Emerging Markets Debt: Reaffirming Our Conviction

Executive Summary

- We believe the recent pessimism surrounding EMD is overblown.

- Western Asset views the recovery in EM asset prices as consistent with underlying fundamental trends, and not as evidence of a market bubble.

- We remain vigilant about the key risks to EM, including disruptive US trade policies, a stronger US dollar and a hard landing for China.

- EMD continues to be our highest-conviction strategy, supported by our global outlook, as well as our views on inflation, interest rates, central bank actions and US dollar strength.

The recent volatility spike in developed markets (DM) rates has rippled onto both hard currency and local currency emerging markets debt (EMD). Not to be dismissive of market spillover, but we do not view the broad market rout as sufficient basis to steer away from our strategic course. To be sure, we maintain our faith in the asset class as EMD continues to be one of our highest-conviction strategies across the Firm’s portfolios.

In this note, we will:

- Revisit the Firm’s global outlook that supports our thesis for EMD.

- Discuss the potential risks to EM countries.

- Reiterate our strong conviction to the case for EMD.

Revisiting Our Global Investment Outlook

We continue to be optimistic that the global and US economic recoveries are intact, as detailed in CIO Ken Leech’s 2Q18 Market Commentary. In the US for example, we expect growth to be slightly above 2% in 2018. Abroad, the prospects are a little better where monetary policy is even more accommodative. Against the backdrop of improving global economic fundamentals, we believe that investing in higher-yielding spread sectors—with EMD offering the most attractive opportunity—should benefit our portfolios. As well, we are steadfast believers that stronger economic growth will not translate into inflation. We believe low inflation globally is not going to change quickly, and hence that interest-rate normalization, specifically in the US, will be slow to develop. Finally, it is our view that US dollar strength may be limited, as explained in our recent paper from Product Specialist Robert Abad, The US Dollar: Fighting Gravity.

Potential Risks

As a risk asset, EMD is understandably vulnerable to market overshoot on the downside. Unlike the pre-taper tantrum years, however, we view the recovery in EM asset prices as consistent with underlying fundamental trends, and not a market bubble. We believe most of the key risks to EM continue to emanate from the global environment, as follows:

- Disruptive US trade policies: US trade policies directed at EM countries such as China or Mexico may pose a risk. For example, though the US made several announcements regarding tariffs on China, certain tariffs have not yet been implemented and are subject to change. Moving forward, both China and the US will have to work toward easing tensions.

- Accelerated US/global rates and a stronger US dollar: Large DM central banks around the world, including the European Central Bank, Bank of England and Bank of Japan, appear likely to remain accommodative, which should provide a positive backdrop for EMD but may still result in additional volatility in the marketplace. As previously noted, the US Federal Reserve’s (Fed) gradual normalization should also provide a decent backdrop for EMD, though a strong US dollar is potentially another source of disruption for EM countries.

- China hard landing: Our expectation continues to be that of a soft-landing. China’s economic data, which we monitor closely, continues to support that view. Policy flexibility and structural shifts in economic composition support the case for approximately 5% to 6% economic growth in China over the next five years. The Chinese have significant tools available to provide stimulus as necessary and we believe they will bend over backwards to avoid a hard landing. The transition from a manufacturing-based economy to a service-based economy will undoubtedly be bumpy. However, China’s profound influence on international commerce and financial markets will continue to be felt.

- Higher oil prices: Crude oil prices appear to have stabilized in the $70 to $80 range and have certainly provided a more stable environment for oil-based EM economies such as Russia. However, higher oil prices may have a negative pass-through impact on certain other EM countries that are large net importers, including but not limited to China, India, Turkey and the Philippines. Higher inflation in EM countries as higher oil prices pass through economies may force EM central banks to raise rates.

- Idiosyncratic/geopolitical risks: Idiosyncratic risks within EM countries (e.g., China capital flight, Russia sanctions) and political uncertainty (e.g., Turkey, Mexico, Brazil) continue to be contributors to volatility in EM assets.

