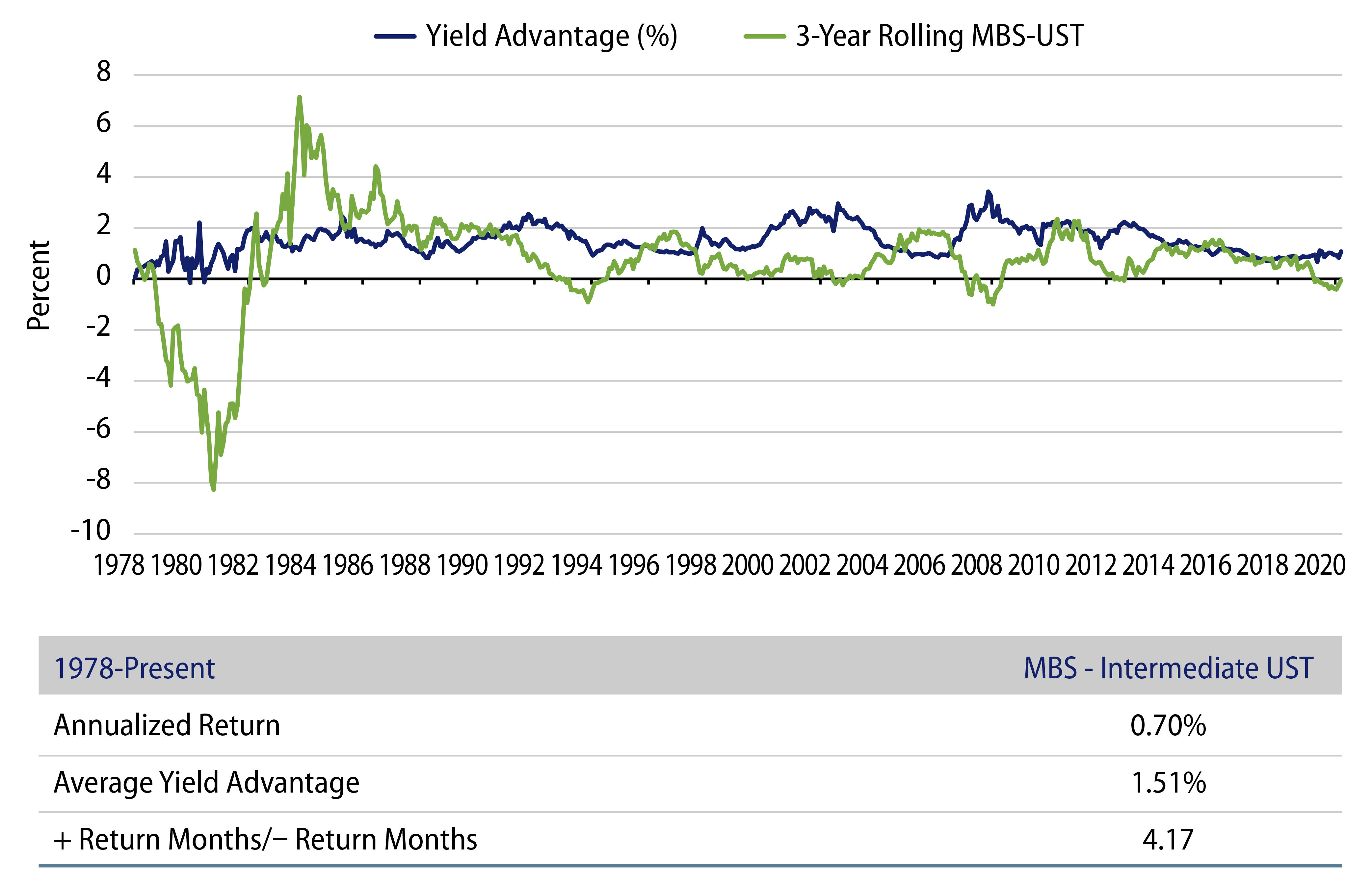

The correlation is the highest between USTs and US MBS at around 0.9 historically, but the yield advantage of agency MBS relative to intermediate USTs represents a significant source of alpha for a similar credit quality investment (Exhibit 5). The asset class outperformed intermediate USTs over longer investment horizons, a key consideration for investors looking to include agency MBS as a core allocation in their fixed-income portfolios.

