Following up on our blog post about the long-term structural drivers of our inflation view, this post explores some of the shorter-term impacts to inflation due to the Covid crisis.

Temporal Supply/Demand Mismatch

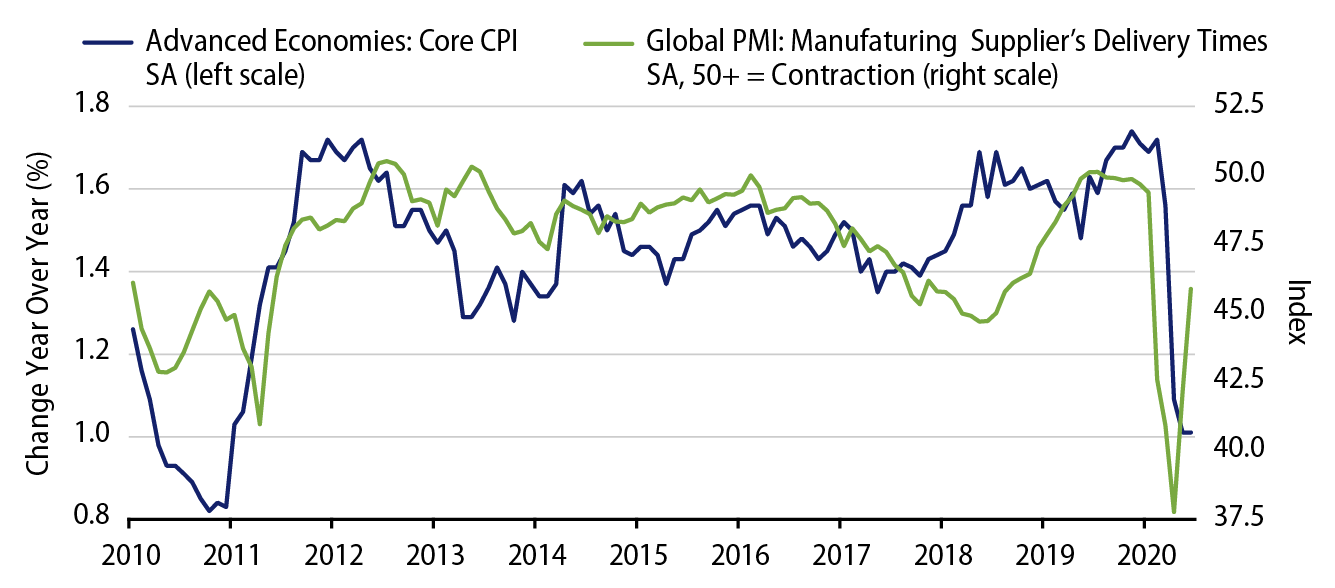

Thus far the COVID-19 pandemic has had a negative impact on both demand and supply. Initially, the fall in demand was disinflationary, particularly via lower energy prices and most affecting those industries directly linked to the velocity of people such as airlines, hotels, autos and clothing. For example, in the US these four categories, which represent only 8% of the CPI basket, together dragged headline inflation lower by a full percentage point between February and June. However, demand has rebounded forcefully and is beginning to highlight some supply-side pressures, in particular in those areas which have seen heightened demand over the lockdown period. Where in place, furloughs or short-term working schemes are essentially paying citizens not to produce. One way to measure this is via supplier delivery times, which have bounced back rapidly from the lows. This points to a normalization in inflation into 2021. Moreover, the sharp reduction in energy prices earlier this year will drop out of the year-over-year headline figures around the same time next year, as the above factors potentially amplify this impact.

However, this temporary bottleneck will normalize as supply catches up, supply chain pressures ease, and the ongoing demand rebound likely flattens due to ongoing and new mobility restrictions as well as increasing uncertainty about future job support. But it does mean that the likely low point in inflation will not be as low as many initially expected. As a result, this has supported inflation-related asset prices.

Consumption Patterns

Changed consumption patterns, which for example have resulted in higher demand for used vehicles (to substitute for public transportation), generic healthcare and home improvement-related goods are beginning to gain in price. If this increased demand lasts, the consumer basket will begin to reflect this over time via higher weights. Correspondingly the sector weights that are most exposed to the velocity of people will likewise fall and this is where the disinflationary pressures have been keenest. Additionally, this has added to the ongoing demographic trend of a rising basket weight for healthcare, which typically sees a higher-than-average inflation rate.

Covid-Related Costs for Business

Fixed costs for some businesses are rising due to Covid, given the expenses incurred by restaurants and offices to comply with new spacing requirements for social distancing, employee health screenings, physical partitions and deep cleaning. In most instances these costs will not be passed on to consumers. However in areas where demand is inelastic, such as healthcare, these costs do appear to get passed on.

