The US president holds a larger sway over international affairs than over domestic policy, which is often dominated by Congress. This simple fact is yet another reason that the upcoming election will be a crucial milestone. In this blog entry, we present our views about possible developments under either a Trump or Biden presidency. If the incumbent is re-elected, we would expect “more of the same” for the international economic agenda, including steps to apply current aggressive trade policies in other contexts, for example in US relations with Europe. Conversely, a new President Biden may want to appear more conciliatory in his administration’s international economic policy stance. Under that scenario, we would expect a return to international coordination, cooperation and civil dialogue. The Biden administration may not be able (or willing), however, to immediately and completely step away from the policy choices made under Trump, in particular where his choices have produced structural changes and are related to other policy areas, including national security. At the time of publishing, the betting markets favor Joe Biden to win 64%-35%.*

Trade and FX Policy

Early on in his presidency, Trump identified the goods trade balance as an important measure of national wellbeing. A negative bilateral balance (from the US perspective) would imply a disadvantage for the US, in particular if it appeared to relate to the loss of manufacturing jobs. To rectify this, the Trump administration adopted a rather forceful trade policy, including the extensive use of tariffs. The degree of intensity surprised observers but is, in many ways, an echo of the first Reagan presidency when the US car industry was threatened by imports from Japan. FX interventions by significant trading partners also attracted a good amount of attention during Trump’s first term for related reasons.