The Federal Reserve and Agency MBS

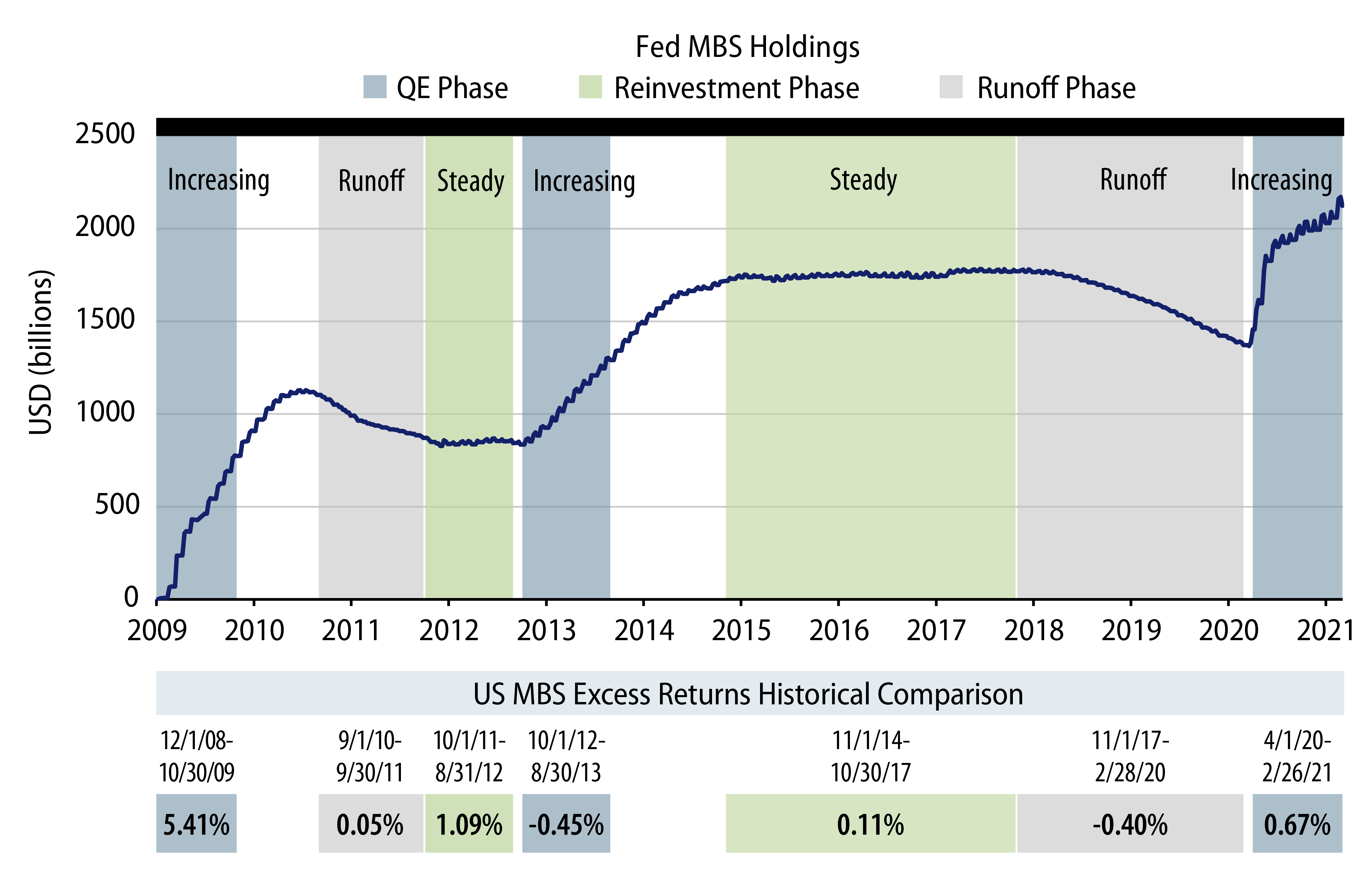

Agency MBS are a key market for consumer credit intermediation, including in the Fed’s asset purchase programs (known as quantitative easing or QE) during times of economic weakness as a way to provide stimulus via lower mortgage rates for US homeowners. During QE efforts the Fed is adding liquidity to the market distorting normal market functions. When the Fed is tapering its purchases, there can be attractive investment opportunities for active investors as there is more potential volatility in the market.

Historically, we identify three distinct phases for the Fed’s agency MBS balance sheet: increasing (active QE purchases and reinvestment of principal prepayments), steady (reinvestment of principal prepayments only) and runoff (no reinvestment happening) as shown in Exhibit 6. Currently, the Fed owns approximately 31% of the agency MBS market, versus 18% in 2013, at a similar time in its QE program. As the current QE program shifts to a reinvestment phase, prior episodes show excess return potential.

