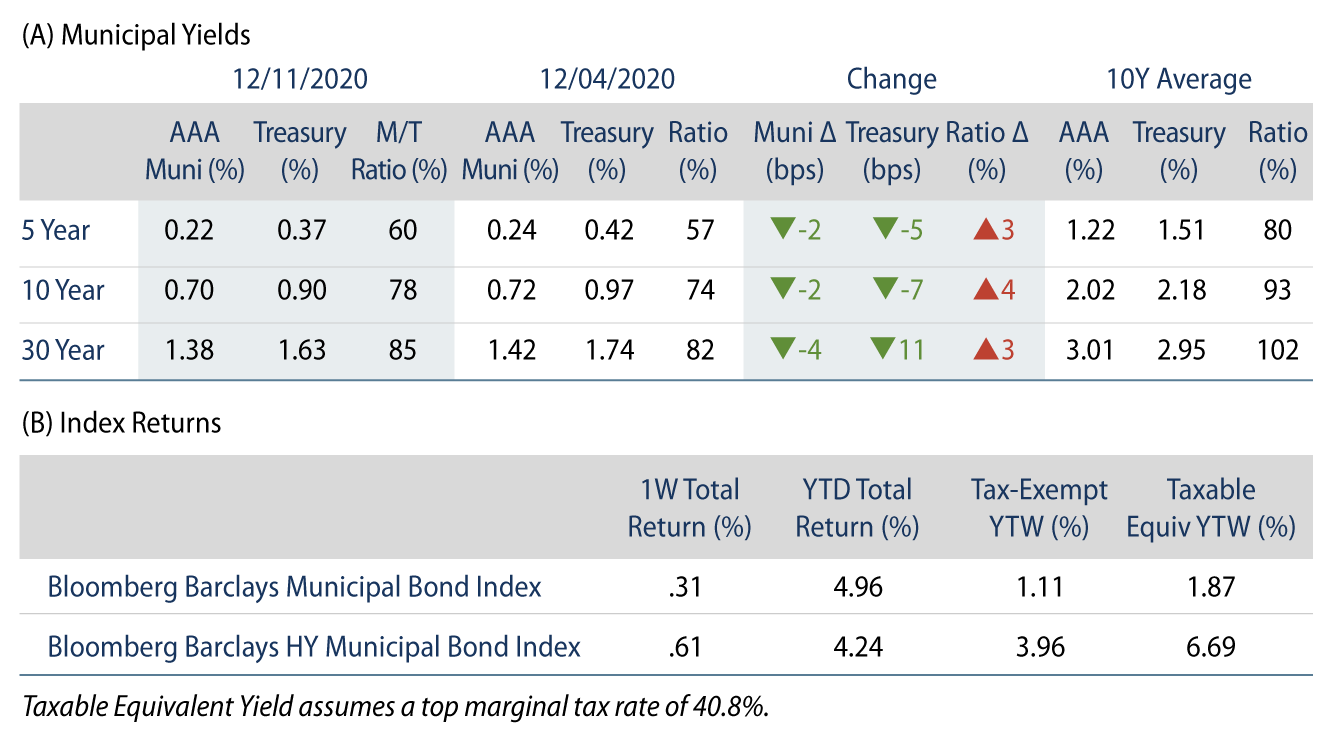

Municipal Yields Moved Lower Across the Curve

Municipal yields moved lower across the curve, but underperformed Treasuries. Municipal technicals remained favorable as positive fund flows continued. A record issuance year was driven by heightened taxable supply. AAA municipal yields moved 2-4 bps lower across the curve. Ratios moved higher as municipals underperformed Treasuries during the week. The Bloomberg Barclays Municipal Index returned 0.16%, while the HY Muni Index returned 0.65%. This week we discuss how taxable muni issuance is driving record supply levels.

Municipal Technicals Remain Strong, Supported by Positive Fund Flows

Fund Flows: During the week ending December 9, municipal mutual funds recorded $992 million of inflows, according to Lipper. Long-term funds recorded $304 million of inflows, intermediate funds recorded $549 million of inflows and high-yield funds recorded $365 million of inflows. Municipal mutual fund net inflows YTD total $35.8 billion.