Government Policies

Some countries have reduced VAT rates to spur consumption. If passed through to consumers, this will have a negative impact on headline inflation over the subsequent 12 months. Other “consumption-inducing” policies will have a similar effect. For example, in the UK, the “Eat out to help out” discounted restaurant meals will likely shave around 40-50 bps off headline inflation in the upcoming August print. Near-term inflation will be negatively impacted should these types of schemes become more widespread.

E-Commerce

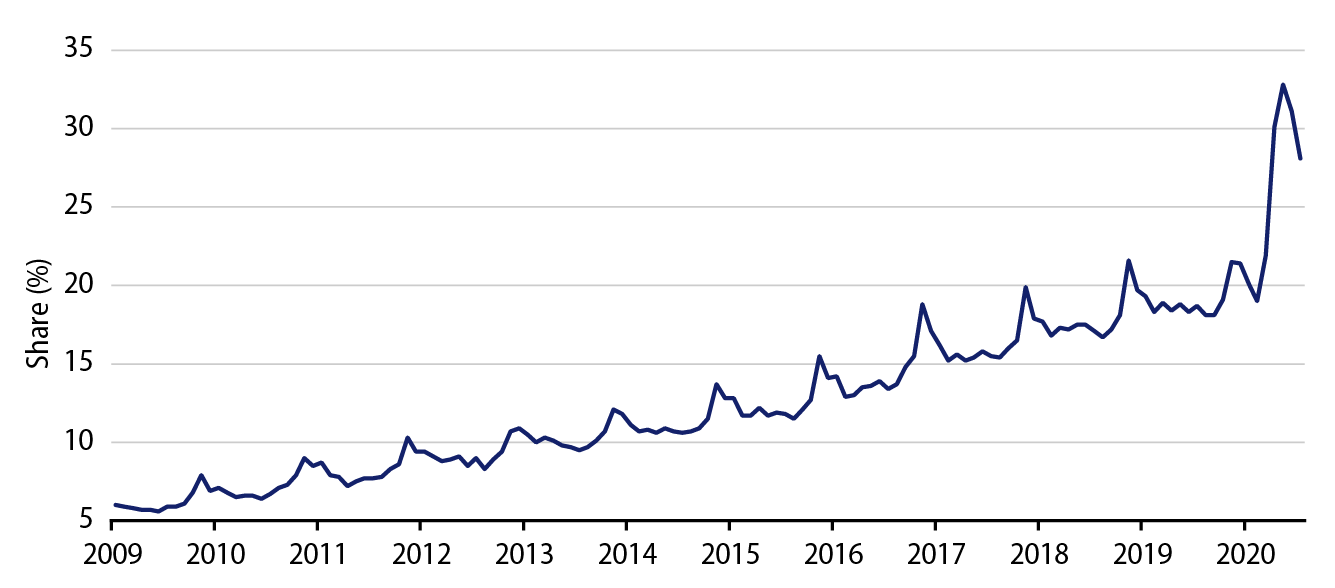

Here the virus has acted as an accelerant to a trend that has been in place for the last 15 years, namely the rising share of online retail sales. In particular the older age cohorts, who have previously had a much lower online presence compared to younger age cohorts, are now shopping online more frequently. Exhibit 2 shows e-commerce as a percentage of total retail sales in the UK. This has been a key disinflationary pressure that over the near term will exert a stronger disinflationary effect going forward. Japan is an extreme example of the boom in e-commerce, with credit card companies forecasting that they will shortly run out of 16-digit credit card numbers due to the surge in online shopping during the lockdown period.

Recent Inflation Surprises

Recent inflation prints have surprised to the upside. However, a lot of this has been related to those four categories mentioned above: airlines, hotels, autos and clothing. For example, the typical seasonal pattern for clothing prices in the eurozone has been thrown out of kilter. Prices fell sharply in March and April when prices are typically stable, yet prices were not reduced in June or July around the start of the summer sales period, leading to much higher inflation rates than expected. These seasonal distortions will wash out next month, pushing inflation lower.

Our Inflation Outlook

We continue to closely monitor the evolution of the pandemic and look for bottom-up signs that may challenge our top-down economic view that inflation will rebound from the crisis lows but that inflation generation remains challenged over the longer term. On balance, we don’t think we have found enough evidence of a sustained upside inflation dynamic. For now, we remain overweight inflation as long as the market still prices an even more pessimistic scenario, but we have reduced our overweight modestly as valuations have moved closer to our view on the back of recent upside prints.