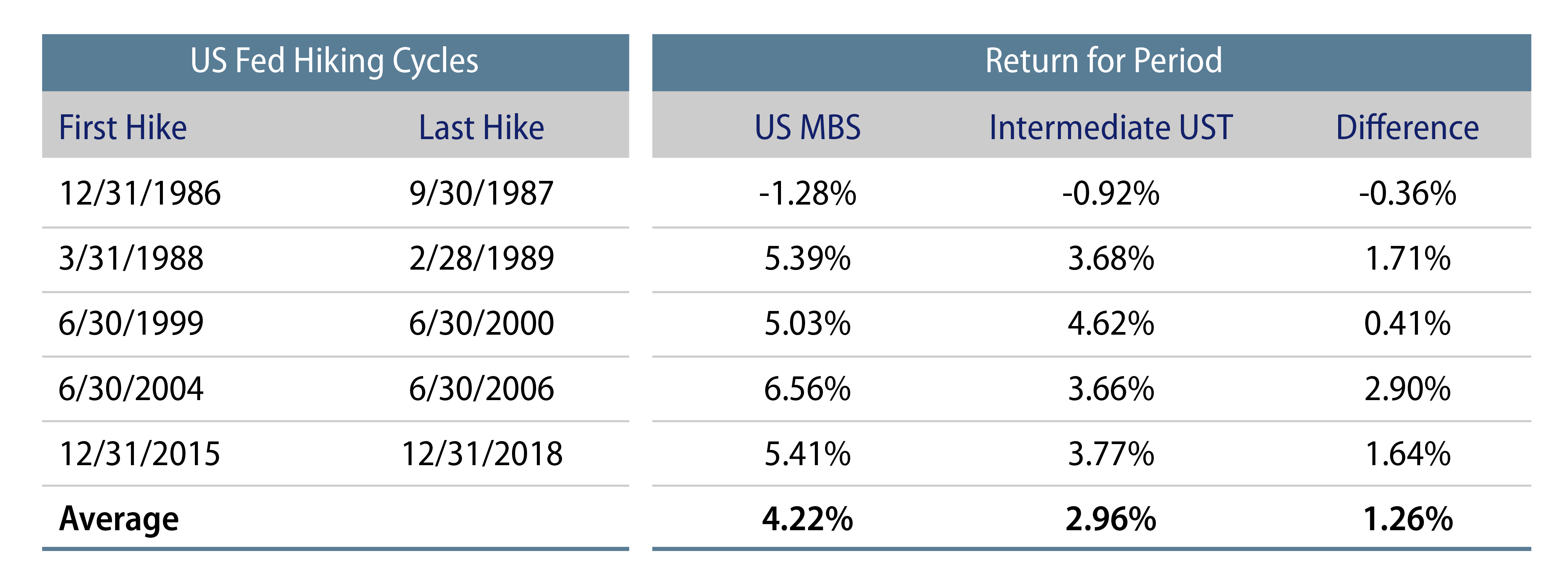

Agency MBS have historically outperformed intermediate USTs during Fed tightening cycles, allowing investors to generate excess returns in rising-rate environments (Exhibit 7).

