Western Asset views high-grade emerging market (EM) debt as a “must have” allocation for insurance assets. As an asset class, EM debt is prone to suffering from the problem of perception. This mischaracterization stems largely from the sector’s historical roots in market crises, seemingly perpetuated by negative headlines on the worst of the pack at any given point in time (as depicted by Venezuela currently). Yet the realities of this heterogeneous asset class suggest a different narrative. Importantly, the universe of USD-denominated EM debt is comprised predominantly of investment-grade issuers and has been so for over a decade.

The rise in the number of high-grade EM issuers broadens the range of investment options for insurers in the context of constraints by the US National Association of Insurance Commissioners (NAIC). Specifically, the NAIC1 (>=A-) and NAIC2 (>=BBB- to <=BBB+) opportunity set, by market capitalization is larger than that of the US high-yield sector and is marked by a set of key attributes—attractive current income, low capital charge, low volatility and high total return potential—that augurs well for their place in insurance asset allocations.

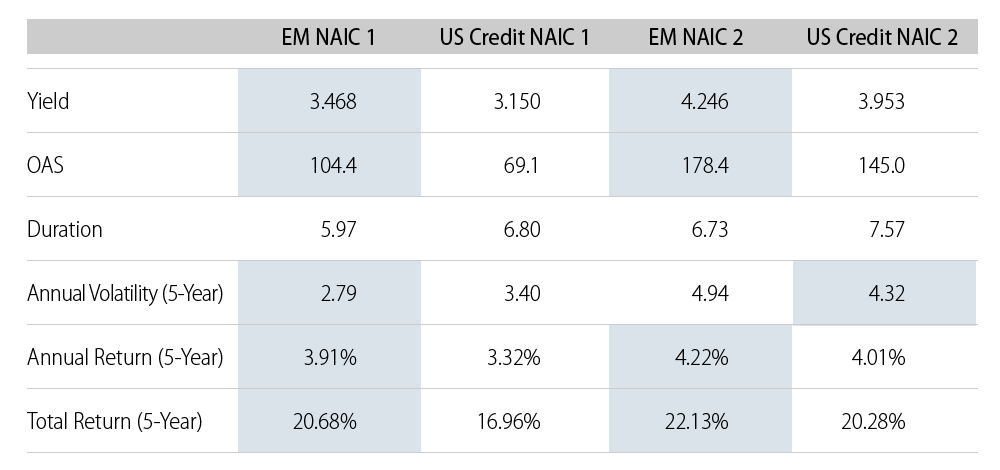

The empirical attributes of EM underscore the progressive maturation of high quality EM credits. As is widely known, EM bonds typically offer a significant income pick-up to similarly rated assets in the US. In addition to the yield pick-up, EM performance over multiple periods of 1-year, 3-year and 5-year exhibited higher total returns relative to the US (Exhibit 1) for both NAIC1 and NAIC2 buckets. Moreover, in the details, the EM NAIC1 bucket actually has a lower volatility ratio than its US peer and the EM NAIC2 bucket volatility ratio is only slightly higher than its US counterpart. The fact that high-grade EM posted higher returns and lower/equal volatility during a period of severe EM stress is remarkable in our view—severe stress punctuated by taper tantrum, energy/commodity shock, China devaluation and Fed hikes as well as currency turmoil in Argentina and Turkey. The historical record suggests this EM segment has become significantly less susceptible to the market contagions of yesteryear.

In addition to the attractive risk-adjusted valuation metrics of EM debt, fundamentals based and portfolio construction attributes favor EM allocations. From a bottom-up credit research perspective, EM issuers are conceivably under-rated due to sovereign ceiling limitations. In this scenario, corporate issuers with size, scale and strong balance sheets are penalized from a ratings perspective due to the country of domicile and/or country operations. We would note that historical downgrades, defaults and recoveries are broadly in line with US peers. Separately, an EM allocation allows for diversification away from the US domestic business cycle and issuer specific risks (BBBs perhaps) in the US.

The key to your EM allocation is finding the “right match.” Western Asset’s consultative approach emphasizes custom solutions rather than “off the shelf” products, recognizing the unique risk-income-return-capital goals which may be more geared toward income or total return (as a part of surplus portfolio) of each of our insurance partners.