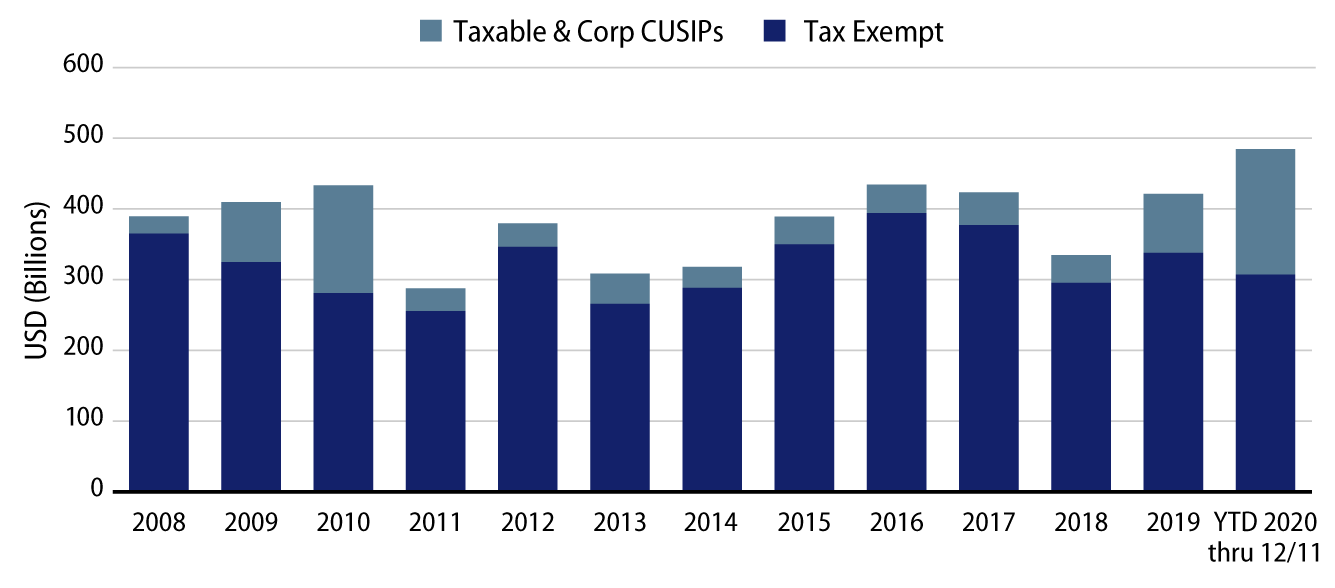

Supply: The muni market recorded $13.9 billion of new-issue volume, up 53% from the prior week. Issuance of $484 billion YTD is 15% above the 2019 calendar year, primarily driven by taxable issuance as tax-exempt issuance is tracking 2.3% lower year-over-year (YoY). This week’s new-issue calendar is expected to decline to $7.9 billion (-43% week-over-week). The largest deals include $1.5 billion taxable New York City GO and $800 million State of Connecticut transactions.

This Week in Munis: Taxable Issuance Driving Record Supply

Total municipal supply eclipsed $484 billion as of December 11, according to Bloomberg. This is 15% above full calendar year 2019 levels and 30% above the prior 10-year average. The banner year for municipal issuance was largely driven by increased taxable issuance which, at $177 billion, comprised 37% of total YTD issuance. This is more than double calendar year 2019 taxable issuance levels, and over 3.3x the prior 10-year average.

The windfall of taxable municipal supply was largely driven by the 2017 Tax Cuts and Jobs Act legislation, which prevented municipalities from advance refunding outstanding debt with tax-exempt securities. As Treasury rates reached record lows, it became more economical for municipal issuers to refinance outstanding tax-exempt debt with taxable securities.

