EUR-denominated debt issued by emerging market (EM) countries/companies is asserting its place in the evolution of the asset class. At Western Asset, we believe there is finally the issuer diversification and depth to call this segment of the EM universe an asset class of its own and warrant a dedicated allocation. The market capitalization of the J.P. Morgan Euro-EM Bond Index Global (Euro-EMBIG Index), comprising sovereign and quasi-sovereign securities, recently surpassed EUR 200 billion as a result of recent issuance. Moreover, regional and country weightings have shifted materially in the past five years, which furthers the opportunities to express a truly broad “EM” portfolio. Given the central bank backdrop and low global yields, we expect these trends to accelerate in the future.

EM issuers are choosing to raise capital in the euro markets over the US dollar markets as 1) all-in yields are lower in the euro, 2) strong demand for euro assets is allowing for size and tenors not previously available and 3) issuers are able to diversify funding sources. For sovereign issuers in particular, which can be somewhat agnostic between raising funds in the euro or dollars, these dynamics are important drivers. As a result, Croatia, Peru, Chile, Serbia, the Ukraine, Saudi Arabia, Russia, Mexico, Poland and Egypt have all priced benchmark euro transactions this year. Eastern European countries in particular are eager to see their USD financings roll off and replace them with euro issuance given the proximity and ties to the eurozone. Latin American and Asian issuers are electing to borrow in euros as a function of cheaper funding costs, a dynamic which is unlikely to change for the foreseeable future. Mexico has taken full advantage of the euro markets and has built its curve out to 2115 (100 years). With regard to corporate issuers, we suspect euro capital raises will be more limited and reserved for those issuers who have exposures to the euro either via exports, costs or revenues. As such, the EUR-denominated corporate issuers are predominantly located on the continent with sporadic issuers from China and Latin America.

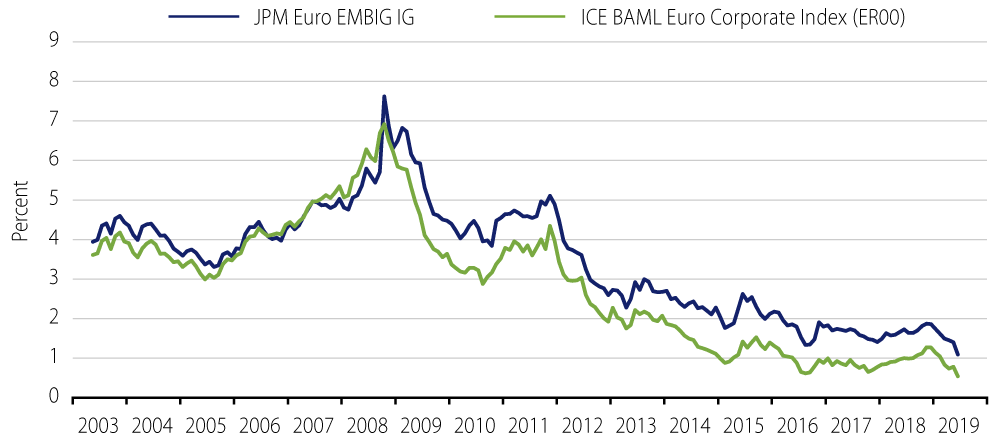

Among EUR-denominated spread products, EM bonds currently offer an attractive pick-up in income and yield. Anecdotally, investors in continental Europe tend to adopt a high-quality bias when investing in credit instruments. Viewed from this perspective, the yield on the investment-grade (IG) Euro-EMBIG Index is currently twice as much as that of the comparable EUR-denominated corporate credits, represented by the BAML Corporate Investment Grade Index (Exhibit 1). This is in marked contrast to parity between the two during the late-2000s. We would note that the universe of IG EUR-denominated EMBIG debt has expanded to account for 84% of the overall index, meaningfully higher than the 63% share 15 years back. All else equal, the proliferation of IG EM securities should help improve secondary market liquidity and broaden the scope for active management.

For the global investor, EM EUR-denominated securities have the twin appeal of being a proxy for core-eurozone rates, as well as having the potential for further spread compression over time. As the ECB policy and fluctuations in core-eurozone rates are key exogenous drivers of EM bonds, strategic investors have become active participants given a global environment of declining or negative yields. Traditional dollar-based investors are becoming more involved, as these securities, when swapped into the greenback, can trade cheap to their USD equivalents. The upshot is that, properly calibrated, an investor can be amply rewarded over the medium term with a diversified portfolio of EM EUR-denominated bonds.

We believe the EM euro-denominated asset class has “arrived.” Issuance, diversification, trading volumes and investor participation are trends that are all likely to increase in the future. With issuance from over 40 (and growing) EM countries, there are plenty of opportunities from a regional and country level to construct a diversified portfolio to meet investor risk-return objectives. These EM opportunities, which are part of a high-conviction strategy at Western Asset, offer a meaningful yield pick-up over like-rated alternatives as they have the potential for higher total returns. We are excited to check off another milestone for the EM asset class.