The Continued Case for Emerging Markets Debt

At Western Asset, EMD continues to be our highest-conviction strategy. Not only is this supported by our global outlook characterized by an ongoing global growth recovery, muted inflation, gradual US interest rate normalization, and a weaker US dollar, but we also provide further points specific to EM supporting our view that recent pessimism surrounding the asset class is overblown.

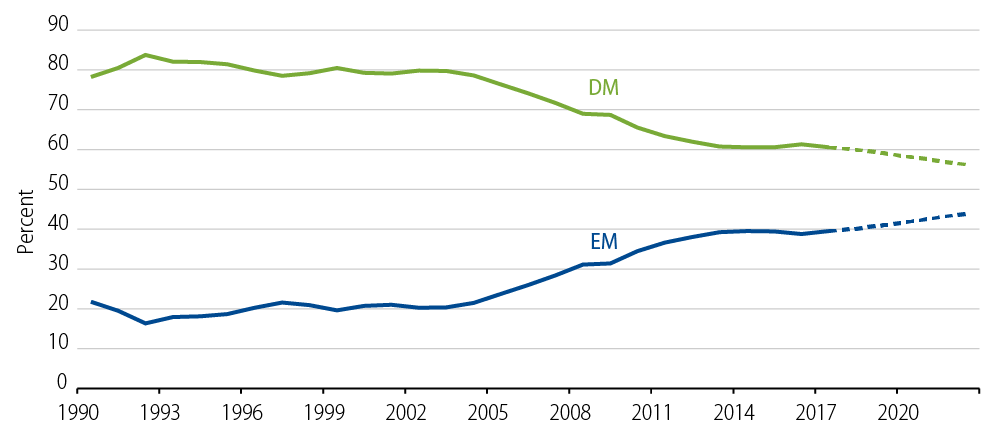

- EM economies are now fundamentally better positioned and should continue to outperform other fixed-income assets. The crosswinds of the taper tantrum, commodity weakness, geopolitical fears and corruption scandals exerted maximum damage to the asset class over the past three to five years. Further, EM countries responded with orthodox macro policies, including currency depreciation, monetary tightening and fiscal restraint. Signs of macro stabilization are now evident in the form of recovering economic growth, abating inflation pressure and improving current account surpluses. Stronger fundamentals should provide better defense against a risk-off market environment while EM countries will continue to be a significant contributor to global growth going forward (Exhibit 1).

Share of Global Output

2018–2022 Estimated

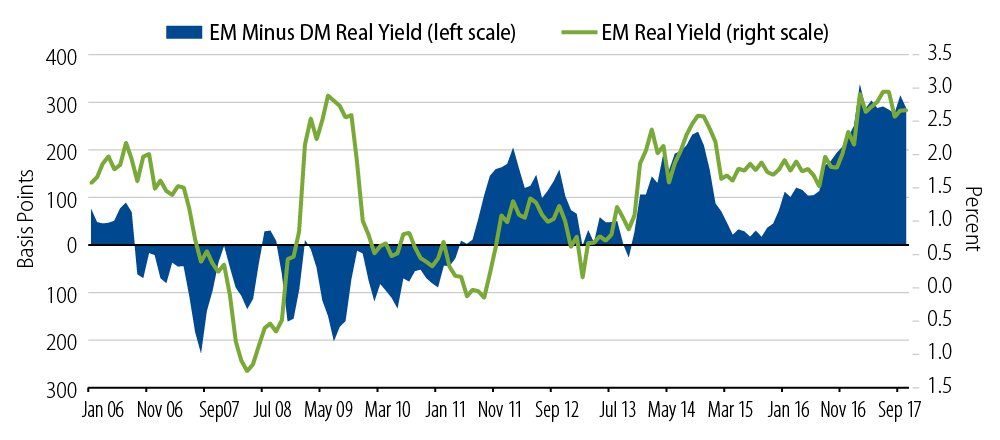

- Valuations are attractive when compared to opportunities in developed markets. From a valuation standpoint, there is little evidence of market froth in EM assets. US Treasury weakness enhances the entry levels for locking in book yields of structurally improving USD-denominated EM sovereign, quasi-sovereign and corporate credits. Local EM bond yields offer value, both adjusted for inflation and relative to DM opportunities (Exhibit 2).