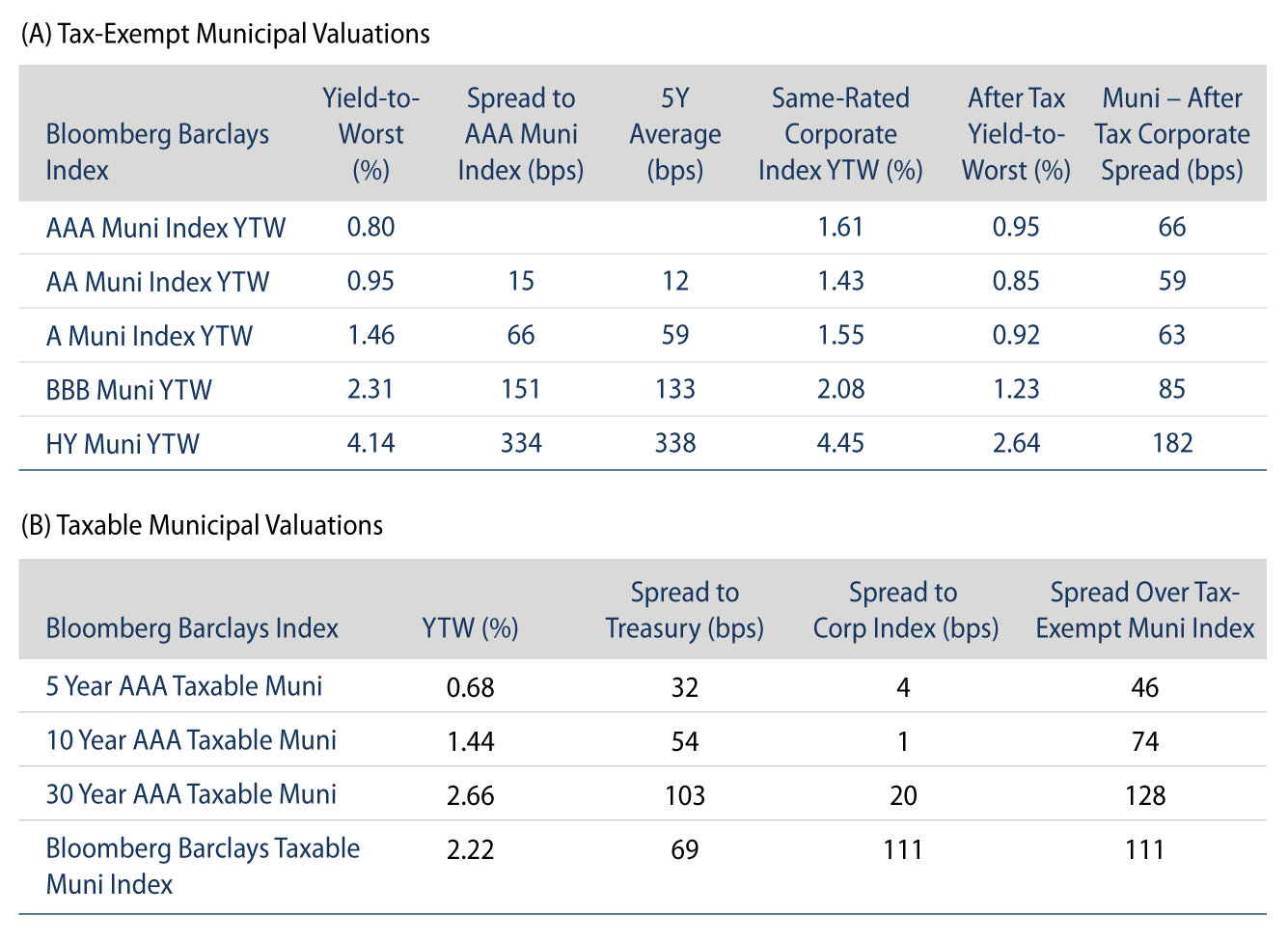

Notably, while overall municipal issuance is higher YoY, tax-exempt issuance is tracking 2.3% lower YoY. Lower new money issuance, combined with redeemed debt associated with taxable refinancing, has supported a heightened scarcity value for the tax-exempt asset class.

Looking forward to 2021, we expect total municipal issuance to remain at or above 2020 levels as municipalities solve for latent infrastructure needs and fund long-term budgetary challenges. In our base case where long rates remain anchored, taxable issuance should remain elevated and continue to offer opportunities for a growing global investor base. Meanwhile, the relative scarcity of tax-exempt munis should support low borrowing costs via the traditional tax-exempt borrowing medium, at a time when munis need it most.