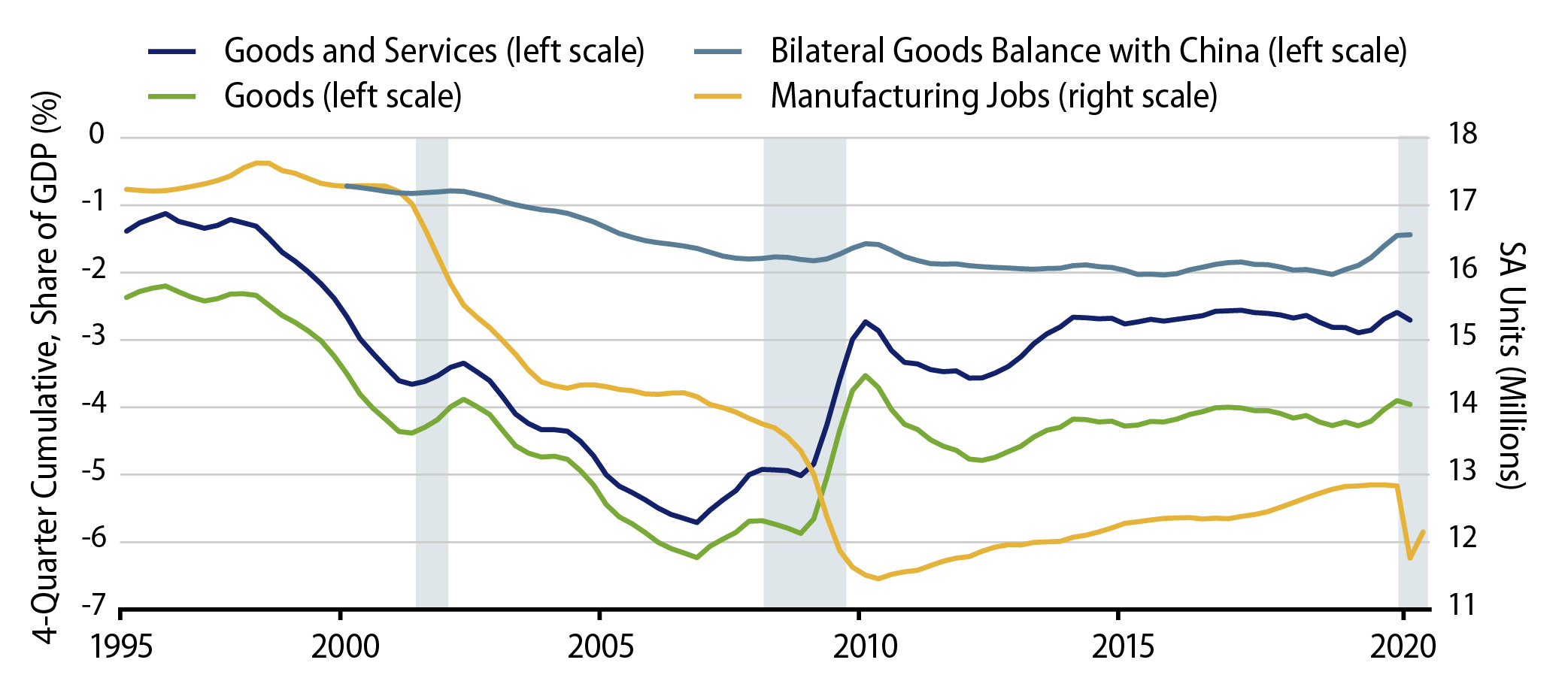

Exhibit 1 shows manufacturing jobs as well as US trade balances for goods as well as goods and services over the last 25 years. Significant job losses in the US manufacturing sector occurred in 2001-2003 and 2009—two periods marked by significant recessions (see shaded areas) but also by China’s accession to the World Trade Organization (WTO) in 2001. Focusing on the last decade, and leaving aside the most recent period affected by the COVID-19 pandemic, the trade balances (as a share of GDP) are largely unchanged since 2013 (or 2010 really), whereas the manufacturing sector has recovered around 1.5 million jobs since 2010 under Presidents Obama and Trump.

The upshot is that a second Trump term would arguably continue to push for job creation in the manufacturing sector—especially given the impact of Covid—using the same or similar policy tools provided that the trade balances have not improved significantly.

We believe that a President Biden would be somewhat constrained, at least initially, by the policy goals of the Trump administration. In particular, the focus on job creation in the manufacturing sector would be hard to pivot away from for a Democratic president, but the means to this end might be different and a “green” presidency would run into headwinds on that front as many manufacturing jobs are now related to oil and gas. In other words, we expect trade policy to become less aggressive, especially with respect to tariffs, but we could imagine that the focus on trading partners’ exchange rate interventions will remain broadly unchanged.

US Relations With China

Under President Trump, the relationship with China has been pushed to the top of the US international policy agenda. Indeed, the relationship with China has clearly outgrown a simple trade spat and has been recognized as a more fundamental strategic rivalry, including with respect to global security issues. A re-elected Trump administration would likely interpret the recent reduction in the bilateral goods trade deficit from 2% to around 1.5% of GDP (see grey line in Exhibit 1) as evidence that the tariffs and other policies adopted over the last few years have worked. We believe that this conclusion will reinforce the administration’s resolve to continue its policy strategy should it win a second term.

Though more weary of the negative impact of tariffs on consumers, a Biden presidency might not want to rock the (political) boat early on and refrain from unwinding too quickly the policy steps taken, as a critical approach to China has become bipartisan. However, we would expect the Biden camp to make more substantive efforts to build international consensus around its approach to China and potentially foster trade around China.

US Relations With Europe

With the US-China relationship in an uneasy equilibrium, the next Trump administration would have the bandwidth to focus on other bilateral relationships. As the US also runs a bilateral trade deficit (to the tune of $175 billion per year) in goods with the EU—and judging from statements by President Trump in his first term—we can imagine his second administration paying a lot more attention to reducing that perceived imbalance. Conversely, we cannot imagine this being a priority under a Biden presidency, in particular in exchange for a shared position versus China.

We do believe that under both presidents, a trade agreement with the UK will start to be negotiated, but we can see this sliding down the priority list under Biden as reshaping of domestic policies will take centre stage early on. Moreover, the speed and contours of such a trade agreement will depend significantly on how the relationship between the UK and Europe is settled, in particular with respect to (Northern) Ireland.

International Organisations and Treaties

Engagement in international bodies is likely to be a major point of distinction between the two candidates’ platforms. President Trump has exited from or severely downgraded cooperation with several international organizations and we would not expect that to change during a second term. In particular, we believe that the WTO could be forced to accept far-reaching reforms or become increasingly sidelined as the important dispute settlement system has already ground to a halt due to the refusal by the US to appoint WTO judges.

A Biden presidency, on the other hand, would likely undo several of the decisions taken in this field by the Trump administration. For example, given the switch in domestic policy focus on climate change and renewables, we believe that the US withdrawal from the Paris climate accord, which is foreseen to take place in November 2020, could be undone. We also expect an instant reversal of the World Health Organization exit. Relatedly, we would expect a Biden administration to join COVAX, the quasi-global initiative aimed at providing countries around the world with equitable access to COVID-19 vaccines once they are licensed and approved.

With respect to economic institutions, we believe that a Biden presidency would take a similarly critical but more constructive approach to reforming the WTO. It might also be inclined to provide more support to help developing countries fight against COVID-19 through international fora such as the International Monetary Fund (IMF), for example by agreeing to an increase in countries’ special drawing rights (SDRs), akin to the allocation provided in 2009 in the context of the great financial crisis.

*Source: Real Clear Politics. As of 8 Oct 20.