EM Rates Appear Attractive. Historical EM Real Yields and EM/DM Real Yields Differential

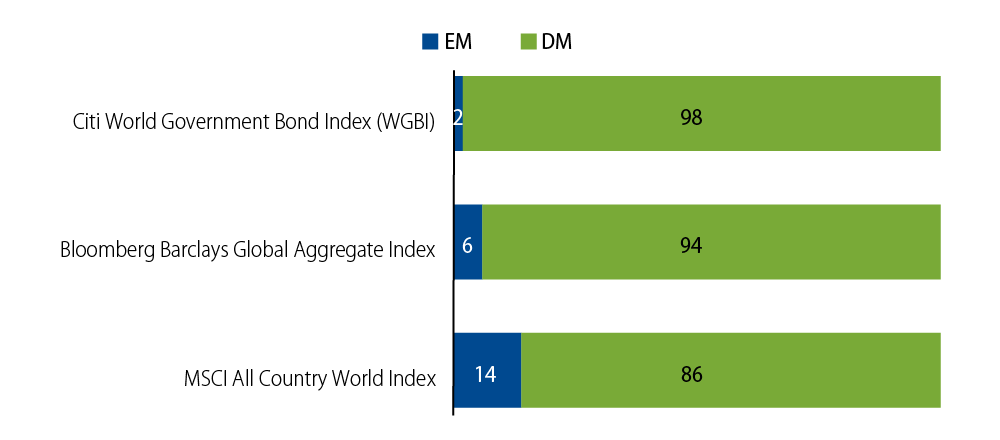

- Strategic allocation to EMD should remain buoyant. Following the 2013 to 2015 exodus, there have been renewed flows into the asset class. Anecdotal evidence suggests that further allocations by both existing and new investors are likely, especially since EM exposure in global indices have not paralleled the growth of EM countries’ contributions to global output (Exhibit 3). Interestingly, sovereign wealth funds—most recently the Bundesbank—have plans to add Chinese yuan assets for diversification, a trend that will have a salutary effect on EMD over the secular horizon.

Weight of EM/DM Securities in Global Indices (%)

- The EM investor base has become more stable. Against a backdrop of measured Fed normalization and subsiding fears surrounding China growth, EMD continues to attract significant demand from global investors, demonstrated by the record net inflows to the asset class over the past couple of years. After the taper tantrum and the commodity price shocks, the EM investor base has become more stable given a reduction in “tourist” players. Despite a resumption of portfolio inflows since 2016, foreign ownership has remained stable, especially with EM local bonds. This is in large part to indigenous demand for duration given the rapid growth and maturation in local insurance and pension funds. Similarly, within the mix of non-resident base, anecdotal evidence suggests increased participation by long-term strategic investors.

Nevertheless, some investors may fret over further legs to the current dislocation in EM asset prices, given that the wounds from the taper tantrum remain raw. Paradoxically, the fact that EM local debt posted double-digit returns in 2016-2017 could generate perceptions of market overvaluation. To stretch the argument even further, an EM skeptic might argue that these gains are out of sync with an external backdrop of rising DM rates. Based on this line of argument, caution is therefore warranted on the belief that EM bonds are ripe for a sharp correction.

The upshot of our analysis is that, when properly calibrated and customized, increasing the allocation to EM fits into the fundamental conviction of global investors with a long-term value-based discipline, given the rising strength of EM countries. Western Asset continues to favor EM countries with the capacity to manage their own economies during times of global economic weakness stemming from prudent policymaking. And we continue to emphasize differentiation and a high-quality approach in our exposure to countries that consistently demonstrate fiscal discipline and strong FX reserve accumulation.