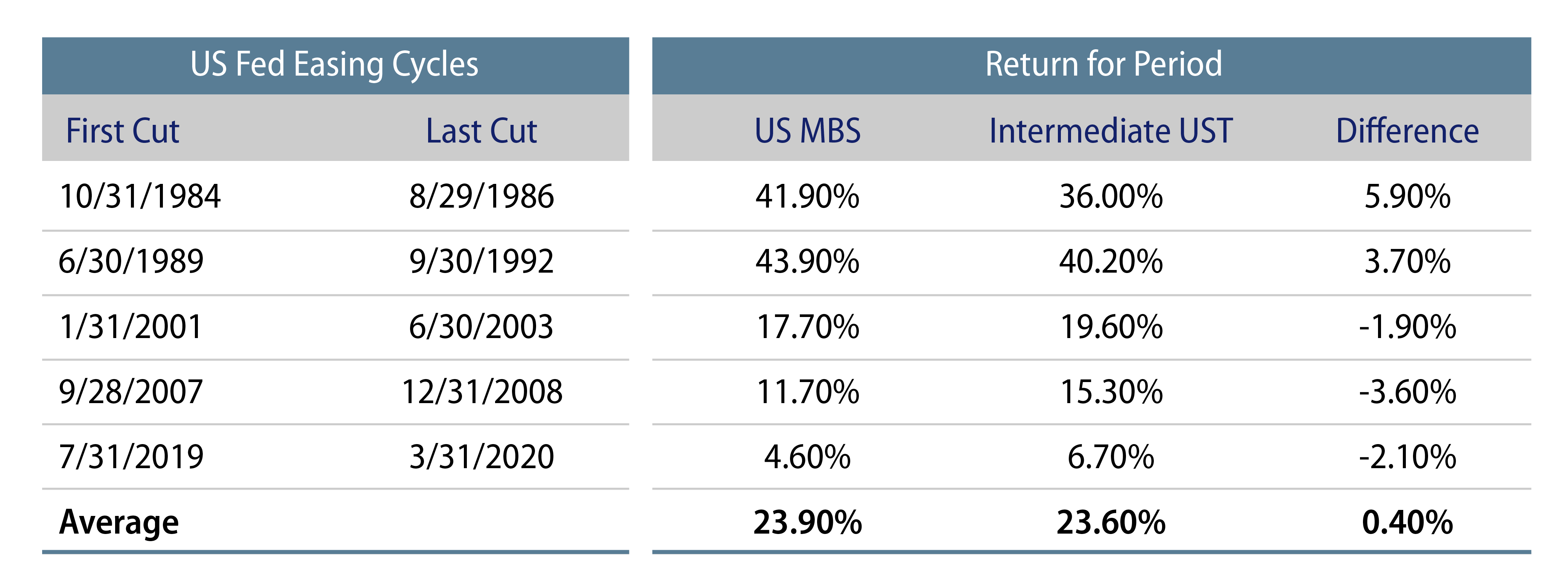

Agency MBS have produced mixed results relative to intermediate USTs during Fed easing cycles, as volatility and refinancing activity picked up especially during recent easing cycles (Exhibit 8).

What Are the Risks?

Changes in the following elements will impact MBS prices:

- Spreads: Similar to any nongovernment fixed-income security, agency MBS valuations are subject to changes in spreads. If spreads widen, the prices of agency MBS will decline. If spreads tighten, the prices of agency MBS will increase.

- Prepayment: When homeowners pay back more principal than required by the regular amortization schedule, it is considered a prepayment. This may occur for a number of reasons; for example, the homeowner might refinance into a mortgage with a lower rate, experience a life-changing event (relocation for a new job, divorce or death) and move into a new home. Because the principal is being returned to the investor at par, this can detract from returns if the MBS was purchased at a premium price. The idiosyncratic aspect of prepayment risk is reduced by the aggregation of large numbers of loans across specified pools.

- Convexity: MBS’ price/rate relationship is negatively convex due to the likelihood the homeowner will refinance into a lower rate mortgage when yields fall, and conversely, the homeowner’s tendency to remain in the mortgage when yields rise. As a result of prepayments, the expected maturity (duration) of the security shortens, as principal is returned sooner and the investor will be faced with reinvesting at lower rates. When rates increase and prepayments slow, the duration extends. This can cause MBS prices to decrease during rate selloffs more than they increase when the rate rallies.

- Volatility: Due to the homeowner’s embedded option, MBS are exposed to changes in volatility. An increase in volatility can result in MBS underperformance.

These risks can be mostly mitigated by active portfolio management. Exchange-traded funds (ETFs) focused on passive replication have on average historically underperformed the index annually by -5 basis points (bps) over the past three years, -15 bps over the past five years, and by -22 bps over the past 10 years as of March 31, 2021.2 Western Asset takes an active approach, focused on long-term fundamental value and using multiple diversified strategies. Our active investment style is focused on MBS subsector rotation, security selection, portfolio hedges and duration management, all of which provide the flexibility to potentially generate risk-adjusted returns that exceed those of benchmark replication strategies.

Agency MBS Are a Core Holding in Fixed-Income Portfolios

Agency MBS are one of the largest and most liquid US fixed-income markets—with cash flow guarantee features backed by the US government—and have outperformed intermediate UST bonds over longer investment horizons. We believe active investors in the agency MBS market have significant opportunities to generate alpha from sector rotation, security selection and duration management relative to the benchmark. Historically, the risk-adjusted returns of agency MBS are one of the most attractive with lower volatility compared to similar high-quality US fixed-income sectors. The asset class also provides portfolio diversification benefits and low correlation to equities, especially during times of financial market and economic stress. For all of these reasons, we believe investors should consider including agency MBS as a core allocation in their fixed-income portfolios.

- Source: Securities Industry and Financial Markets Association (SIFMA), as of January 2021. Average trading volumes were calculated over the last 25 months.

- Source: Morningstar, Western Asset. As of 31 Mar 21.